The latest statistics from the Builders Merchant Building Index (BMBI) reveal a ‘mixed performance’ for the sector in Q2 2019, with the weather and political uncertainty as key underlying factors.

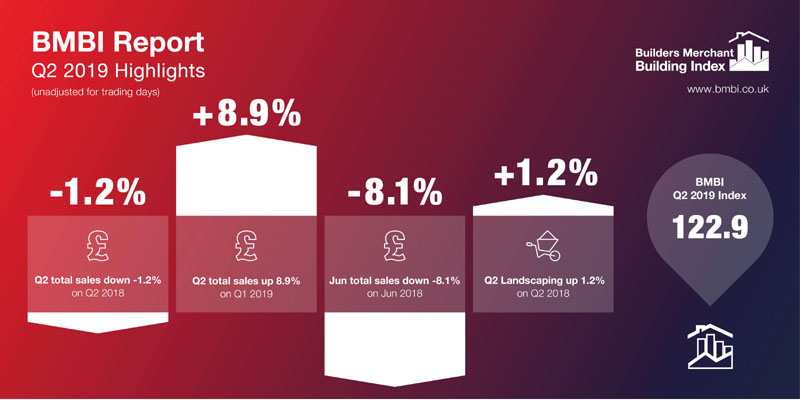

Following a strong start to the year, the BMBI reports that Total Builders Merchants sales were down -1.2% in Q2 2019 against the same period last year, although the adjusted figure, which takes into account the trading day difference, was marginally positive at +0.4%. The negative quarterly figure was heavily influenced by poor trading towards the end of the quarter, with overall sales in June down -8.1% compared with the same month last year. However, compared with Q1 2019, the picture is more positive.

Emile van der Ryst, GfK’s Senior Client Insight Manager – Trade, said: “The exit of Theresa May, arrival of Boris Johnson and the passing of two Brexit deadlines has impacted business and consumer confidence in 2019. However it is the noticeable effect that weather has had on the industry over the past 18 months that stands out.

“Q2 2019 saw a decline of -1.2% in value terms against Q2 2018, but this is exclusively driven by the month of June. June 2018 will be remembered for extreme heat and a lack of rain, while 2019 saw most of England and Wales with a higher rain fall than average, alongside one less trading day resulting in June 2019 being down by -8.1% year on year. Furthermore Q2 2018 sales spiked due to Q1 external construction delays following the Beast from the East, so assessing Q2 2019 too harshly would be wrong.”

Emile continued: “The topline value indicator for Q2 2019 vs 2018 shows Timber & Joinery stable at -0.1%, balanced against minimal Timber increases and a slight decline in Sheet Materials. Heavy Building Materials has declined by 1.6%, with highlights including growth for Plaster & Plasterboards and Insulation and a decline in Aggregates.

“Year to date figures still show value growth against 2018, but this has slowed down to 2.1% with price inflation the driver as volume continues to slow. The core sectors of Heavy Building Materials and Timber & Joinery have driven most of this growth, increasing in value by 2.2% and 3.1% respectively. Landscaping remains the best performing, up by 6.5% however Tools has shown a sluggish performance down by -4.9%.

He continued: “Core sub-categories within these main categories are driving this performance and provide a positive indicator that the market continues to plug away, with Bricks, Plasterboards, Insulation, Timber & Flooring all seeing higher than market average increases. Does this emphasize the fortitude of the industry in riding through this challenging time, with better days hopefully ahead? Time will tell.

“Q3 should provide some smoothing of these short term weather trends, as well as a more realistic outlook on how the industry has progressed in 2019. The 31st of October deadline is just around the corner; will this deliver the end of these gloomy and turbulent times? In this current political climate who can tell.”