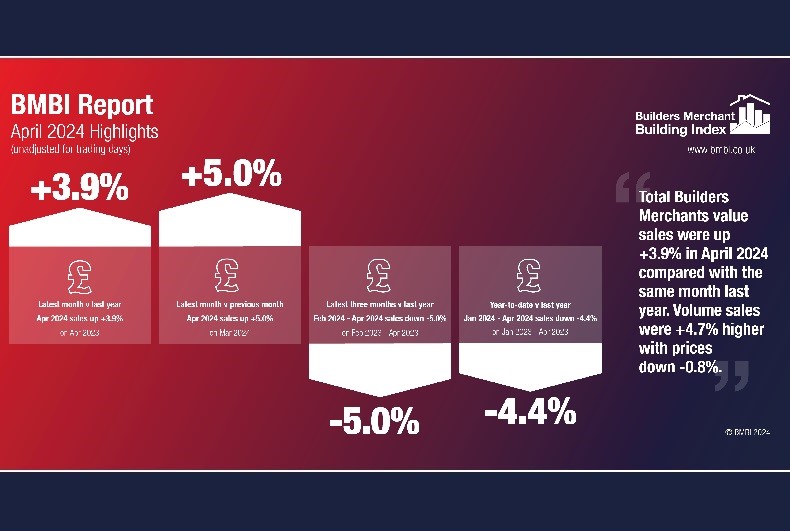

The latest Builders Merchant Building Index (BMBI) report, published in June, shows builders’ merchants’ value sales were up +3.9% in April compared to the same month a year ago. Volume sales increased +4.7% and prices eased -0.8%. However, with three additional trading days this year, like-for-like value sales were down -11.0%.

Year-on-year, eight of the twelve categories outperformed Total Merchants, with Workwear & Safetywear (+28.9%), Miscellaneous (+15.0%), Decorating (+14.1%) and Plumbing Heating & Electrical (+13.2%) in the lead. The three largest categories – Heavy Building Materials (+1.4%), Timber & Joinery Products (+1.4%) and Landscaping (+3.2%) – all grew more slowly.

Month-on-month

April total value sales were +5.0% higher than the previous month. Volume sales increased +7.4% and prices were down -2.3% compared to March. With one more trading day in April, like-for-like value sales were flat (+0.0%). Ten of the twelve categories sold more, with seasonal category Landscaping (+15.4%) well up, but Heavy Building Materials (+4.8%) and Timber & Joinery Products (+3.6%) recorded more moderate growth. Plumbing Heating & Electrical (-1.4%) and Workwear & Safetywear (-4.6%) were the weakest performing categories.

Full year sales

Total merchant sales in the 12 months from May 2023 to April 2024 were -4.7% lower than the same period the year before (May 2022 to April 2023). Volume sales slumped -9.6% and prices rose +5.4%. With four extra trading days in the most recent 12-month period, like-for-like sales were down -6.3%.

Nine categories sold more with Workwear & Safetywear (+8.3%), Decorating (+7.5%) and Miscellaneous (+5.3%) the strongest performers. The three largest categories – Heavy Building Materials (-5.0%), Landscaping (-5.7%) and Timber & Joinery Products (-11.3%) – all sold less.

For the quarter, total value sales from January to April were -4.4% down on the first four months of 2023.

Mike Rigby, Managing Director of MRA Research which produces the BMBI report, said: “Heavy rainfall and strong winds again disrupted construction output, with the latest ONS data reporting all bar two sectors contracting in April. Private new housing (-4.4%) and private repair and maintenance (-2.5%) were the biggest losers year-on-year.

“On the face of it, the forecasts for the economic headwinds which are impacting new building works and RMI projects aren’t looking much better. Interest rates are holding firm at 5.25% and any chance of a cut is likely to be at least August. Inflation has finally dropped to +2.3% yet prices are still increasing, and some goods are increasing more than others which is squeezing many household budgets.

More positively, Mike continued: “Despite all the negatives, the most recent GfK Consumer Confidence Index scores for May show an increase in positive outlook for personal finances and consumers expectations for the economy, with the overall index improving two points to -17. With a general election, and a near-certain expectation of a change in government, could there be a bounce in the economy and much needed relief for consumers, trades and builders’ merchants in the second half of the year?”

April’s BMBI report is available to download at www.bmbi.co.uk.

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and intended to be the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK.

The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for 92% of total sales from builders’ merchants throughout Great Britain from companies including Buildbase, Jewson, Travis Perkins, EH Smith, Gibbs & Dandy, MKM, Bradfords, Covers and Sydenhams. Live data confirms total annual sales for the Multiple Generalist Builders Merchants Channel to be in excess of £6bn..

An in-depth review, which includes commentary by sector experts, is provided each quarter.