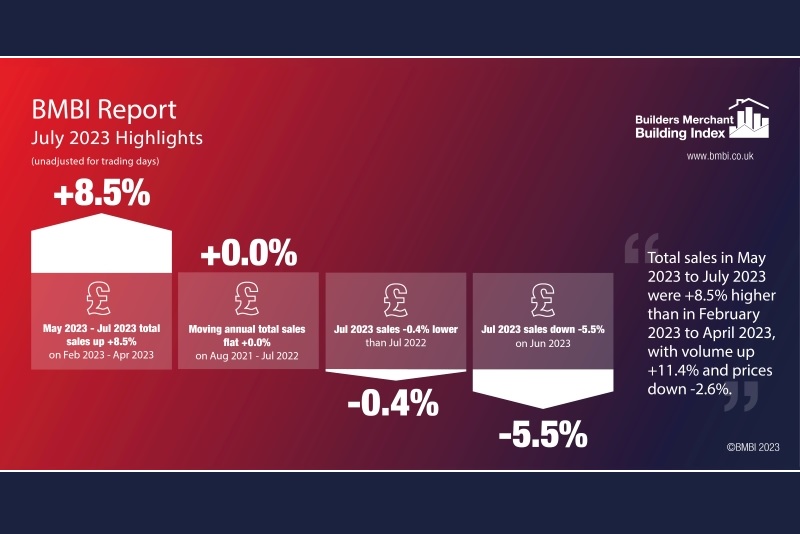

The latest Builders Merchant Building Index (BMBI) report shows builders’ merchants’ value sales were down -0.4% in July compared to the same month in 2022, with volume falling -7.9% and prices up +8.1%. However, the last three months, May to July, value sales were +8.5% higher than in February to April 2023.

Nine of the twelve categories sold more this year than in July 2022. Renewables & Water Saving (+51.2%) continues its strong form, leading the field by a significant margin. Plumbing, Heating & Electrical (+14.0%), Decorating (+13.6%), Tools (+11.1%) and Kitchens & Bathrooms (+10.1%) all achieved double digit growth. Landscaping (-7.2%) and Timber & Joinery Products (-12.1%) were the weakest performing categories.

Month-on-month, total merchant sales were down -5.5% in July compared to June. Volume sales were down -7.5% while prices increased slightly (+2.2%). With one less trading day in July, like-for-like value sales were -1.0% lower. Only three of the twelve categories sold more, led by Renewables & Water Saving (+15.5%). Landscaping (-15.6%) was the weakest category.

Total merchant sales in the twelve months from August 2022 to July 2023 were flat (+0.0%) compared to the same period a year ago, with volumes down -12.2% and prices up by +13.9%. Nine of the twelve categories sold more with Renewables & Water Saving (+45.4%) doing best.

Plumbing, Heating & Electrical (+13.8%), Decorating (+13.5%) Workwear & Safetywear (+12.9%), and Kitchens & Bathrooms (+10.8%) also hit double figure increases. Landscaping (-9.9%) and Timber & Joinery Products (-13.3%) were again the weakest categories.

Mike Rigby, CEO of MRA Research which produces this report, said: “The latest figures from BMBI show a slight drop off in Merchant value sales for July, but the rolling three month quarter on quarter comparison is more positive with May to July value sales up +8.5% on the previous three months.

“Housebuilding fell in July, for the eighth month in succession, as higher mortgage rates and cost of living pressures impact demand. Cool, wet and windy weather in July further dampened demand and delayed planned works.”

Mike continued: “After six months of incremental increases, GfK’s Consumer Confidence Index dipped in July (down -6 points to -30) but recovered in August to -25. This renewed optimism was reflected in households’ personal finances and their expectations of the general economic outlook in the next 12 months. More significantly for RMI, there was an +8 point improvement in major purchase intentions.

“All is not doom and gloom. It’s too easy to be swept along with the gloomy tendency of the national media narrative, a narrative which has had to be reset after the ONS released revised figures for the economy showing Britain to be doing as well and, in some cases (Germany), better than other European economies.

He concluded: “Commercial building and infrastructure projects are still going strong, and the Government announced in July a raft of overdue initiatives to unblock bottlenecks in the planning system to speed up developments and build more homes to help meet their (revised) one million homes target.”

July’s BMBI report, published in September, is available to download at www.bmbi.co.uk.

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and designed to be the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK.

The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show a positive year-on-year comparison, with total value sales for July 2023 through specialist plumbing and heating merchants were up +8.5% on July last year. Prices increased +4.9%, as did volumes (+3.4%).

Month-on-month, value sales in July were -3.9% lower than June. Volume sales decreased by -2.3% and prices also fell -1.6%. With one less trading day in July, like-for-like sales were slightly up (+0.7%).

Total value sales over the last three months, May to July 2023, were +5.8% higher than the same period a year ago. Volume sales were marginally down (-0.4%) with prices climbing +6.3%. With one more trading day in the most recent three-month period, like-for-like sales were +4.1% higher.

Plumbing & Heating merchants’ value sales in the 12-month period from August 2022 to July 2023 were +9.0% higher than the previous twelve-month period (August 2021 to July 2022). Volumes edged up (+0.2%) while prices increased sharply (+8.8%).

July’s PHMI index was 95.0 with no difference in trading days.

Mike Rigby, CEO of MRA Research which produces the report, said: “Given the economic headwinds of persistent inflation, rising interest and mortgage rates and recovering but still wavering consumer confidence, July’s year-on-year volume sales growth aptly represents the resilience of the Plumbing and Heating sector.

“There was more to cheer in July as a further reduction in the Energy Price Cap was announced, bringing welcome relief for bill payers. In the medium term, energy prices are unlikely to dip to pre-Ukraine war levels, so the impetus remains for those with savings or disposable income to invest in energy and water efficient products which will protect them from volatile prices in the future while also helping them to do their bit for the planet. Two very strong arguments to encourage purchases.”

Mike continued: “With the new build housing sector continuing to falter, it is likely that demand for replacement heating and plumbing products may be the merchants’ bread and butter over the coming months, until more favourable economic conditions or policy changes can get Britain building – and buying – again.”

To download the latest report, visit www.phmi.co.uk.

The Plumbing & Heating Merchant Index (PHMI) is designed to be the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation.

There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.