In an early teaser for PBM’s December issue, editor Paul Davies cautions that the merchant sector needs to pay close attention to the ways in which the big home improvement retailers are increasingly setting their sights on growing their share of the trade market.

Publishing deadlines mean that this column is being written ahead of Rachel Reeves Budget on 26th November, but I’m sure that by the time the issue lands on your desk or drops into your inbox, the world will be a sweeter place… Perhaps not then.

Irrespective of the Chancellor’s pronouncements, it continues to be a challenging market. Yet at the recent NBG Conference in Glasgow, delegates maintained a defiant level of energy and enthusiasm that bellied the circumstances they are confronted with at the coalface. And the sector is facing the challenge head on — evident from the host of product innovations on display at the stands of the exhibition, to the ideas discussed from the stage.

Amongst its many other aims, the industry-wide Data Yard initiative, for example, will help to drive efficiencies for merchants and suppliers, whilst the recently announced strategic alliance between NBG and IBC promises far-reaching benefits for the members, suppliers and ultimately customers of both groups.

Citing stagnant housebuilding data and the most recent BMF forecast which suggests a relatively meagre 2.5% sales growth for the year, NBG MD Mark Hughes made the vital point that, to paraphrase, we can’t rely on the market to help us; we have to do it ourselves…

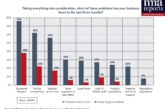

So, if growing share is the way to navigate a flat market, from whom can this be taken? Whilst some merchants are clearly struggling more than others, we must also step outside the sometimes narrow, self-imposed definitions the industry imposes and consider a broader picture.

“While we wait in hope for the wider economic recovery and the levers being turned to finally unlock housebuilding and beyond, the battleground is in the RMI market and harnessing (indirect) consumer spending.”

For instance, it should no longer be heresy to look at the activities of the major home improvement retailers — and the lessons that can be learned. In its recently published Q3 trading update, Wickes reported “another quarter of volume-led growth across all areas of the business” with overall Group revenue increasing 6.9% year-on-year in the period.

But is the retailer only serving DIY customers, and therefore ‘distant’ from merchant market comparisons? Well, its TradePro loyalty scheme (offering an automatic 10% discount on all purchases in-store and online, with no minimum spend) recorded sales growth of 8% year-on-year, driven by an increase in “active members” to 632,000.

Whilst our deadline comes too soon for Kingfisher’s Q3 update, scheduled for 25th November, its half year report presented a similar picture. Indeed, B&Q’s trade focused banner TradePoint delivered +6.9% LFL growth, and now represents 22.4% of the retailer’s total sales (of around £4bn annually). A “clear focus on product, price and customer engagement, supported by further investment in dedicated trade sales partners” were all shown to contribute, alongside enhanced marketing and brand visibility.

Furthermore, “strong growth in e-commerce, particularly in click & collect” continued to drive store footfall, buoyed by use of the TradePoint app which saw “active membership grow 9% YoY to 1.4 million” with the app now accounting for 25% of online sales.

The trade-centric Screwfix banner, meanwhile, saw total sales +4.4% (LFL +3.0%) to £1,358m for H1, with “healthy demand from trade customers” again fuelled by digital developments including continued growth through its app (+9.2% YoY) driven by “personalised rewards, a visual search engine, streamlined collection and rapid delivery through Screwfix Sprint.”

And beyond the competition from the big box retailers, we’re not even beginning to contemplate the challenge online retailers present, from specialists to marketplaces and giants like Amazon…

Cash is tight for many people, but plenty do have money to spend. While we wait in hope for the wider economic recovery and the levers being turned to finally unlock housebuilding and beyond, the battleground is in the RMI market and harnessing (indirect) consumer spending.

To gain market share, merchants need to be aware not just of the competition across the trading estate but at the retail park on the edge of town. Yes, they are ‘different’ and go about their business in a different way. And the sector might not like to consider them as competitors in the truest sense. But they are already explicitly focused on growing their share of the trade market..

The question is how to respond.