With the housing market “remaining in the doldrums,” figures for the second quarter of 2024, released in the latest Builders Merchant Building Index (BMBI) from the BMF “show little sign of growth in demand for building materials.”

Against this backdrop the second quarter of 2024 shows a year-on-year decline, however the rate of decline is lower than seen in the first quarter of 2024.

Quarter 2 2024 v Quarter 2 2023

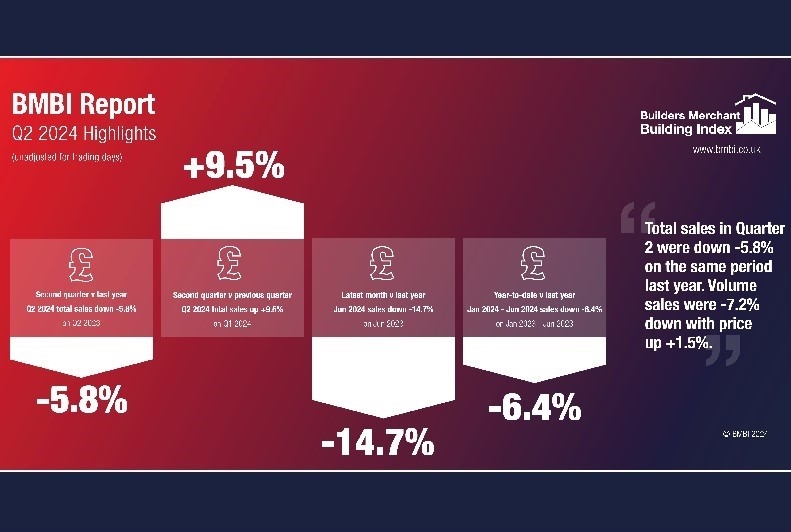

Year on year total value sales in Q2 2024 fell by -5.8% compared with the previous year Q2 2023. Volume sales were down by -7.2%, while prices rose by +1.5%. With two more trading days in 2024, like-for-like total value sales were -8.8% lower this year.

Sales of the two largest categories fell by more than the total sales average. Heavy Building Materials saw one of the largest value declines, down by -8.4%. The other main category, Timber & Joinery Products, declined in both value and price growth in Q2 2024, down by -7.4% and 12.9% respectively.

Landscaping, the third largest category, also fell (- 5.7%) whilst Renewables and Water Saving was the weakest category, down by -28.5%.

Six of the twelve categories outperformed the total market average, with Workwear and Safetywear (+15.6%) the highest performer.

Quarter 2 2024 v Quarter 1 2024

Total value sales in Q2 2024 were +9.5% higher than in the first quarter. Volume sales were +13.8% higher, whereas prices were -3.8% lower. With one less trading day in Q2 2024, like for like total sales were +11.2% higher than the first quarter of the year.

Eight of the twelve categories sold more, led by Landscaping (+43.4%), a strong seasonal performer. The largest category, Heavy Building Materials also increased, up by +10.3%. The weakest category was Plumbing Heating & Electrical, which fell by -10.6%.

Latest 12 months v previous period (July 2023 – June 2024 v July 2022 – June 2023)

Looking back over the past 12 months, total merchants value sales from July 2023 to June 2024 were -6.1% lower than the same period a year earlier. Volume sales were -10.0% lower, while prices were +4.4% higher. With two more trading days in the latest 12 month period, like for like sales were -6.8% lower.

Five of the smaller categories sold more, led by Workwear & Safetywear (+9.3%) and Decorating (+5.3%), but the two largest categories Heavy Building Materials (-7.4%) and Timber & Joinery Products (-10.6%) were amongst the weakest.

The BMBI reports are compiled by data from GfK’s “ground-breaking” Builders Merchants Panel, which tracks real sales information from leading builders’ merchants. Emile van der Ryst, Senior Client Insight Manager – Trade at GfK, commented: “The second quarter builders’ merchant sector is a continuation of wider market trends, seeing challenging economic conditions and a pessimistic short-term outlook.

“There has been some positive communication by the new government related to construction and new house building, but only time will tell if these ambitions are to be met. In the short term there are concerns about a potential US recession, which could grind any short-term positivity to a halt. Unfortunately, this will likely have a negative effect on both Q3 and Q4 results.”

John Newcomb, CEO of the BMF, added: “Challenges continued for the construction industry in the second quarter of the year, notably in new housing where the slowdown is most pronounced.

“With many merchants supplying both the newbuild and housing RMI markets, which is still feeling the impact of high interest rates and a lack of consumer confidence, demand remains a key concern. It now seems we are unlikely to see a significant upturn in the market until 2025.”