The latest monthly survey — conducted in July — shows the industry returning to a pre-Covid world to an extent, with many branches now fully open and most of the rest are planning to follow. PBM presents more feedback from the merchanting front line in the September issue of PBM.

Branches are in safety mode, operating with restrictions to protect staff and customers, and this is unlikely to change anytime soon. Following a surge in sales and confidence in June, merchants were more cautious in July with sales and confidence easing a little. Overall, though it’s a positive picture.

Ongoing impact of COVID-19

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 6th and 9th July. Because of the unusual circumstances, we continued with the extra questions we added in April to get a better picture of the market through the lockdown.

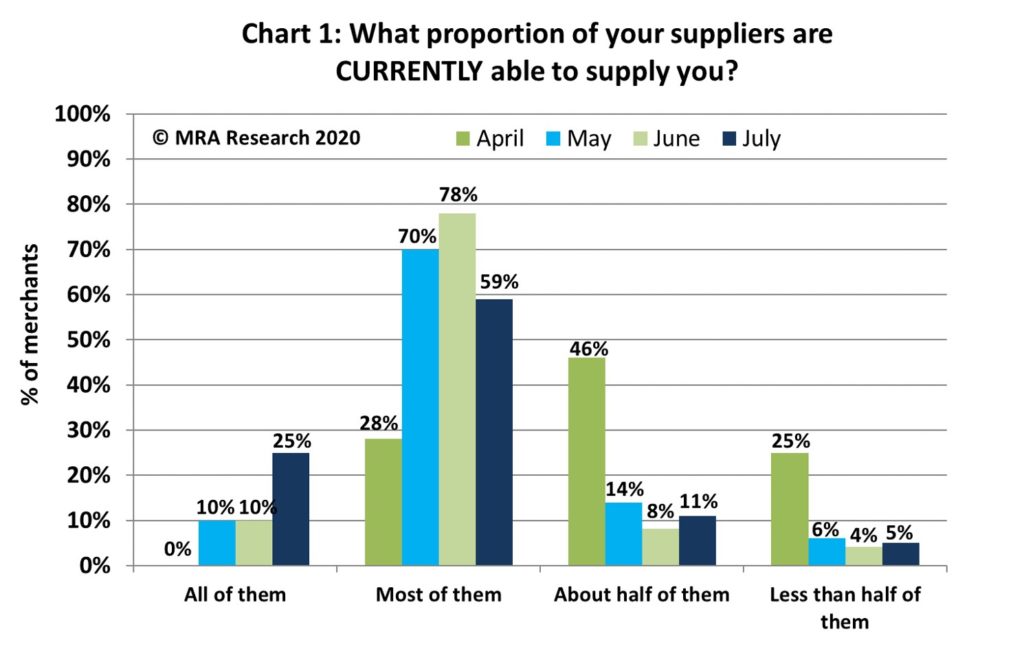

While material supply continues to improve in line with the easing of lockdown (see Chart 1), supplies of many products and extended lead times are a problem.

Sales expectations

Sales expectations

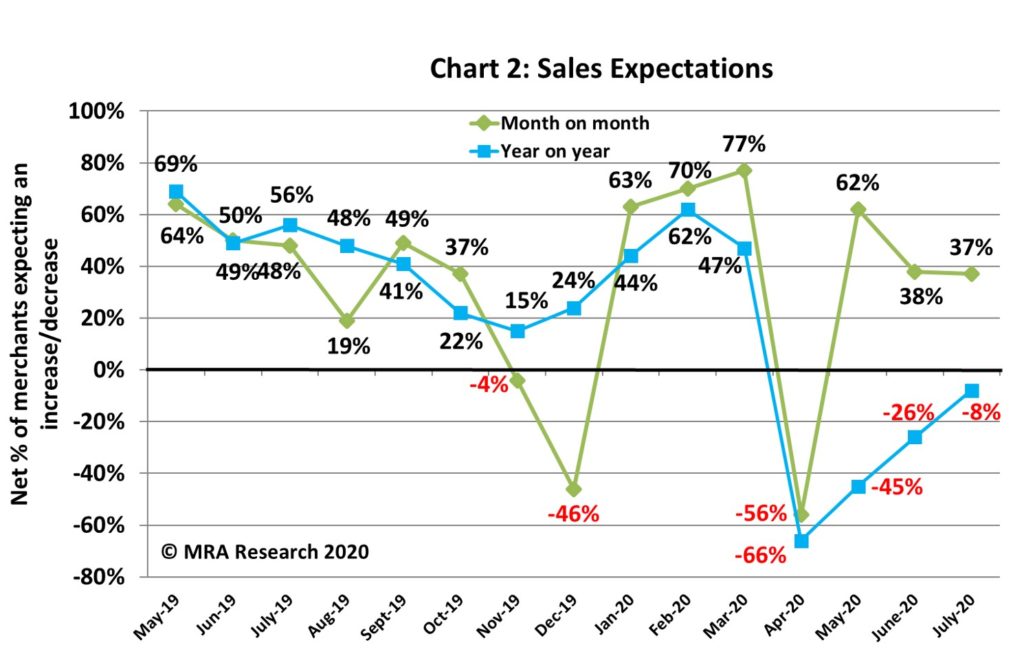

As in the last survey, a net +37% of merchants expected sales to improve in July compared to June (Chart 2). Large branches (+75%) and Nationals (+50%) were most bullish.

Year-on-year expectations continue to improve, reaching -8%, a net +18% improvement from June’s survey (Chart 2). Mid-sized outlets and independents are more positive with a net +5% and +7% respectively forecasting increased sales. Large branches (-30%) and those in Scotland (-23%) are cautious.

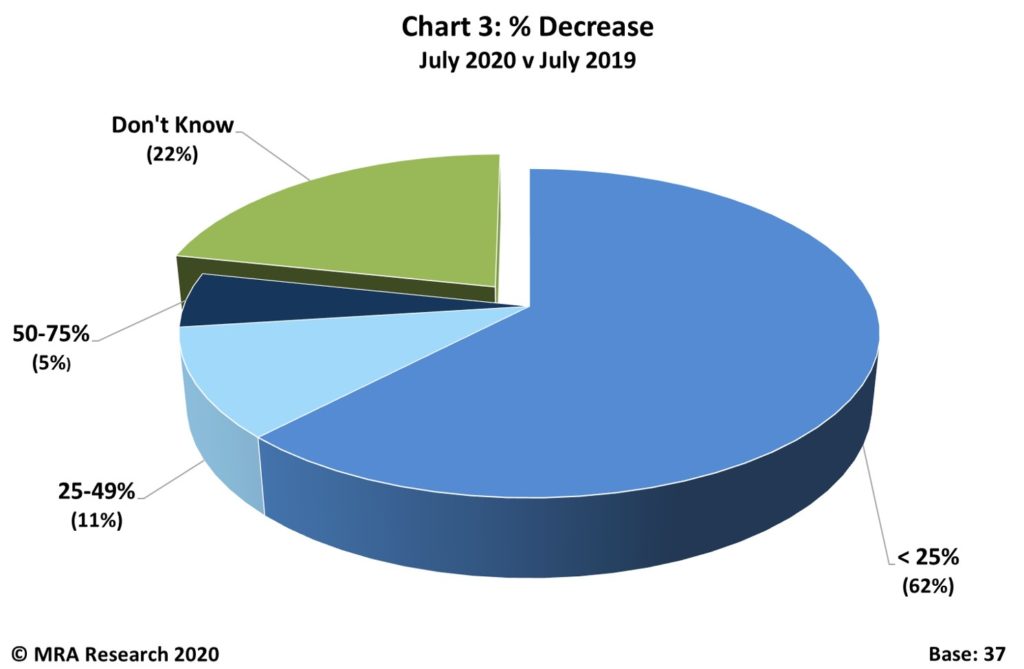

Nearly two thirds of merchants forecasting lower year-on-year sales expected July sales to be as much as 25% down compared to July last year. See Chart 3.

Nearly two thirds of merchants forecasting lower year-on-year sales expected July sales to be as much as 25% down compared to July last year. See Chart 3.

However, the outlook for quarter-on-quarter sales is upbeat and continues to improve. A net +52% of merchants expect better sales in July to September compared to April to June. Expectations are strongest in large outlets (+80%).

However, the outlook for quarter-on-quarter sales is upbeat and continues to improve. A net +52% of merchants expect better sales in July to September compared to April to June. Expectations are strongest in large outlets (+80%).

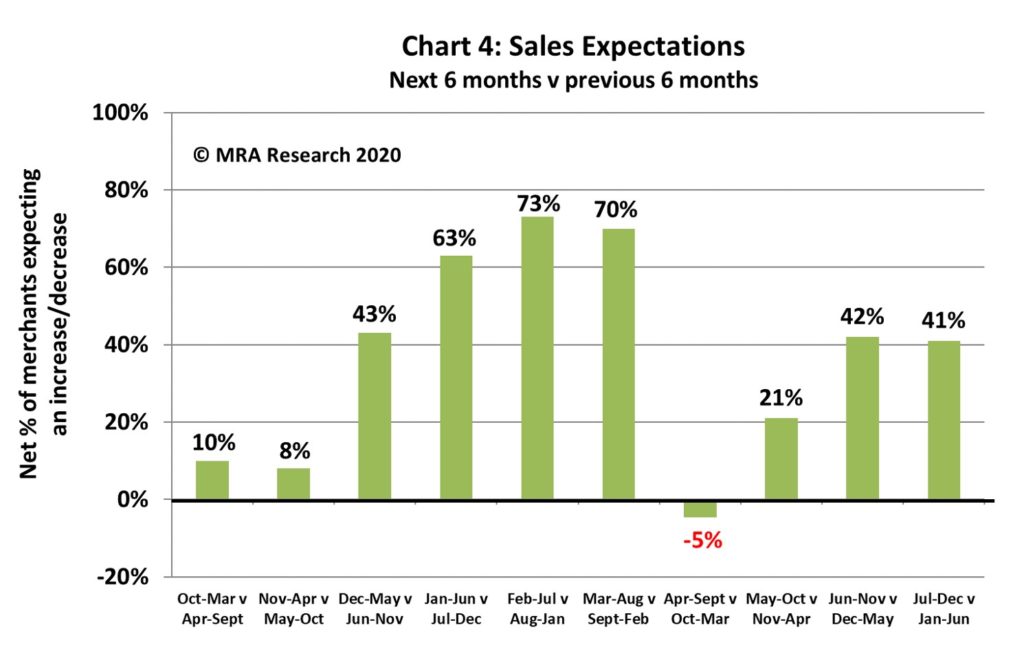

Looking six months ahead, expectations are also positive — but not as strong as the surge in expectations after the election and before Covid (Chart 4). The largest outlets are significantly more bullish with a net +75% expecting sales to grow.

Confidence in the market

Confidence in the market

Market confidence has eased since the June survey but is still positive. A net +30% of merchants were more confident in July than in June. While there was no change among independent merchants, a net +30% of regionals and +42% of nationals were more confident.

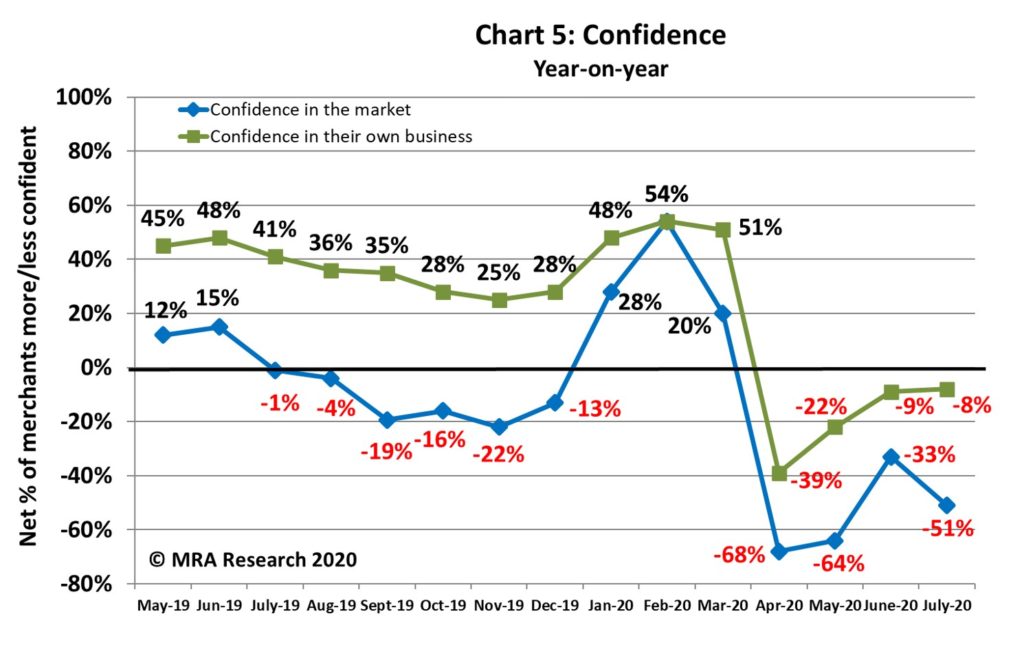

Confidence in the market weakened year-on-year, compared to the June survey, with a net -51% of merchants less confident (see Chart 5). It was weakest in Scotland (-62%) and the South (-65%).

Confidence in their business

Merchants’ confidence in their own business dipped a little since the June survey but remains strong. A net +46% of merchants were more confident in July compared to June. Branches in the Midlands (+52%) and Scotland (+69) are most positive, with none of those interviewed in these regions less confident over the period.

Year-on-year, confidence in their own business levelled off in July’s survey (also Chart 5). It’s much improved compared to April and May, but is well down on normal levels. Independents (-29%) and merchants in the North (-28%) are least confident.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 15th in the series, with interviews conducted by MRA Research between 6th and 9th July 2020. Each month a representative sample of 100 merchants is interviewed. Due to the Coronavirus lockdown and impact on business closures and restrictions, surveys since April have been based on a larger number of contacts. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

The full report can be downloaded from www.mra-research.co.uk/the-pulse or call Lucia Di Stazio at MRA Research on 01453 521621