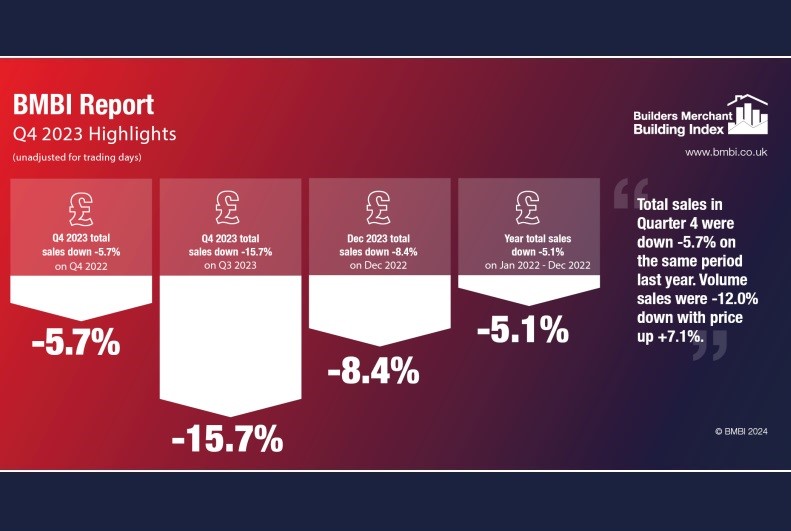

Figures for the final quarter of 2023, released in the latest Builders Merchant Building Index (BMBI) from the Builders Merchants Federation confirm the extent of the downturn in construction during the quarter and over the course of the year, with annual sales values falling by -5.1% compared with 2022, after two years of strong growth.

Quarter 4 2023 v Q4 2022

Year on year total sales values for Q4 2023 fell by -5.7% compared to Q4 2022. Volume sales were -12.0% down, whereas prices were up by +7.1%. With one more trading day in 2023, like for like sales during Q4 were -7.3% lower than in 2022.

On a category level, Timber & Joinery Products (-10.3%) contributed most to the Q4 on Q4 decline in sales value. However, all three of the largest categories sold less with Heavy Building Materials down by -7.3% and Landscaping down by -6.7%.

Six of the twelve categories did see value growth, including Workwear & Safetywear (+8.6%) and Decorating (+7.1%).

Quarter 4 2023 v Q3 2023

Comparing sales in Q4 2023 with the third quarter of the year, total value sales dropped by -15.7% in Q4. Volume sales were -19.8% down, while prices were up by +5.1%. With four fewer trading days in the most recent quarter, like for like sales were -10.1% lower in Q4 over Q3 2023.

Plumbing, Heating & Electrical (+4.4%) was one of only two categories to show quarter on quarter value growth, with the smaller Workwear & Safetywear category up +17.0%.

Landscaping (-33.2%), a seasonal category, was the largest negative contributor, followed by Renewables and Water Saving (-20.9%), Heavy Building Materials (-17.4%) and Timber & Joinery Products (-15.1%).

Full year 2023 v 2022

The effect of rising prices and falling volumes can be seen in the full 12-month comparison of 2023 and 2022. Annual sales values fell by -5.1%, but this annual headline figure represents a fall in sales volumes of -13.7%, and price growth of +10.0%.

With two more trading days in 2023, overall like for like sales were -5.9% lower than 2022.

On a category level Heavy Building Materials saw a full year value decline of -3.2%, a volume decline of -17.7% and price growth of 17.6%. Other value indicators shows Landscaping down by -11.9%, with Timber & Joinery Products down by -14.4% due to a price decline of -14.6%.

Decorating and Kitchens & Bathrooms were up by 9.0% and 3.2% respectively.

BMF CEO John Newcomb said: “It has been yet another challenging quarter for construction, concluding a year that most of us would like to forget. Construction output seems likely to contract further before returning to growth in 2025. But with an election on the horizon, the Chancellor may look to stimulate the housing market in his Spring Budget, while the Governor of the Bank of England has not discouraged market speculation on a series of interest rate cuts later in the year.

“Taking a more optimistic view, the market could take a positive turn in the second half of 2024. But we are not holding our breath.”

The BMBI is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data. Emile van der Ryst, Senior Client Insight Manager – Trade at GfK, commented: “Economically, 2023 will go down as one of the worst in recent memory for the UK, with ONS figures indicating a technical recession at the end of 2023. This backdrop had a noticeable impact on the merchanting sector.

“While a challenging year was widely expected within the sector, the extent of it wasn’t. 2024 should see a continuation of the challenges seen towards the end of 2023. However, price growth as measured in the BMBI should noticeably drop off in the coming months, while volumes should recover in the second half of the year, hopefully paving the way for a market returning to growth in 2025.”

Mike Rigby, CEO of MRA Research which produces the report, added: “Quarter 4 did little to turn the tide on falling sales volumes through the UK’s builders’ merchants, as 2023 closed -13.7% down on volume sales compared to 2022.

“But despite this drop in activity and the announcement of the UK economy entering a technical recession at the end of 2023, and a continuing stream of gloomy world news, consumer confidence is increasing. Falling inflation and food prices, and maybe even the prospect of political change with a general election in view have lifted spirits.”

Mike continued: “According to GfK’s Consumer Confidence Index, consumer confidence climbed three points to -19 in January 2024, the best it’s been in two years. Better still, consumers’ personal financial index also improved to zero after 24 months of negative scores. Inflation and the prospect of falling bank rates undoubtedly contributed to this.

“Whether it foreshadows a more positive period for the repair, maintain, and improve markets, and an increase in spend on home improvement projects in 2024 remains to be seen.”

The BMBI, a brand of the BMF, is produced and managed by MRA Research. It uses GfK’s Builders Merchant Point of Sale Tracking Data which analyses sales out data from over 92% of generalist builders’ merchants’ sales across Great Britain. Unlike data from sources based on estimates, or sales from suppliers to the supply chain, this up-to-date data is based on actual sales from merchants to builders and other trades.

For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.