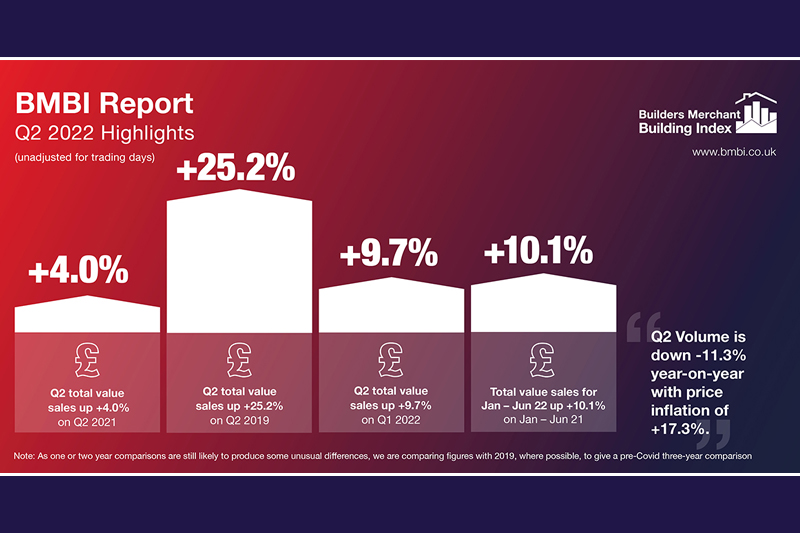

The Q2 2022 report from the Builders Merchant Building Index (BMBI) shows that merchant sales volumes have fallen again, but price inflation has made for a record-breaking quarter.

The Total value sales data from Britain’s builders’ merchants shows Q2 2022 recorded the highest revenue since the BMBI started, despite lacklustre June sales. However, with Q2 volumes falling -11.3% compared with Q2 2021, it is +17.3% price inflation which is behind the record-breaking growth.

Quarter 2 2022 total value sales were 4.0% higher than Q2 2021, with one less trading day this year. Ten of the 12 categories sold more with Kitchens & Bathrooms (+18.5%), Heavy Building Materials (+9.2%), Decorating (+7.0%), Tools (+2.9%) and Ironmongery (+1.3%) all having their best-ever quarterly sales. Only Timber & Joinery Products (-3.0%) and Landscaping (-6.3%) sold less.

Comparing Q2 2022 with Q2 2019, a more normal pre-Covid trading year, total value sales were +25.2% higher this year, but volume sales were -2.7% down while prices were up +28.7%. Despite one less trading day, like-for-like sales were +27.3% higher.

All categories sold more, including Landscaping (+38.9%), Timber & Joinery Products (+37.0%) and Renewables & Water Saving (+29.6%) which all outperformed Merchants overall. Heavy Building Materials (+22.1%) and Kitchens & Bathrooms (+20.3%) grew more slowly.

Mike Rigby, CEO of MRA Research which produces this report, said: “The continuing theme for 2022 is the impact of price inflation and rising costs on the building sector which can be seen clearly in the Q2 results. A record-breaking quarter, but unlike last year, it’s price and not volume which is driving growth. With energy price reviews now every three months, and inflation expected to reach 13% around the turn of the year, this may be the case for some time to come.”

John Newcomb, CEO of the Builders Merchants Federation, commented: “The negative effect of rampant inflation is starting to show with escalating input costs across fuel, energy, raw materials and wages impacting production costs and adding to existing material supply issues. It is plain to see that the increase in sales values of building materials during the first half of the year has been driven by price inflation rather than volume growth. Regrettably, this pattern seems set to continue into 2023.”

Emile van der Ryst, Senior Client Insight Manager – Trade at GfK, added: “The second quarter of this year has amplified some of the global difficulties, with the continued Russian invasion and spiraling cost of living issues at the forefront. Unfortunately, no immediate end is in sight. With UK inflation approaching double digits, the counterbalance between inflation and interest rates is increasingly difficult to control and will be the ultimate test for the next year or so.”

The full report can be downloaded here:

About BMBI

The Builders Merchant Building Index (BMBI) tracks builders’ merchants’ actual sales to builders and contractors using GfK’s Builders’ Merchant Point of Sale Tracking Data. BMBI participating merchants are said to represent over 80% of the value of the builders’ merchants’ market.

For all the latest reports, trends, analysis, comments and industry issues from our panel of construction industry experts visit here.