Figures for the final quarter of 2022 published in the BMF’s Builders Merchants Building Index (BMBI) found sales through UK builders’ merchants slowing during the final quarter of the year.

Quarter 4 2022 v Quarter 3 2022

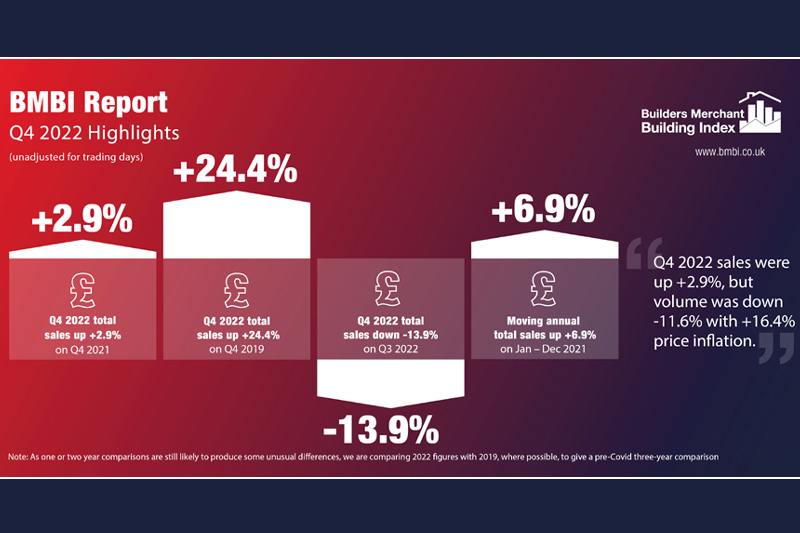

Comparing sales in Q4 2022 with the previous quarter, total sales values in Q4 were -13.9% lower than in Q3 2022. Volume sales dropped by -18.3%, but prices increased by +5.4%. With five less trading days in Q4, like-for-like sales values, adjusted for the difference in trading days, were down by -6.6%.

Only three smaller product categories recorded an increase in sales value, led by Plumbing, Heating & Electrical which grew by +13.2%. Renewables and Water Saving and Workwear & Safetywear both grew by +7.1%. The largest two product categories both recorded double digit falls, with Heavy Building Materials down by -13.7% and Timber & Joinery down by -16.6%. The seasonal category of Landscaping saw the largest fall as -33.6%.

Quarter 4 2022 v Quarter 4 2021

Comparing the last three months of 2022 with the same quarter in 2021 found total sales in Q4 2022 were up by +2.9%. This was, however, largely price driven with volume sales down by -11.6% and prices up by +16.4%. Adjusted for one less trading day in 2022, like-for-like sales were +4.6% higher.

Ten of the twelve categories saw sales values increase year on year, led by Renewables & Water Saving (+48.6%). Plumbing, Heating & Electrical (+18.6%) and Workwear & Safetywear (+14.8%) had their highest quarter revenue and were among categories which grew faster than Merchants overall. Kitchens & Bathrooms increased by +14.4% and Heavy Building Materials increased by +8.6%.

Landscaping (-5.9%) and Timber & Joinery Products (-11.5%) were the only categories to sell less in Q4 2022 over Q4 2021.

2022 vs 2021 Full Year

Across the full year the builders’ merchant sector saw value growth against 2021 of +6.9%, driven by price growth of +16.2% and a volume decline of -8.0%. With three less trading days this year, overall like-for-like sales were +8.2% higher.

All categories saw value growth apart from Timber & Joinery, down by -2.2% and Landscaping down by -0.6%.

The best performing category was Renewables and Water Management at +31.5%, followed by Kitchens & Bathrooms (+18.9%), and Plumbing, Heating & Electrical (+14.8).

Looking at the largest category, Heavy Building Materials in more detail, the full year saw a value increase of +11.6% with a noticeable price growth of +18.6%. Volume was down by -5.9% indicating that it was less affected than Timber & Joinery and Landscaping, which saw volume declines of -15.5% and -14.9% respectively.

Mike Rigby, CEO of MRA Research who produce this report, said: “Renewables & Water Saving products – one of the smaller categories tracked by BMBI – took off in Q3 2022, and has pretty much stayed in front as products which save energy or water are in high demand by trades and homeowners. With no end in sight to the astronomical energy bills which marred 2022 and a further review of the Energy Price Guarantee (which expires in April) due soon, there is a lot of uncertainty over what households will be paying for gas and electricity in 2023. Those with money in the bank are purchasing energy savings products to ease their utility bill woes.

“So far the economy has hovered on the brink of recession, and if the recession isn’t as deep as expected and inflation continues to fall, we may see a gradual return in consumer confidence. And perhaps an end to the permacrisis mindset that we’ve been locked in since 2020, which will be positive news for new building and RMI markets. But it has some way to go!”

Mike continued: “Consumer spending is an important driver of the economy, so consumer confidence matters and GfK’s Consumer Confidence Barometer shows how far it has to recover. Confidence fell 3 points in January to -45, a near-historic low. That’s not surprising given how battered and bruised is a large section of the population. Interesting perhaps as an indicator of how the Haves, older homeowners who’ve paid off or nearly paid off their mortgages, are feeling, the Savings Index (which is not a component of the confidence index) is still positive at +14, just one point down on January last year.

He concluded: “That’s some contrast with the precipitous drop in overall consumer confidence from -19 in January 2022 to -45 in January 2023. Whichever way you cut it, it’ll be a difficult year ahead.”

John Newcomb, CEO of the Builders Merchants Federation, commented: “With so much volatility in the UK economy in 2022, it comes as no surprise to see the slowdown in some areas of construction reflected in merchant sales. Slowing demand throughout the final quarter, however, has helped to ease pressures on product supply.

“With forecasts for 2023 predicting further slowdown in the first half of the year, general product availability should have an opportunity to recover before the market begins to recover in the second half.”

Emile van der Ryst, Senior Client Insight Manager – Trade at GfK added: “During 2021 we widely believed that things were on their way up, with various market predictions at the beginning of 2022 indicating some form of growth – but the year turned out completely different.

“A quarterly review against 2021’s applicable quarter shows the increased difficulty the sector experienced as the year went on. The first quarter saw value growth of +17.7%, followed by +4.1%, +4.3% and +2.9% in quarters two to four. Price growth was consistently high each quarter, sitting between +15.0% and +17.7%, while volume started at +1.5% in quarter one and dropped to -11.6% in the fourth quarter.”

The Q4 2022 BMBI report is available to download at www.bmbi.co.uk

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and is billed as being “the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK.”

The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.