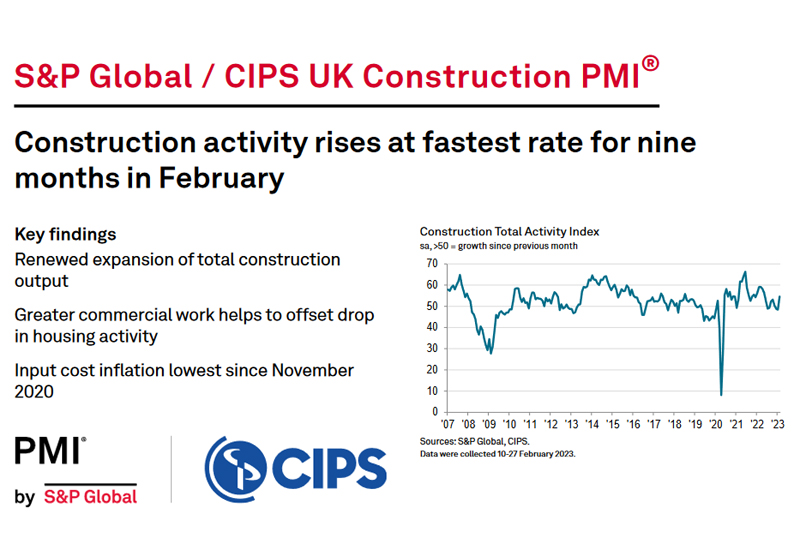

The latest S&P Global / CIPS UK Construction PMI report for February highlighted a “robust increase in overall business activity across the UK construction sector, thereby ending a two-month period of decline.” However, housebuilding activity continued to show a decline.

The overall rate of growth was recorded as the strongest since May 2022, supported by a marked rebound in commercial work and a positive contribution from civil engineering activity. In contrast, the report showed that housing activity decreased for the third month running.

At the same time, the latest survey pointed to the least widespread supplier delays since January 2020 and a slowdown in input cost inflation. The overall rate of purchase price inflation was the lowest for 27 months in February.

The headline seasonally adjusted S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – registered 54.6 in February, up from 48.4 in January and above the neutral 50.0 threshold for the first time in three months. The latest reading was the highest since May 2022.

Commercial construction was the best-performing area in February (index at 55.3), with the rate of expansion the steepest for nine months. Civil engineering activity also returned to growth in February (index at 52.3), although the rate of expansion was only modest.

Construction companies noted a fall in residential building work for the third consecutive month in February (index at 47.4). The speed of the downturn eased since January, however. Survey respondents commented on subdued market conditions due to elevated interest rates, alongside cutbacks to new house building projects in anticipation of weaker demand.

Total new work picked up in February, as signalled by an improvement in order books for the first time since November 2022. Construction companies reported signs of a turnaround in demand for commercial projects due to the improving near-term economic outlook.

Forthcoming project starts contributed to a modest upturn in purchasing activity during February. Despite rising demand for construction products and materials, the latest survey indicated that supply pressures continued to ease. The respective index signalled that delays with vendor delivery times were the least widespread for just over three years.

A better alignment of demand and supply helped to bring down input price inflation across the construction sector in February. The latest round of purchase price increases was the slowest since November 2020. Higher input costs were mostly linked to suppliers passing on rising energy bills and salary inflation, although this was offset by lower transportation bills.

Business expectations for the year ahead improved further from the 31-month low seen in December 2022. Around 46% of the survey panel anticipate a rise in construction activity over the year ahead, while only 13% predict a decline. The resulting index pointed to the highest level of optimism for one year. Construction firms often noted signs of a recovery in client demand, despite elevated interest rates and recession risks.

Finally, latest data indicated a modest increase in employment numbers across the construction sector. However, efforts to cut costs continued to hold back staff recruitment, according the survey respondents.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“Business activity in the UK construction sector returned to growth during February as a rebound in commercial work and civil engineering output helped to compensate for housing market weakness. Some firms noted that fading recession fears and an improving global economic outlook had boosted client confidence in the commercial segment. At the same time, work on major infrastructure projects such as HS2 contributed to the expansion of civil engineering activity in February.

“Cutbacks to new house building projects remained the weak spot for construction sector activity, with total residential work falling for the third month running in February. Survey respondents often commented on subdued demand and a headwind from elevated interest rates.

“Construction companies appear increasingly confident about the year ahead business outlook, with optimism rebounding strongly from the lows seen in the final quarter of 2022. Softer inflationary pressures and the least widespread supplier delays for just over three years were factors supporting business expectations in February.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said:

“The overall figure paints a bright picture of progress in the construction sector with a robust jump in output last month. Supply deliveries were at their most improved since January 2020 and some commentators mentioned sourcing closer to home to avoid logjams in supply chains caused by China’s Covid policy and the war in Ukraine.

“New order levels were also at their highest since November 2022 but these strong numbers belie the fact that there is uneven growth in building activity in the UK. Commercial and civil engineering projects dominated this performance with activity on projects such as HS2 and commercial builds. Residential building on the other hand was the odd one out with a third month in contraction as mortgages rates put a dampener on the number of house purchases and buyers were unwilling to commit.

“Builders themselves remained cheerful as optimism rose sharply and almost half of the survey’s respondents believed business would improve in 2023. With the slowest inflationary rises for raw materials since November 2020 this offered some relief, and it was cheaper transportation costs that helped offset salary and energy costs which were still rising.”

In response, the Federation of Master Builders (FMB) asserted that the fall in residential building work for the third consecutive month in February is “a major concern for small, local house builders.”

FMB Chief Executive Brian Berry said: “It is encouraging that overall business activity across the UK construction sector is on the rise. However, the fall in residential building work will cause much concern for SME house builders, especially as it’s in part driven by the expectation of weakened demand. Small, local house builders are facing increasing cost pressures from a range of upcoming regulatory changes and desperately need a change in fortunes.”

He continued: “In this month’s Spring Budget, the Government needs to prioritise the delivery of the new homes that the UK so desperately needs. We need to see significant reform to the current planning system, which is far too slow and complex, alongside direct funding from government into planning departments. If the Government wants to deliver its stated ambition to deliver a mouse diverse housing supply then it needs to be actively supporting small house builders.”

Related News

S&P Global / CIPS UK Construction PMI January 2023 data

S&P Global / CIPS UK Construction PMI December 2022 data

S&P Global / CIPS UK Construction PMI November 2022 data

S&P Global / CIPS UK Construction PMI October 2022 data