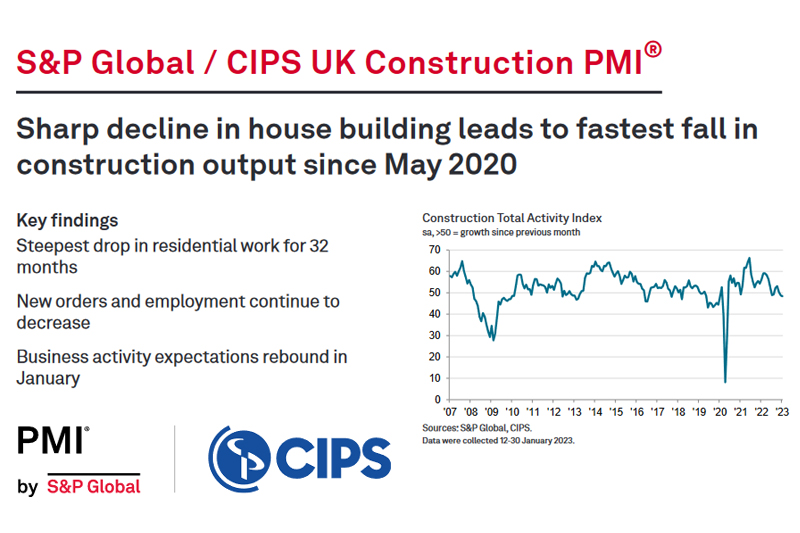

The latest S&P Global / CIPS UK Construction PMI report for January 2023 shows that whilst construction output continues to fall, business confidence in the sector has rebounded.

UK construction companies reported another downturn in business activity during January, largely reflecting weaker client demand and fewer new projects starts in recent months.

In contrast, business expectations regarding the year ahead rebounded considerably since December 2022, with confidence reaching its highest level for six months. Survey respondents noted that the general economic outlook appeared to have improved, while some cited tentative signs of a turnaround in sales enquiries.

At 48.4 in January, up from 48.8 in December, the headline seasonally adjusted S&P Global / CIPS UK Construction Purchasing Managers’ Index® (PMI®) – which measures month-on-month changes in total industry activity – posted below the neutral 50.0 threshold for the second month running. The latest reading signalled a modest reduction in overall business activity and the rate of decline was the fastest since May 2020.

House building (index at 44.8) was the weakest-performing category of construction output in January, with the rate of contraction the steepest since May 2020. Lower volumes of residential work were attributed to rising borrowing costs, unfavourable market conditions and greater caution among clients.

Commercial activity (48.2) decreased for the first time in five months during January, reflecting softer demand and delayed-decision making on new projects. Meanwhile, civil engineering activity (49.7) was close to stabilisation, with the latest reading the highest seen since June 2022.

Total new work decreased for the third time in the past four months, albeit at only a modest pace. Survey respondents cited particularly weak demand in the house building sector.

Mirroring the trend for business activity, latest data indicated that employment numbers decreased for the second consecutive month in January. The rate of job shedding was the fastest for two years, with construction companies often commenting on hiring freezes and the non-replacement of voluntary leavers due to softer demand.

January data pointed to the sharpest fall in purchasing activity since May 2020. Lower demand for construction products and materials helped to alleviate pressures on supply chains at the start of 2023. This resulted in the least marked downturn in vendor performance for three months.

Cutbacks to input buying and improved materials availability contributed to a slowdown in overall input cost inflation during January. The latest survey pointed to the second-slowest rise in purchase prices since December 2020. Where higher cost burdens were reported, this was mainly linked to increased energy prices.

Looking ahead, around 43% of the survey panel anticipate a rise in business activity over the year ahead, while only 17% forecast a decline. The resulting index signalled a sharp rebound in business expectations from the 31-month low seen in December 2022. Construction companies often commented on improved sales pipelines and hopes of a turnaround in new orders. Some firms cited optimism that confidence would eventually return to the housing market over the course of 2023, assisted by a stabilisation in borrowing costs.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“A sharp and accelerated decline in house building activity led to the weakest UK construction sector performance for just over two-and-a-half years in January. Construction companies once again cited a headwind from lacklustre market conditions, rising interest rates and fewer new project starts in the residential segment. Commercial building also slipped into contraction as the subdued UK economy weighed on business investment.

“However, there were positive signals for longer-term prospects across the construction sector, with business activity expectations staging a swift rebound from the low point seen last December. For some firms, the recovery in business optimism to its highest for six months was driven by signs of a turnaround in new sales enquires at the start of 2023. Other construction companies simply noted gradual improvements in the general economic outlook and hoped that confidence would return at a later stage this year to alleviate the current lack of momentum in the house building sector.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said:

“The wrecking ball of higher inflation and interest rates has knocked the UK’s residential building output to its weakest since May 2020 as stretched mortgage affordability impacted on the building of new homes. The other sectors also saw stagnation, so, it’s a construction conundrum, that builder optimism has risen to the highest for six months with the sector facing the second consecutive month of order books looking increasingly empty.

“This hopeful aspect could potentially be attributed to more enquiries filtering through to building companies which could develop into concrete orders in the coming months alongside the economy showing small, incremental improvements. Delivery times and material availability also improved which was a boost for firms working on ongoing projects.

“The continuing price pressures for energy and wages still remain a concern, along with the highest level of job shedding for two years and building skills remaining in short supply. Evidently, there are still roadblocks ahead, but we should have faith that the sector can see a path through for better outcomes in 2023 after languishing in contraction in the last few months.”

Related News

S&P Global / CIPS UK Construction PMI December 2022 data

S&P Global / CIPS UK Construction PMI November 2022 data

S&P Global / CIPS UK Construction PMI October 2022 data