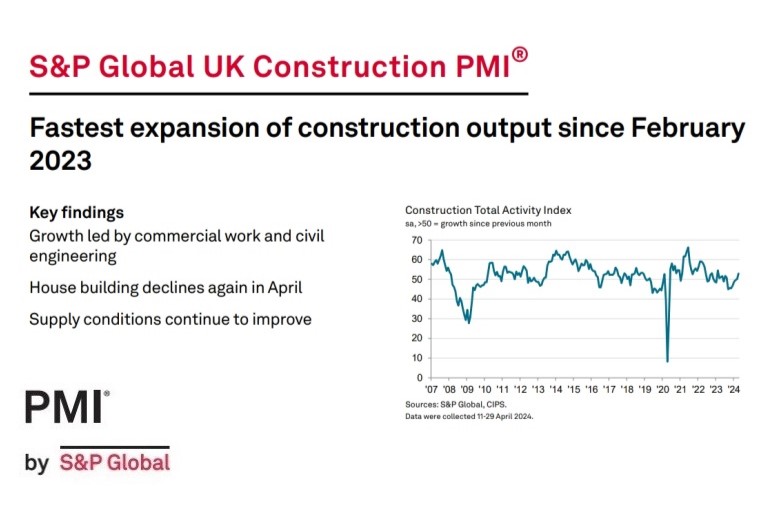

The latest UK Construction PMI report from S&P Global reveals that business activity growth gained momentum across the sector in April, largely due to “solid rates of expansion in the commercial and civil engineering segments.”

Near-term prospects remained relatively positive, the report contends, as new work increased for the third month running amid reports of a boost to sales from improving domestic economic conditions.

Supplier lead times meanwhile were said to have shortened to the greatest extent in 2024 so far, which survey respondents linked to rising materials availability and relatively soft demand for

construction inputs.

At 53.0 in April, up from 50.2 in March, the headline S&P Global UK Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted index tracking changes in total industry activity – registered in positive territory for the second month running and signalled the strongest pace of

expansion since February 2023.

Commercial building (index at 53.9) increased for the first time since August 2023 and was the fastest-growing area of construction activity in April. Survey respondents commented on rising workloads and a turnaround in customer demand, in part driven by refurbishment projects. Civil engineering activity (index at 53.6) meanwhile expanded again in April and at the strongest pace for nine months.

However, the latest survey signalled a setback for house building activity (index at 47.6). April data pointed to a moderate fall in residential building work, although the rate of decline was

the steepest since January. Construction companies again noted sluggish market conditions and the impact of elevated borrowing costs.

New business volumes increased for the third successive month in April, although the rate of expansion eased since March and was only modest. Those reporting higher new order intakes typically cited improved client confidence, particularly in the commercial segment.

Despite sustained rises in output and new work, the latest survey pointed to another marginal reduction in employment numbers. Lower staffing levels were often linked to the non-replacement of voluntary leavers, due to cost pressures and the completion of major projects.

Demand for construction products and materials softened for the eighth consecutive month in April. Lower input buying was partly attributed to destocking. Supplier performance meanwhile improved at the fastest pace since December 2023.

Sub-contractor availability increased at a robust rate in April, despite a rise in usage for the first time in 2024 to date. Rates charged by sub-contractors increased at the strongest pace since August 2023.

Purchasing prices rose only modestly in April, with construction firms noting that suppliers had sought to pass on greater wage bills and transportation costs. However, the overall rate of cost inflation was only modest and well below the long-run survey average.

Finally, optimism regarding the year- ahead business outlook edged up in April. Nearly half of the survey panel anticipate a rise in output during the next 12 months, while only 11% forecast a decline. Survey respondents mostly commented on improving sales enquiries and more positive signals for customer demand, alongside hopes of interest rate cuts in the latter half of 2024.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“The construction sector consolidated its recent return to growth in April, with total industry activity rising at the fastest pace for 14 months amid an ongoing recovery in

order books. Demand was boosted by greater confidence regarding the broader UK economic outlook. Commercial construction outperformed in April and civil engineering also provided a solid contribution to overall growth.“Lacklustre market conditions in the house building segment continued to weigh on activity. The latest survey pointed to the fastest reduction in residential building work since January, although the speed of the downturn remained much softer than in the second half of 2023.

“Hiring trends were subdued in April despite a recovery in workloads, which mirrored trends seen in other part of the UK economy, as construction firms sought to maintain a tight focus on costs against a backdrop of strong wage pressures. Purchasing prices nonetheless increased only modestly in April. An improved balance between supply and demand helped to contain overall input cost inflation, as suggested by the fastest improvement in vendor performance so far in 2024.

“Business activity expectations for the year ahead picked up slightly in April, supported by a sustained recovery in new orders, positive signals for sales pipelines, and anticipated interest rate cuts in the second half of 2024.”

Purchasing Managers’ Index (PMI)

Comment from the Federation of Master Builders:

The continuing fall in house building rates, despite positive growth in the construction sector, is a major concern all consumers, industry and government, says the Federation of Master Builders (FMB) in response to the S&P Global/CIPS UK Construction PMI data for April 2024.

Brian Berry, Chief Executive of the FMB, commented: “While today’s data shows positive signs on the horizon for the wider construction industry, the benefit is seemingly being felt by the larger contractors, with uplifts seen in the commercial and civil engineering sectors. Small, local house builders have little to celebrate, with the fastest reduction in residential house building rates since January, alongside another reduction in employment numbers, both of which are cause for significant concern.”

Brian continued: “The UK is currently experiencing both a housing crisis, and a crisis in construction skills and training. If we are to achieve sustainable long-term growth, it is vital both house building and employment rates are prioritised. The FMB’s newly launched manifesto ‘Growth from the ground up’, sets out a positive approach for the next Government to follow in order to turbocharge economic growth, by delivering housing and planning reform, and a long-term skills plan to tackle the workforce shortage. Politicians need to take note of the bigger picture beyond the positive headlines, and adopt these proposals before it is too late.”

Related News

S&P Global UK Construction PMI March 2024 data

S&P Global UK Construction PMI February 2024 data

S&P Global UK Construction PMI January 2024 data

S&P Global UK Construction PMI December 2023 data

S&P Global / CIPS UK Construction PMI November 2023 data

S&P Global / CIPS UK Construction PMI September 2023 data

S&P Global / CIPS UK Construction PMI July 2023 data

S&P Global / CIPS UK Construction PMI June 2023 data