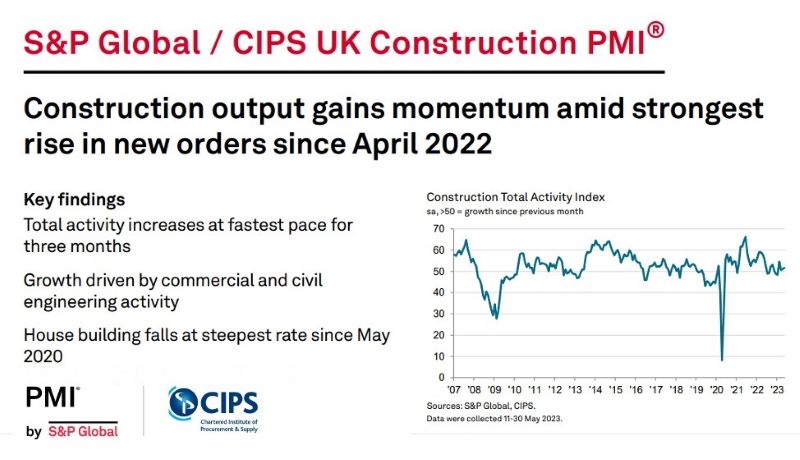

The construction sector experienced a “modest upturn” throughout May, according to the latest S&P Global / CIPS UK Construction PMI report, however house building remained the weakest-performing category “by far”.

May PMI data signalled a modest upturn in overall UK construction output, driven by faster rises in commercial building and civil engineering activity. Meanwhile, house building was said to have remained by far the weakest-performing category of activity, with output “declining at the steepest pace for three years.”

Supply conditions “continued to normalise in May,” as highlighted by what the report described as the greatest improvement in vendor lead times since August 2009. This “helped to alleviate cost pressures across the construction sector,” with the overall rate of input price inflation easing to its weakest for 32 months.

The headline seasonally adjusted S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – registered 51.6 in May, up from 51.1 in April and above the neutral 50.0 mark for the fourth successive month. Although indicative of only modest growth, the latest reading pointed to “the strongest upturn in total construction activity since February.”

According to the data, there were again divergent trends across the three main categories of construction activity. For example, Commercial building (index at 54.2) was the best-performing segment, with output rising at a “robust and accelerated pace.” Construction companies cited a gradual turnaround in confidence among clients and faster decision-making on new projects.

Civil engineering also gained momentum (index at 53.9), with growth hitting an 11-month high in May.

Worries about the impact of higher interest rates and subdued market conditions continued to dampen housing activity. Work on residential building projects decreased for the sixth month running and at the steepest pace since May 2020. Aside from the pandemic-related downturn, the latest reading for this category of construction activity (42.7) was reported as being “the lowest for just over 14 years.”

Total new business, meanwhile, increased at a strong pace in May, despite weakness in the house building sector. The overall rise in construction order books was the strongest recorded since April 2022. This spurred an upturn in staffing numbers for the fourth month in a row. However, input buying remained broadly unchanged during the latest survey period, which partly reflected efforts to reduce excess inventories.

Supply conditions, however, were seen to have improved considerably in May. Average lead times for the delivery of construction products and materials shortened to the greatest extent since August 2009. This was attributed to fewer logistics bottlenecks, alongside an improved balance between demand and supply.

Purchasing price inflation also eased sharply since April, which some firms linked to rising competition among suppliers alongside softer demand for construction inputs. Although still signalling a robust increase in cost burdens, the latest survey data indicated the weakest rate of inflation for just over two-and-a-half years.

Finally, construction companies remain upbeat about their growth prospects for the year ahead. Around 45% of the survey panel expect an increase in output levels, while only 14% predict a decline. That said, the degree of positive sentiment slipped to a four-month low in May. Survey respondents suggested that concerns about the UK economic outlook and the impact of rising interest rates were the main factors holding back growth projections in May.

Comment

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“May data highlighted a mixed picture across the UK construction sector as solid growth rates in commercial and civil engineering activity contrasted with a steeper downturn in house building. Rising demand among corporate clients and contract awards on infrastructure projects meanwhile underpinned the fastest rise in new orders since April 2022.

“However, cutbacks to new residential building projects in response to rising interest rates and subdued housing market conditions resulted in the sharpest drop in housing activity for three years. This meant that residential work underperformed the rest of the construction sector by the greatest margin since October 2008. Survey respondents also commented on concerns about the broader UK economic outlook, which contributed to an overall drop in output growth projections to the lowest for four months.

“Inflationary pressures meanwhile eased considerably May, with purchase prices increasing to the smallest extent since September 2020. Supply chain normalisation helped to moderate cost inflation, as signalled by the strongest improvement in delivery times for construction products and materials for almost 14 years.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said:

“Though overall output in the construction sector showed an improvement for the fourth month in a row, the steepest drop in house building activity since April 2009, barring the initial pandemic lockdown in early 2020, will send a chill down the spine of the UK economy.

“The residential sub-sector is closely linked to consumer confidence and levels of spending. A further hike in interest rates is expected this month, and along with the relentless increase in the cost of living is making buyers hesitate about purchasing homes. As a result, builder confidence was pinched to remain below the survey average, as business costs remained high and firms expanded their workforce numbers at only a modest pace as they were cautious about their own affordability rates.

“Even with the strongest increase in new orders for just over a year, where commercial and civil engineering projects made up the shortfall, purchasing activity remained flat. Companies were de-stocking their built-up supplies because, with the fastest turnaround in supplier delivery times since August 2009, builders expected that demands for materials would be met should a long-awaited sustainable upturn ever arrive.”

In response to the latest S&P Global / CIPS UK Construction PMI data, the Federation of Master Builders (FMB) has said that UK house building is in “dire straits” as it falls at fastest rate since May 2020.

The house building sector is in crisis with too few homes being delivered and not enough being done to boost the market, according the FMB. Its Chief Executive Brian Berry said: “This latest data makes for worrying reading, it is the sixth month in a row that residential building has declined and if you discount the exceptional circumstances of the pandemic, it’s the lowest housing delivery for over 14 years.

“We need to see Government get to grips with this issue as it is vital to secure a healthy, growing economy. The 300,000 housing target must be reinstated to give hope to both consumers and house builders alike that it is serious about increasing the supply of new homes.”

Brian continued: “For too long we have not been building enough homes, resulting in overcrowding and young people not being able to afford to get on the housing ladder. What is very concerning is that the Government lacks a clear plan to solve the housing crisis, with the result being that the housing market continues to soften and housing remains unobtainable for many members of the public.”

Related News

S&P Global / CIPS UK Construction PMI April 2023 data

S&P Global / CIPS UK Construction PMI March 2023 data

S&P Global / CIPS UK Construction PMI February 2023 data

S&P Global / CIPS UK Construction PMI January 2023 data

S&P Global / CIPS UK Construction PMI December 2022 data

S&P Global / CIPS UK Construction PMI November 2022 data

S&P Global / CIPS UK Construction PMI October 2022 data