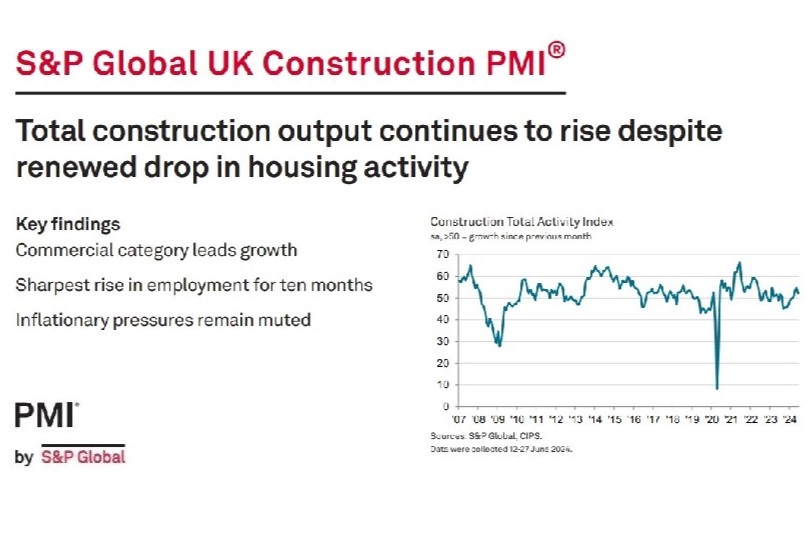

According to the latest UK Construction PMI report from S&P Global, total construction output continued to rise in May despite a renewed drop in housing activity.

The UK construction sector remained inside growth territory as the second quarter of the year drew to a close, although the overall expansion softened amid a renewed fall in housing activity. A slower rise in new orders was also recorded, in some cases linked to election uncertainty, but the pace of job creation picked up.

Meanwhile, the rate of input cost inflation quickened from May, but remained muted.

The headline S&P Global UK Construction Purchasing Managers’ Index – a seasonally adjusted index tracking changes in total industry activity – registered 52.2 in June, down from 54.7 in May. Remaining above the 50.0 no-change mark for the fourth consecutive month, the latest reading signalled a sustained improvement in overall construction activity in the UK, albeit with the pace of growth softening from the previous month.

The main driver of growth continued to come from commercial activity, which increased markedly again in June. That said, the rate of expansion softened from May’s two-year high. A slower increase in civil engineering activity was also recorded, with output up modestly. The only category to record a drop in activity was housing, where output fell solidly following a first increase in 19 months during May.

Anecdotal evidence suggested that the expansion in total activity reflected the securing of new contracts during the month. Data on new orders showed a fifth consecutive monthly expansion amid successful tendering and a rise in client activity. That said, the rate of growth in new business was only modest and the slowest since February. Some respondents indicated that uncertainty as a result of the general election had caused new work inflows to slow.

Despite the softer expansion in new orders, construction firms responded to greater workloads by taking on additional staff for the second month running. Moreover, the rate of job creation was solid and the sharpest since August last year.

Companies also expanded their use of sub-contractors at a solid pace, extending the current sequence of growth to three months. Despite this, sub-contractor availability continued to improve, with the latest increase in supply the largest in nine months.

Rising new orders led firms to increase their purchasing activity for the second month running, with the rate of expansion little changed from that seen in May.

There remained little sign of pressure on supply chains, however, with vendor delivery times shortening for the sixteenth consecutive month.

Meanwhile, input costs rose only slightly again in June as some suppliers limited price rises in an effort to secure new business. The rate of inflation ticked higher amid rising costs for some raw materials, but remained well below the series average. Meanwhile, sub-contractor rates also increased modestly, and at the slowest pace in four months.

Confidence in their ability to secure new contracts over the coming year supported continued optimism in the 12-month outlook for construction activity in June. Expectations that interest rates will start to come down also contributed to positive sentiment. More than half of respondents predicted an increase in construction activity, with the level of confidence broadly in line with that seen in May.

Andrew Harker, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“Continued growth of the UK construction sector in June meant that the sector has recorded sustained expansion throughout the second quarter of the year. While there were signs of a slowdown in the latest survey period, most notably around housing activity, firms indicated that a slowdown in new order growth was in part related to election uncertainty. We may therefore see trends improve once the election period comes to an end.

“Moreover, confidence in the year ahead outlook remained strong and firms increased employment to the largest extent in ten months.

“In terms of inflation, there remains little sign of cost pressures picking up to any great extent, encouraging firms to expand purchasing activity. Supply-chain conditions also remained favourable.”

Related News

S&P Global UK Construction PMI May 2024 data

S&P Global UK Construction PMI April 2024 data

S&P Global UK Construction PMI March 2024 data

S&P Global UK Construction PMI February 2024 data

S&P Global UK Construction PMI January 2024 data

S&P Global UK Construction PMI December 2023 data

S&P Global / CIPS UK Construction PMI November 2023 data

S&P Global / CIPS UK Construction PMI September 2023 data