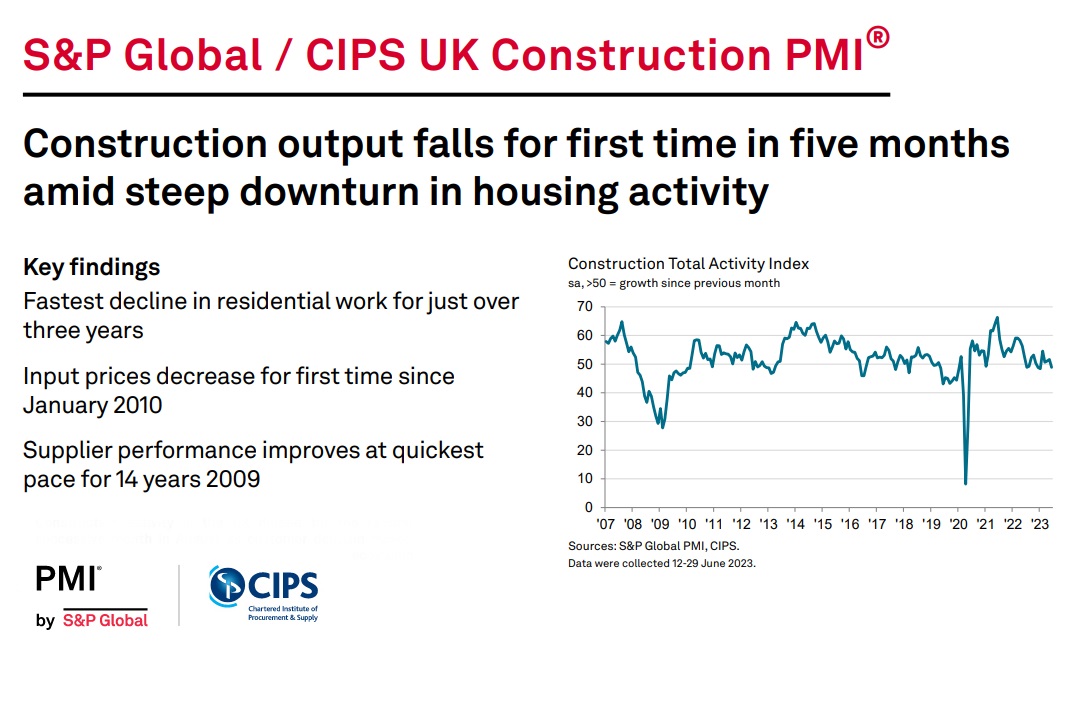

The S&P Global / CIPS UK Construction PMI report for June saw UK construction companies signalling a “renewed decline in business activity… as a steep and accelerated downturn in house building weighed on overall workloads.”

The latest data also highlighted a reduction in new orders for the first time since January. However, on a more positive note, softer demand and fewer supply bottlenecks were shown to have resulted in the sharpest improvement in delivery times for construction inputs since July 2009. This, the report contends, also contributed to an outright decline in purchasing prices for the first time in thirteen-and-a-half years.

At 48.9 in June, down from 51.6 in May, the headline seasonally adjusted S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – registered below the neutral 50.0 threshold for the first time in five months. The reduction in output levels was marginal overall, but this masked divergent trends across the three major categories of construction activity monitored by the survey.

Residential work (index at 39.6) decreased at the steepest pace since May 2020. Aside from the lockdown-related fall in house building, the rate of contraction was the fastest since April 2009. Survey respondents widely commented on weaker demand due to rising borrowing costs and a subdued outlook for the housing market.

Civil engineering was the best-performing segment (index at 53.1), with business activity rising at the second-fastest pace since June 2022. Construction companies mostly noted increasing work on infrastructure projects.

Commercial building also expanded at a solid pace in June (index at 53.0), although the rate of growth slipped to a three-month low. Rising demand for refurbishment projects was cited in June, but some firms reported more cautious decision-making by clients.

New order volumes decreased for the first time since January, although the pace of decline was only marginal overall. Subdued demand was mostly linked to the impact of rising interest rates on house building projects, alongside concerns among clients about the general economic outlook.

Construction companies sought to reduce their inventories and cut back on purchases of products and materials in

June. Mirroring the trend for new orders, the reduction in input buying was the first for five months.

Suppliers’ delivery times shortened for the fourth month running. The latest improvement in vendor performance was the strongest for around 14 years. Survey respondents widely commented on improved availability of inputs due to rising stocks among vendors and softer underlying demand.

June data signalled a marginal decline in overall input prices across the construction sector. This was the first outright reduction in average cost burdens since January 2010. Construction companies cited lower fuel, steel and timber prices, alongside more competitive market conditions in response to falling demand. Meanwhile, sub-contractor charges increased at the slowest pace for 31 months.

Construction firms signalled a downturn in business confidence for the third month running in June. Weaker optimism about future workloads mostly reflected concerns related to rising interest rates and subdued housing market conditions.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“Weaker housing market conditions in the wake of higher borrowing costs acted as a major constraint on UK construction output in June. Total industry activity declined for the first time in five months due to the steepest downturn in residential work since May 2020. Aside from the lockdown-related fall in house building, the rate of decline was the fastest for just over 14 years. Survey respondents widely commented on cutbacks to new residential building projects and more caution among clients in response to rising interest rates.

“Solid rates of output growth in the commercial and civil engineering segments helped to offset some of the weakness in residential construction. Higher levels of business activity were attributed to resilient demand for refurbishment projects in the commercial construction sector and robust infrastructure workloads.

“Construction companies experienced an outright decline in their purchasing prices during June, which contrasted with the rapid rates of cost inflation seen over the past three years. Anecdotal evidence suggested that more competitive market conditions and improved materials availability had helped to bring down inflationary pressures. Supply constraints continued to ease in the latest survey period, as signalled by the fastest improvement in delivery times for construction inputs since July 2009.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said:

“The construction sector became rooted in contraction territory in June as interest rate rises and squeezed affordability rates impacted on residential building output which fell to its greatest extent since 2009 outside the pandemic years.

“Fewer houses being built meant the sector was dragged down overall because civil engineering and commercial building projects remained relatively buoyant with stronger pipelines of work. Delivery times for building materials were also the most improved since 2009. Input price inflation fell blow the no-change mark, meaning raw materials became less expensive and were more widely available for construction companies.

“Looking ahead, there were few reasons to be cheerful as optimism fell to its lowest since January. A large blot on the landscape was the fall in employment growth. With interest rates at the highest for 15 years and inflation four times over the Bank of England target, the sudden reduction in construction sector hiring is one of the red flags facing the UK economy at the moment.”

Related News

S&P Global / CIPS UK Construction PMI May 2023 data

S&P Global / CIPS UK Construction PMI April 2023 data

S&P Global / CIPS UK Construction PMI March 2023 data

S&P Global / CIPS UK Construction PMI February 2023 data

S&P Global / CIPS UK Construction PMI January 2023 data

S&P Global / CIPS UK Construction PMI December 2022 data

S&P Global / CIPS UK Construction PMI November 2022 data

S&P Global / CIPS UK Construction PMI October 2022 data