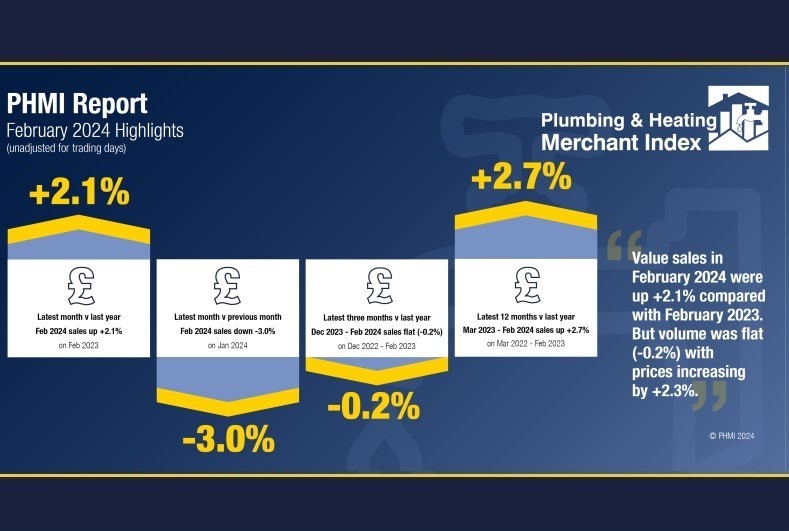

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for February through specialist plumbing and heating merchants were up +2.1% in 2024 compared to February 2023. Prices edged up +2.3% while volume was flat (-0.2%).

With one additional trading day in 2024, like-for-like sales for February (which taking trading day differences into account), were -2.8% lower than 2023.

Compared to January, February value sales were down -3.0% and volume was down -0.9%. Prices also decreased -2.1%. With one less trading day in February, like-for-like sales were +1.6% higher.

Total value sales in the three months December 2023 to February 2024 were flat (-0.2%) compared to the same period a year ago. Volume sales were down -4.2% and prices rose +4.3%. With two additional trading days in the most recent three-month period, like-for-like sales were -3.5% lower.

Value sales in the three months December 2023 to February were -10.3% down on the previous three-month period (September to November 2023). Volume sales were -13.9% down, with prices up +4.1%. With six less trading days in the most recent period, like-for-like sales were -1.2% lower.

Plumbing & Heating merchants’ value sales in the rolling 12-month period from March 2023 to February 2024 were +2.7% higher than the previous 12-month period. However, volume sales fell -3.0%, while prices increased +5.9%. With three extra trading days this year, like-for-like value sales were up +1.5%.

February’s PHMI index was 106.6 with no difference in trading days compared to the base period.

Mike Rigby, CEO of MRA Research which produces the report, commented: “The medium to long term prospects for new build housing could hardly be stronger with housing accepted by most political parties as a priority. The same applies to upgrading the existing housing stock so it is more energy and water efficient.

“But addressing the capacity constraints to tackle the backlog and start meeting demand for both new housing and upgrading the housing stock will take time.”

Mike continued: “Although the housing market is recovering and prices are starting to rise again, housebuilding is way below recent peaks, which is restricting new plumbing and heating installations. The top end of the RMI market is still busy but the middle to lower sector of the market is waiting on the economy to revive.

“Research by Confused.com supports the growing sentiment for home repairs and improvements, with a survey revealing that a third (32%) of UK homeowners are planning a renovation project for 2024. Bathroom remodels (33%) and kitchen upgrades (28%) top the wish lists.”

To download the latest report visit www.phmi.co.uk.

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation.

There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.