February data presented in the latest S&P Global UK Construction PMI report pointed to improved demand conditions across the UK construction sector.

Although only marginal, the rate of new business growth was the fastest since May 2023. A turnaround in construction order books contributed to a near-stabilisation of overall output levels in the latest survey period.

Business optimism improved for the third time in the past four months and was the highest since January 2022. Construction companies often cited hopes of a sustained upturn in customer demand as well as more favourable economic and financial conditions over the course of 2024.

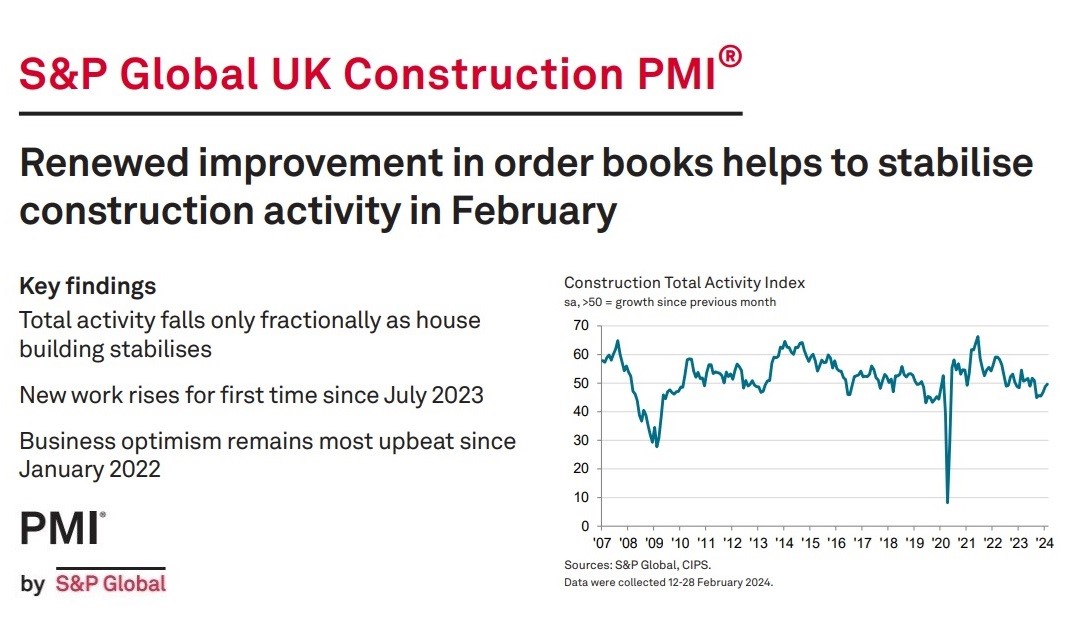

At 49.7 in February, up from 48.8 in January, the headline S&P Global UK Construction Purchasing Managers’ Index™ (PMI®) – a seasonally adjusted index tracking changes in total industry activity – registered its highest level since August 2023 and was only fractionally below the neutral 50.0 threshold.

All three main categories of construction activity saw a near-stabilisation of business activity in February. House building saw the biggest turnaround since January, with the respective index at 49.8, up from 44.2 and the highest level since November 2022.

Survey respondents suggested that improving market conditions had gradually contributed to a stabilisation of residential construction work. In contrast, the commercial segment saw a more subdued performance than in January, with construction companies typically citing hesitancy among clients and constrained budget setting.

Total new work increased marginally in February, thereby ending a six-month period of decline. This appeared to reflect a turnaround in tender opportunities and greater client confidence, especially in the house building segment.

Employment was a weak spot in February, despite positive trends for order books and sales pipelines. Staffing numbers decreased for the second month running and, although only moderate, the rate of job shedding was the fastest since November 2020. Comments from panel members suggested that a recent soft patch for work on site, alongside strong wage pressures, had led to cost cutting measures including the non-replacement of voluntary leavers.

More than half of the survey panel (51%) anticipate a rise in business activity over the year ahead, while only 6% forecast a reduction. This pointed to the strongest degree of business optimism for just over two years in February. Construction companies mostly noted new project starts and positive signals for customer demand, partly linked to expected interest rate cuts.

Supply conditions meanwhile improved again in February, albeit to the smallest extent for one year. There were some reports citing a negative impact on deliveries of construction products due to Red Sea shipping disruptions. Demand for construction inputs remained relatively subdued, as

signalled by a reduction in purchasing activity for the sixth month running.

Finally, average cost burdens increased for the second consecutive month in February. Higher input prices were often linked to strong wage pressures and rising transportation costs. However, the rate of inflation was only modest and eased from January’s eight-month high, with some firms citing opportunities to negotiate price discounts amid intense supplier competition.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“A stabilisation in house building meant that UK construction output was virtually unchanged in February. This was the best performance for the construction sector since August 2023 and the forward-looking survey indicators provide encouragement that business conditions could improve in the coming months.

“Total new orders expanded for the first time since July 2023, which construction companies attributed to rising client confidence and signs of a turnaround in the residential building segment. Meanwhile, the degree of optimism regarding year ahead business activity prospects was the strongest since the start of 2022, in part due to looser financial conditions and expected interest rate cuts.

“However, a protracted downturn in activity has made construction companies cautious about their employment numbers. Staffing levels dropped for the third time in the past four months and the latest round of job shedding was the steepest since November 2020. Purchasing activity also decreased in February, but construction firms continued to cite supply side challenges. Moreover, input costs increased for the second month running as strong wage pressures and renewed materials price inflation placed upward pressure on operating expenses.”

Purchasing Managers’ Index (PMI)

Related News

S&P Global UK Construction PMI January 2023 data

S&P Global UK Construction PMI December 2023 data

S&P Global / CIPS UK Construction PMI November 2023 data

S&P Global / CIPS UK Construction PMI September 2023 data

S&P Global / CIPS UK Construction PMI July 2023 data

S&P Global / CIPS UK Construction PMI June 2023 data

S&P Global / CIPS UK Construction PMI May 2023 data

S&P Global / CIPS UK Construction PMI April 2023 data

S&P Global / CIPS UK Construction PMI March 2023 data

S&P Global / CIPS UK Construction PMI February 2023 data