With responses canvased in December and showcased in PBM’s January 2023 issue, the latest instalment of The Pulse saw builders’ merchants reflect on a tumultuous 2022 – but there are signs of positivity for the year ahead.

Sales expectations were weak partly because it was ‘that time of year’, but mainly as a consequence of the political turmoil and economic uncertainty. Price increases and the cost-of-living crisis weighed heavily.

However, merchants’ sales expectations were more positive for the next six months (Dec to May), with greater confidence in the prospects for their own business than for the market overall.

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 1st and 5th December 2022 (3 working days).

Problems faced

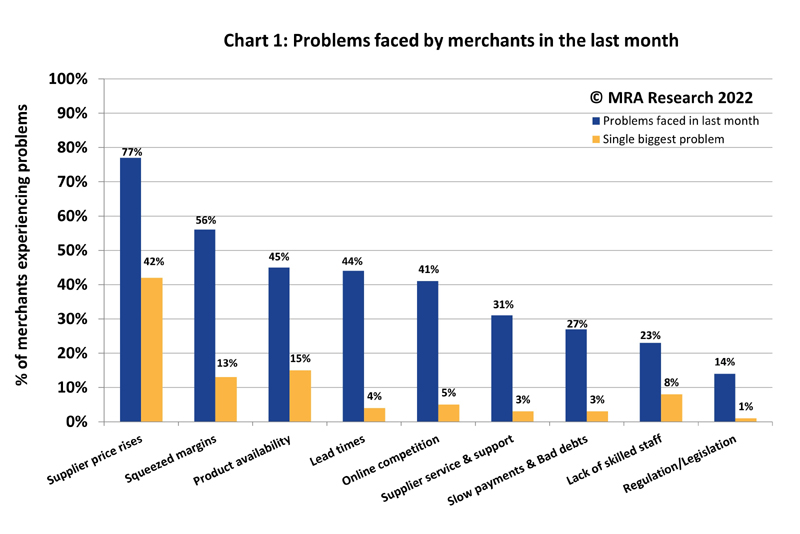

Supplier price increases were a problem for nearly 8 out of 10 merchants (77%) — Chart 1. More than half (56%) mentioned Squeezed margins with over 1 in 10 (13%) saying they were their single biggest problem. Supplier price rises were the single biggest problem for over 4 in 10 merchants (42%) whilst Product availability was the single biggest concern for 15% of merchants. Sales expectations

Sales expectations

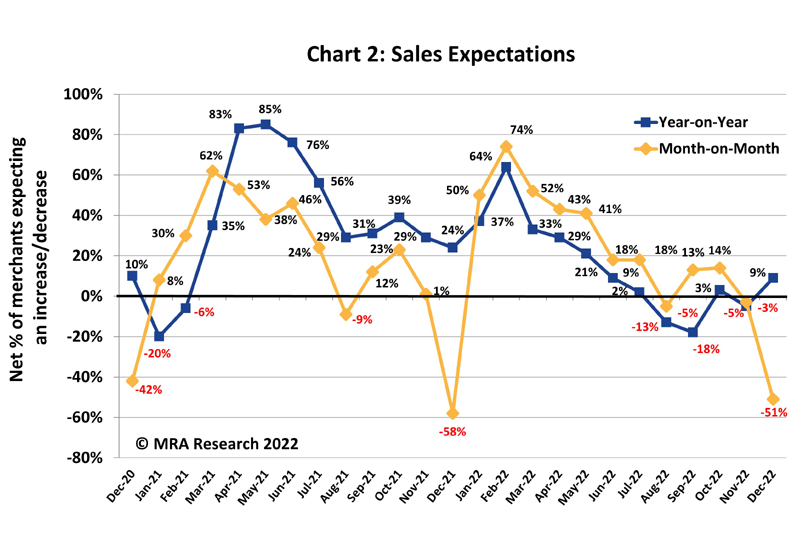

Sales expectations dropped sharply in December compared to November (net -51%) — Chart 2. Expectations were weakest in Mid-sized outlets (-62%) and Independents (-59%).

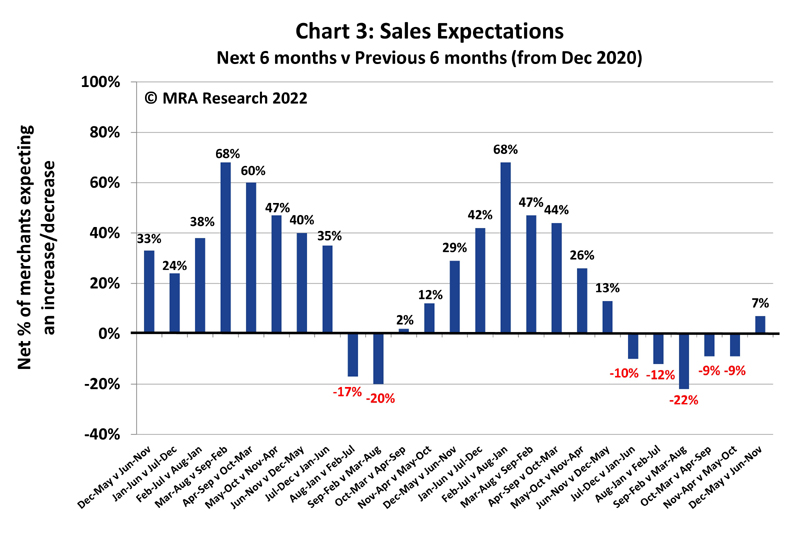

December’s sales expectations, compared to a year previously, lifted to a net +9% having dropped to a negative -5% in November. All types of merchant expected sales to increase year-on-year. More merchants in Scotland (+31%) and the South (+20%) expected sales to increase, while merchants in the Midlands (-19%) expected sales to fall. Small branches expected sales to grow most (+16%). Looking six months ahead, a net +7% of merchants expected sales to increase in the six months December 2022 to May 2023 compared to the previous six months — Chart 3. That was the first time Merchants had forecasted growth since April 2022.

Looking six months ahead, a net +7% of merchants expected sales to increase in the six months December 2022 to May 2023 compared to the previous six months — Chart 3. That was the first time Merchants had forecasted growth since April 2022.

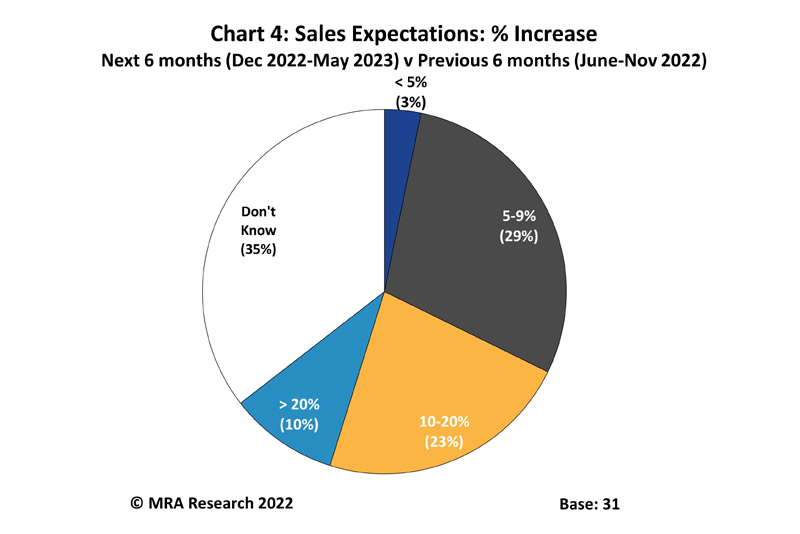

Except for Scotland, which expected no change, all regions expected some growth. A net +13% of Nationals expected growth. Fewer Independents (+3%) and Regionals (+3%) expected growth. Nearly one in three (32%) merchants who expected sales to build in the next six months, projected an increase of under 10% — Chart 4. But almost a quarter (23%) expected growth of 10% to 20% while 10% expected an uplift of more than 20%.

Nearly one in three (32%) merchants who expected sales to build in the next six months, projected an increase of under 10% — Chart 4. But almost a quarter (23%) expected growth of 10% to 20% while 10% expected an uplift of more than 20%. Confidence in the market

Confidence in the market

A net -27% of merchants were less confident in the market in December compared to November. Confidence in the market was weak in Small branches (a net -29%) and Mid-sized outlets (-33%). Scotland (-44%), the Midlands (-41%) and Independent merchants (-41%) were the least confident.

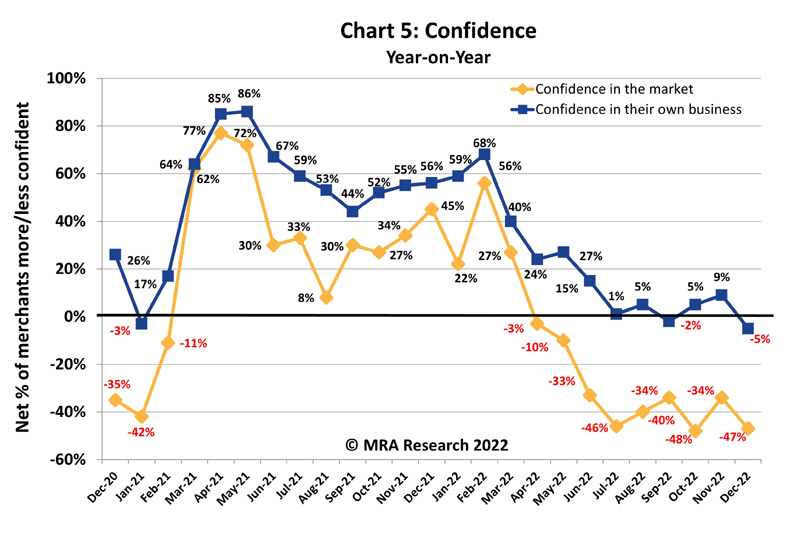

Year-on-year, confidence in the market also fell from last month. A net -47% of merchants were less confident in the market at the start of December than they were in December 2021 — Chart 5. Confidence was low across all sizes of outlet, regions and types of merchant. Independents (-59%), Merchants in Scotland (-62%) and the Midlands (-59%) were least confident.

Confidence in their business

While merchants lacked confidence in the market, they were consistently more confident in the prospects for their own business with a net +16 being more confident month on month. All types of merchant in all regions were confident. Nationals (+21%) and Regionals (+17%) were most confident, but Independents were also confident in their own business (+9%).

Year-on-Year, merchants’ confidence in their own business had weakened to a net -5% — Chart 5.

But Regionals (+17%), Small branches (+4%), and the South (+3%) were still more confident than they were the same time last year. A net -25% of Independents and Nationals (-5%) were less confident in the prospects for their business than they were last year. Omnibus question: Grenfell

Omnibus question: Grenfell

On 14 June 2017, 72 people died in the fire at the 24-storey Grenfell Tower in West London. The story has barely been off the front pages in the ensuing years, and the enquiry into the causes of the fire have exposed much that needs to change.

A high-profile industry group compiled a new Code for Construction Product Information (CCPI), and we can expect more changes to follow, but how much has Grenfell affected builders’ merchants and their customers?

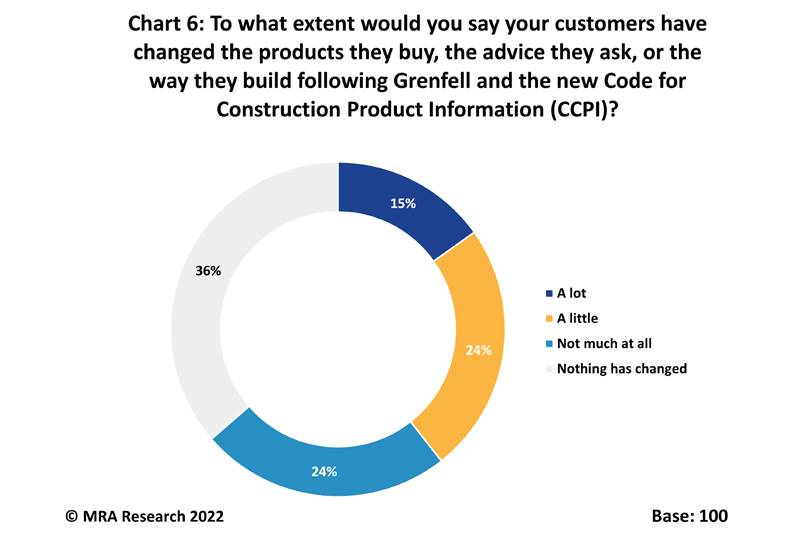

More than 1 in 4 (26%) merchants think Grenfell has changed attitudes in construction to fire safety and the way we build but most (74%) think little to nothing has changed since the fire shocked the nation.

Just 15% of merchants say their customers have changed the products they buy, the advice they seek or the way they build following Grenfell and the new CCPI — Chart 6. Just over one in five merchants (22%) say they have changed the products they sell, or the information they give customers to help them build more safely following Grenfell.

The full report can be downloaded for free from www.mra-research.co.uk/the-pulse or call Ralph Sutcliffe at MRA Research on 01453 521621.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 44th in the series, with interviews conducted by MRA Research between 1st and 5th December 2022 (three working days). Each month a representative sample of 100 merchants is interviewed, balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

The difference between the percentage of merchants expecting growth and those expecting a decrease is the net figure, expressed as a percentage. A positive net percentage indicates growth, a negative indicates decline. Net zero implies no change.