As published in the June edition of PBM, the latest instalment of The Pulse reveals that while merchants remain confident about strong customer demand, market conditions continue to raise concern.

Builders’ merchants’ sales expectations are robust for the short and medium-term despite some easing. However, a relentless stream of price rises is squeezing merchant margins and product availability is still a problem.

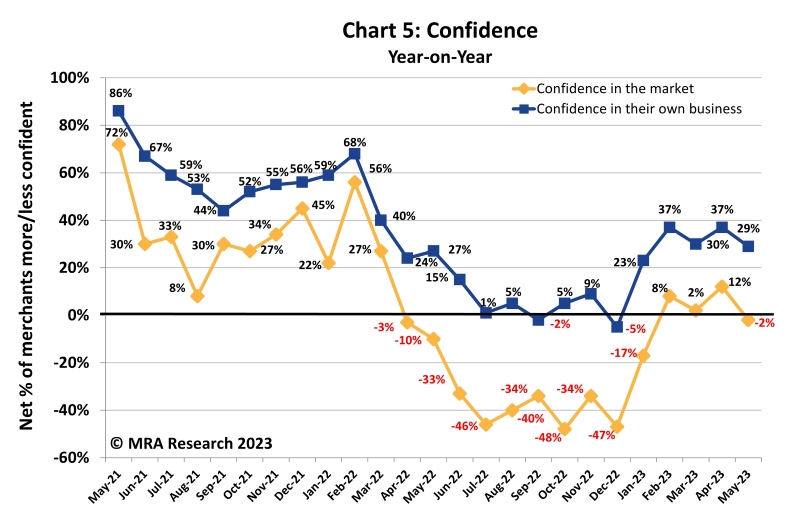

And although merchants’ confidence in the market is weakening, their confidence in their own business stays strong.

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place from the 2nd to the 4th May 2023 (three working days).

Problems faced

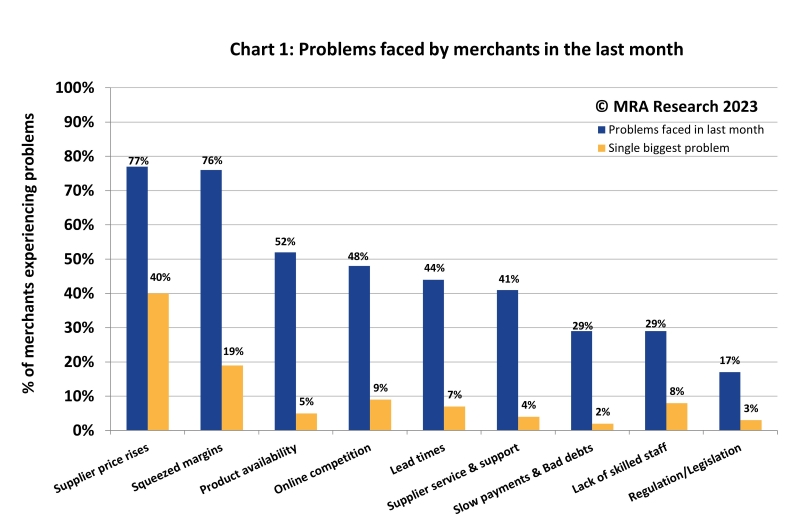

Supplier price rises (77%) and Squeezed margins (76%) were a problem for 3 in 4 merchants — Chart 1. Product availability (52%), Online competition (48%) and Lead times (44%) were problems for around one in two merchants. However, Supplier price rises remained the single biggest problem (40%).

Trends in merchants’ problems

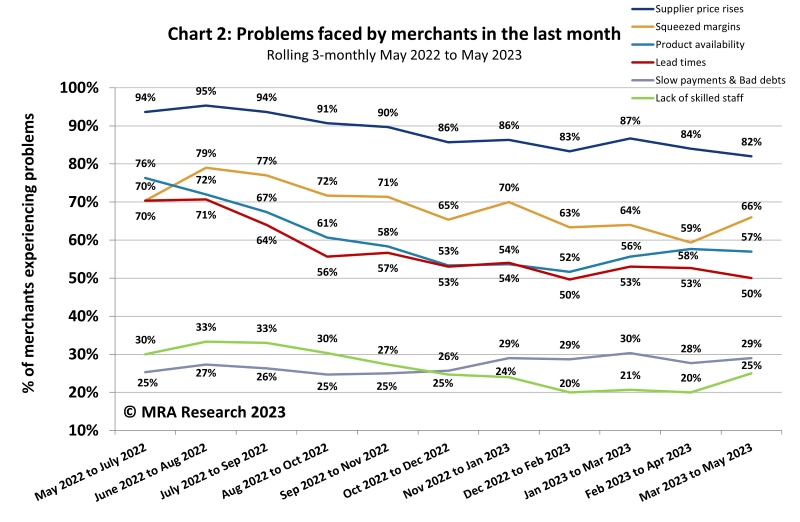

Supplier price rises are easing as the single most important problem but 4 in 5 merchants mentioned them — Chart 2. Two thirds complained of Squeezed margins and nearly six in ten still listed Product availability.

Sales expectations

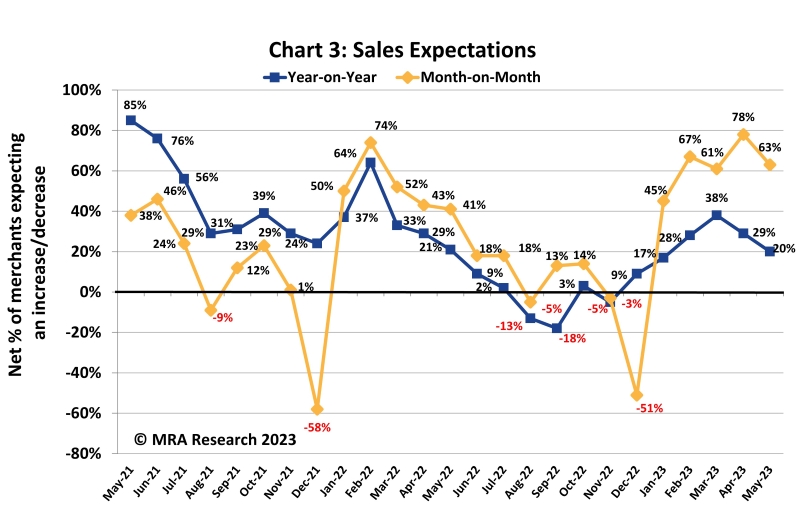

A net +63% of merchants expected May sales to increase compared to April, down from 78% month-on-month in April, the highest level in two years — Chart 3. All types and size of merchants expected growth: Regionals (+67%), Independents (+65%) and Nationals (+59%). Small outlets had the lowest expectations (+55%).

Most merchants in the North (+74%), South (+63%) and the Midlands (+60%) expected their sales to increase. Merchants in Scotland had slightly lower expectations (+53%).

A net +20% of merchants expected higher sales in May compared to May last year. That’s down from a relatively high +38% in March. Expectations were highest in the South (+46%), and Midlands (+12%). The number of merchants in the North who were more confident in the market was balanced by the number who were less confident (net 0%). Merchants in Scotland (-13%) expected to sell less compared with last year.

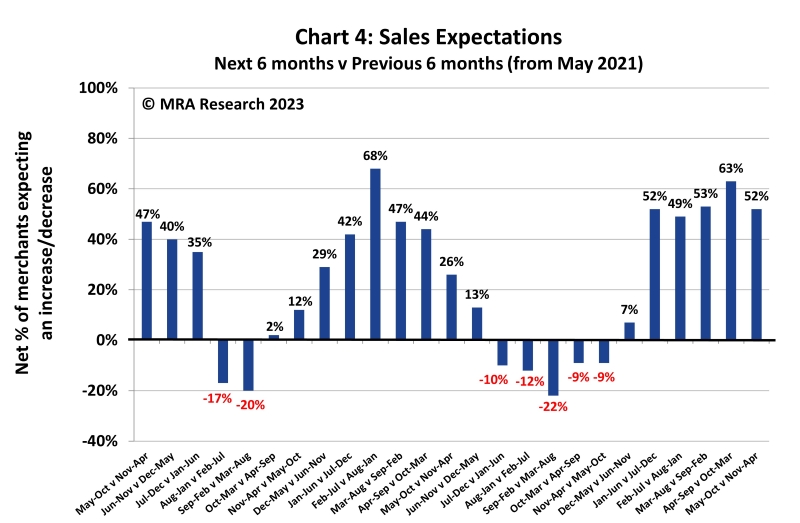

A net +52% of merchants expected sales to increase in the six months May to October 2023 compared to the previous six months — Chart 4. Expectations remained solid across the first five months of 2023. More Merchants in Mid-sized (+68%) and Larger outlets (+59%) expected sales to grow. Fewer Small outlets (+33%) expected sales to increase.

A net +52% of merchants expected sales to increase in the six months May to October 2023 compared to the previous six months — Chart 4. Expectations remained solid across the first five months of 2023. More Merchants in Mid-sized (+68%) and Larger outlets (+59%) expected sales to grow. Fewer Small outlets (+33%) expected sales to increase.

Over a quarter (28%) who expected higher sales, expected them to improve by up to 9% in the next six months. Almost half (47%) expected sales to grow by 10 to 20%, and 12% by more than that.

Confidence in the market

Having built to a net +30% in April, month-on-month, confidence in the market eased to +14% in May. More Merchants in Nationals (+22%) were confident than Regionals (+12%). The number of Independents who were more confident in the market was balanced by the number who were less confident (net 0%).

Confidence in the market had dropped year-on-year, from a net +12% last month to -2% (see Chart 5). The number of merchants in Scotland and the North who were more confident in the market was balanced by those who were less confident (net 0%). Only the South (+5%) was more confident. Large outlets (-29%) were least confident. More Small outlets (+10%) were confident.

Confidence in their business

Merchants’ confidence in the prospects for their own business dropped from a 2023 peak to date (net +52%) to +36% more confident month-on-month. Regionals (+52%) were the most confident. Independents (+12%) were least confident. Merchants in the Midlands (+40%) and the South (+37%) were more confident than other regions.

Merchants’ confidence in their own business remained strong year-on-year. A net +29% of merchants were more confident in May than they were in May last year. Regionals (+52%) were more confident than Nationals (+15%) and Independents (+6%). Small outlets (+36%) were more confident than Large (+29%) and Mid-sized outlets (+22%). Those in the South (+37%) were more confident than the Midlands and the North (both at +32%) and Scotland (+0%).

The full report can be downloaded for free from www.mra-research.co.uk/the-pulse or call Yvette Kirk at MRA Research on 01453 521621.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 49th in the series, with interviews conducted by MRA Research from the 2nd to the 4th May 2023 (three working days). Each month a representative sample of 100 merchants is interviewed. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

The difference between the percentage of merchants expecting growth and those expecting a decrease is the net figure, expressed as a percentage. A positive net percentage indicates growth, a negative indicates decline. Net zero implies no change.