Figures for the final quarter of 2021 in the BMF’s Builders Merchants Building Index (BMBI) found sales through UK builders’ merchants slowing slightly after two record quarters.

Total value sales data from Britain’s builders’ merchants shows Q4 2021 recorded the third-highest quarterly BMBI sales ever, rounding off a record-breaking year for merchants. However, after a year characterised by supply shortages and ending with soaring energy costs, resulting in substantial price increases, growth is largely driven by pricing rather than volume.

Bricks, Blocks, Insulation, Lintels, Plasterboard, Sheet Materials and Roofing Products saw their highest average price during Q4 2021, highlighting the cost pressures currently affecting the market. Accordingly, the BMBI concludes that the figures “suggest the 2021 trade boom has inevitably slowed”.

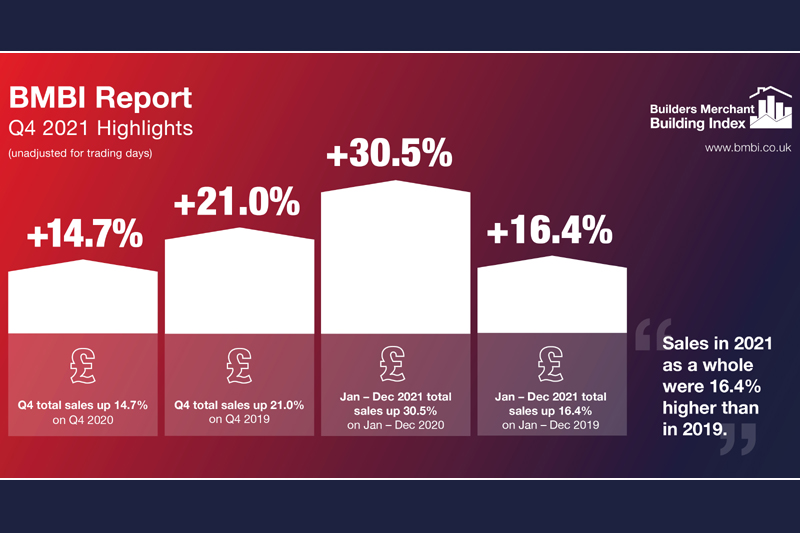

Quarter 4 2021 total value sales were 14.7% higher than Q4 2020, with no difference in trading days. All categories sold more. Timber & Joinery Products was out in front (+28.2%), followed by Landscaping (+14.4%) which recorded its highest quarterly sales of the year. Heavy Building Materials (+11.1%), Kitchens & Bathrooms (+10.0%) and Plumbing Heating & Electrical (+9.6%) grew more slowly. The weakest category was Workwear & Safetywear (+0.1%).

A closer look at regional activity confirms that all regions sold significantly more in 2021 vs 2020, which is not surprising given the Covid disruption in Spring 2020. The strongest growth was seen in Scotland (+39.8%), followed by South East excl. London (+35.4%) and East Midlands (+31.6%).

Comparing Q4 2021 with Q4 2019, a more normal pre-Covid year which has provided a more accurate barometer for many merchants, total value sales were 21.0% higher this year, with the benefit of one more trading day. Nine of the twelve categories sold more, including Timber & Joinery Products (+44.4%) and Landscaping (+40.6%) which were well ahead of other categories. Like-for-like sales were up 18.9%.

Quarter-on-quarter

Sales were down 12.7% in Q4 compared to Q3, not helped by four less trading days in the most recent period. Only Workwear & Safetywear (+15.3%) and Plumbing Heating & Electrical (+9.0%) sold more, while Renewables was weakest (-30.3%). Like-for-like sales were 6.9% lower than in Q3.

December 2021 sales were significantly down compared to November 2021 (-33.0%), with five less trading days. This impacted the overall Q4 results. However, the decline in sales between November and December is in line with previous years’ results.

Compared to December 2020, when large parts of the country were subject to tiered Covid restrictions, total sales were up 16.3% in December 2021 with no difference in trading days. All categories sold more, as Timber & Joinery Products (+25.0%) and Landscaping (+18.8%) again finished ahead of the rest. Heavy Building Materials (+14.7%), Kitchens & Bathrooms (+10.7%) and Decorating (+7.2%) grew more slowly than merchants’ overall.

Total value sales in December 2021 were 26.5% higher than the same month two years ago, helped by two more trading days this year. All categories sold more but much of this growth can be attributed to Timber & Joinery Products (+50.4%) and Landscaping (+48.6%) which continued to significantly out-perform the others. Like-for-like sales were 11.6% up.

John Newcomb, CEO of the Builders Merchants Federation, said: “This is a year that merchants can look back at with pride. They have shown remarkable adaptability and resilience to overcome testing conditions arising from the Covid crisis that has now affected operations for almost two years. While sales remained strong in 2021, merchants are now facing continuing supply challenges coupled with a 30 year high in the cost of living which will inevitably impact consumer confidence.”

Emile van der Ryst, Senior Client Insight Manager – Trade at GfK Retail & Technology UK, added: “Merchants (have shown) they were adept at efficiently adjusting to unique market conditions and maximising returns to the best of their abilities. The year 2022 does however bring a dark cloud of even more price increases, further economic difficulties for consumers and potential geopolitical issues further afield. It won’t be an easy year, which makes predictions even more difficult, but there’s an expectation that the market will remain relatively flat. Only time will tell, but right now signs point towards a bumpy year.”

The Q4 2021 BMBI report is available to download at www.bmbi.co.uk.

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.