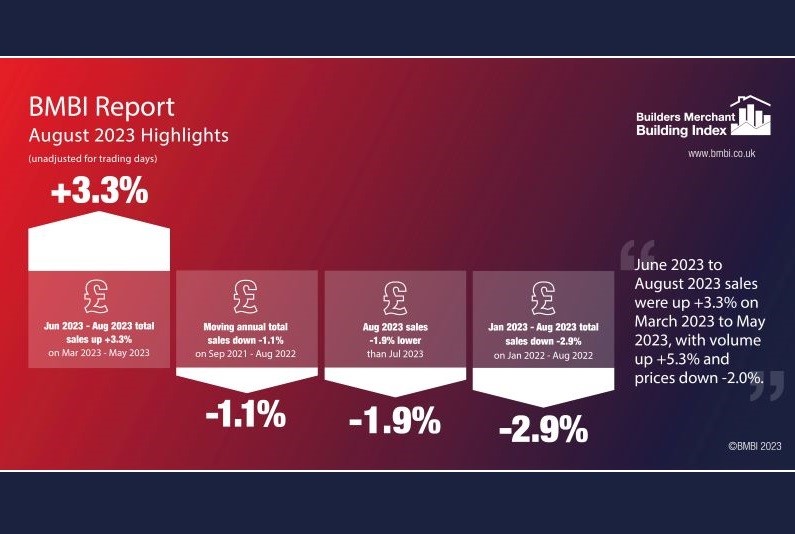

The latest Builders Merchant Building Index (BMBI) report covering the period June to August 2023 shows that builders’ merchant volumes were up +5.3% on previous three months.

Value sales in the most recent three month period covered were also +3.3% higher than March to May 2023, with prices down -2.0%. However, builders’ merchants’ value sales were down -3.3% in the month of August compared to the same month in 2022, with volume falling -10.5% and prices up +8.0%.

Eight of the twelve categories sold more this August than in August 2022 with Renewables & Water Saving (+37.6%) continuing to dominate the field. Workwear & Safetywear (+11.6%), Plumbing, Heating & Electrical (+10.8%) and Decorating (+10.8%) increased more than other categories. Landscaping (-7.0%) and Timber & Joinery Products (-13.2%) were weakest.

Month-on-month, total merchant sales were down -1.9% in August compared to July. Volume sales were down -3.2% while prices increased +1.4%. With one additional trading day in August, like-for-like sales were -6.3% lower. Five of the twelve categories sold more, led by Workwear & Safetywear (+7.5%). Renewables & Water Saving (-9.6%) was the weakest category.

Total merchant sales in the twelve months from September 2022 to August 2023 were -1.1% down on the same period a year ago, with volumes falling -12.8% and prices up by +13.3%. Nine of the twelve categories sold more with Renewables & Water Saving (+46.0%) the best performer by a considerable margin. Plumbing, Heating & Electrical (+13.2%), Decorating (+13.0%) and Workwear & Safetywear (+12.5%) also recorded double digit growth. Landscaping (-10.9%) and Timber & Joinery Products (-14.0%) sold less.

Mike Rigby, CEO of MRA Research which produces this report, said: “When the ONS recently announced more accurate statistics for the last three years, it revealed that Britain had done rather better than several European countries, and much better than the dismal economic narrative economists and the national media had been recounting. Britain isn’t in recession, unlike some others.

“But in October, consumer confidence, as reported in GfK’s Consumer Confidence Index, lost all its gains since April, as consumers were hit by a mix of concerns – war in the Middle East, a rise in fuel and gas prices, and colder weather.”

Mike continued: “In 2017, according to Reuters’ research, 24% of UK citizens were news avoiders. Today that has jumped to 41%. More than half the avoiders said the negative impact on their mood was the reason for avoiding the news.

“So it’s good to report that builders’ merchants volume sales were up +5.3% in the three months June to August on the previous three months. August sales were a damp squib but that’s no surprise. In addition to the tail off in demand due to customer and contractor holidays, the wetter than average summer months hampered outdoor trades and project starts, and many people spent their money on last minute holidays to escape the rain, rather than on home improvements. Travel agents recorded a quadrupling of bookings in July for August travel.”

He added: “Housebuilding has been an even damper squib. Despite a pause on interest rate rises, net mortgage approvals fell again in August. With people staying put, the repair, maintain and improve market offers the best opportunities for growth in the short to medium term. Britons have got the message: now’s the time to ‘improve not move’.”

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

PHMI findings show plumbing & heating merchants’ August sales volumes were +0.8% ahead of July.

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for August 2023 through specialist plumbing and heating merchants were up +2.8% higher than July. Volume sales edged up +0.8% with prices up +1.9%. With one extra trading day in August, like-for-like sales – which take trading day differences into account – were down -1.9%.

August’s total value sales were +2.9% higher than in August last year. Prices increased +7.9%, while volumes fell -4.6%.

Total value sales over the last three months, June to August 2023, were +6.2% higher than the same period a year ago. Volume sales were down -0.3% and prices rose +6.6%. With two more trading days in the most recent three-month period, like-for-like sales were up +3.0%.

Plumbing & Heating merchants’ value sales in the 12-month period from September 2022 to August 2023 were +8.1% higher than the previous twelve-month period (September 2021 to August 2022). Volumes were down -0.7% with prices rising +8.8%. With one less trading day in the most recent period, like-for-like sales were +8.5%.

August’s PHMI index was 97.6. With one more trading day compared to the base figure, the like-for-like index was 91.7.

Mike Rigby, CEO of MRA Research, which produces the report says: “Plumbing and Heating sector volumes largely held steady in August with less than a one point variance in month-on-month, quarterly, and rolling 12 month comparisons. Prices are still edging up though and this remains the main driver of value growth.

“Hit by a mix of concerns in October – war in the Middle East, a rise in fuel and gas prices, and colder weather – consumer confidence lost all the gains since April, as reported in GfK’s Consumer Confidence index. Confidence is however well up from the October 2022 lows.”

Mike continued: “In August, housebuilding continued to slump as indicated by the S&P Global/CIPS UK Purchasing Manager’s Index which saw residential work fall to 38.1. Anything below 50 is bad news. The increased cost of borrowing and weak economic conditions were the main reasons cited by housebuilders for the sustained dip.

“With housebuilding in a downturn, the repair, maintain and improve market will likely provide the best opportunity for plumbing and heating sales in the Autumn whether that’s a boiler or heating system upgrade to improve the energy efficiency of the home before winter, or a new bathroom before Christmas.”

He added: “Despite the government back pedalling on its green promises, there is a growing appetite for products which save energy and water, and those that are kinder to the environment, so this should remain a focus for trades and merchants alike.”

The Plumbing & Heating Merchant Index (PHMI) is designed to be the first to analyse point of sales data collated from specialist plumbing & heating merchants (with combined annual sales of £3bn) to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

To download the latest report, visit www.phmi.co.uk.