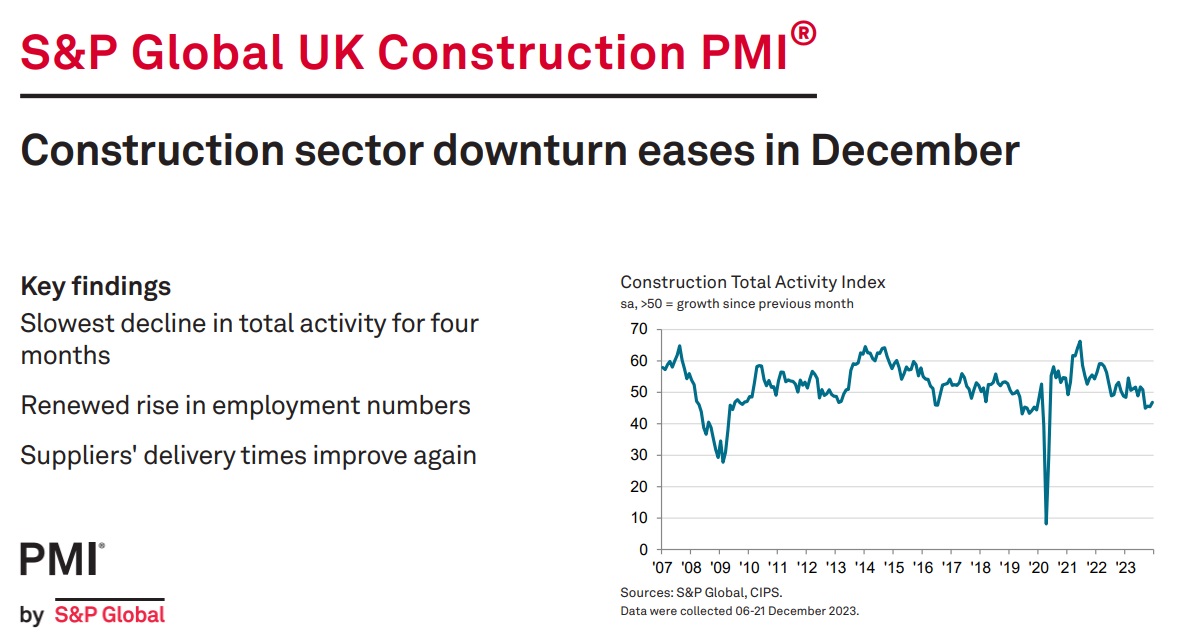

As presented in the latest S&P Global UK Construction PMI report, December data indicated “another solid fall in UK construction activity.” However, the rate of the fall eased to the slowest since the current phase of decline began last September.

A sustained slump in house building was the main factor said to be holding back construction output, which survey respondents linked to elevated interest rates and subdued confidence

among clients. More positively, improving supply conditions continued in December, with

delivery times for construction items shortening for the tenth month in a row. Price discounting among suppliers was also said to contributed to a moderate fall in average cost burdens across the construction sector at the end of 2023.

At 46.8 in December, the headline S&P Global UK Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted index tracking changes in total industry activity – was below the neutral 50.0 mark for the fourth month running. However, the index was up from 45.5 in November and the highest for four months.

House building remained the weakest-performing category of construction work in December (index at 41.1), despite the rate of decline easing to its slowest since July 2023. Civil engineering activity (index at 47.0) also posted a softer pace of contraction at the end of last year.

Commercial construction meanwhile declined only modestly (index at 47.6), but the speed of the downturn accelerated to its fastest since January 2021. Some firms noted that concerns about the domestic economic outlook, alongside elevated borrowing costs, had led to greater caution among

clients.

Total new work decreased at the slowest pace since the current period of decline began in August 2023. Subdued customer demand across the house building sector was often cited as a factor leading to reduced order books. A softer decline in new work and hopes of a turnaround in demand conditions during 2024 contributed to a renewed rise in employment numbers in December. However, the rate of job creation was only marginal.

Mirroring the trend for construction output, latest data indicated the slowest fall in purchasing activity for four months. Where a decline in input buying was reported, this often reflected a lack of new work to replace completed projects.

Lower demand for construction products and materials resulted in shorter wait times for suppliers’ deliveries in December. Improving vendor performance has been recorded in each month since March 2023. Survey respondents often noted that competition for market share among suppliers had led to price discounting at the end of last year. Average cost burdens across the construction sector decreased for the third month running in December, albeit only modestly

and at the slowest pace during this period.

Finally, latest data indicated somewhat upbeat business expectations at UK construction companies for output levels during the year ahead. Around 41% of the survey panel anticipate an increase in business activity over the course of 2024, while only 17% predict a decline. Anecdotal evidence suggested that subdued forecasts for the UK economy were a key concern, while hopes of reduced interest rates and a turnaround in market confidence were factors cited as likely to boost construction activity.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“Construction companies experienced another fall in business activity at the end of 2023 as weak order books meant a lack of new work to replace completed projects. House building was the worst-performing area of construction activity, but even in this segment there were signs that the downturn has started to ease.

“Elevated borrowing costs and a subsequent slump in market confidence were the main factors leading to falling sales volumes across the construction sector in the second half of 2023. Survey respondents also continued to cite worries about the broader UK economic outlook, especially in relation to prospects for commercial construction.

“However, expectations of falling interest rates during the months ahead appear to have supported confidence levels among construction companies. December data indicated that 41% of construction firms predict a rise in business activity over the course of 2024, while only 17% forecast a decline. This contrasted with negative sentiment overall at the same time a year earlier.”

Purchasing Managers’ Index (PMI)

Related News

S&P Global / CIPS UK Construction PMI November 2023 data

S&P Global / CIPS UK Construction PMI September 2023 data

S&P Global / CIPS UK Construction PMI July 2023 data

S&P Global / CIPS UK Construction PMI June 2023 data

S&P Global / CIPS UK Construction PMI May 2023 data

S&P Global / CIPS UK Construction PMI April 2023 data

S&P Global / CIPS UK Construction PMI March 2023 data

S&P Global / CIPS UK Construction PMI February 2023 data