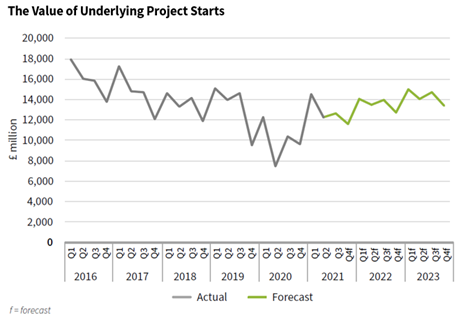

Glenigan’s 2021-2023 Construction Industry Forecast shows activity has rallied, and is on an upward trajectory since the start of the year according to the Construction Industry Forecast 2021-2023.

Its central predication is that construction output will return to pre-COVID levels by 2022, with underlying starts 3% above 2019 levels. (The data has had projects of over £100m removed to give a clearer view of the UK construction landscape)

This forecast provides a comprehensive overview of where the construction industry is, in the here-and-now, combined with considered and fact-based forecasts of how the sector will perform over the next two years.

Although COVID-19 had a significant impact on the UK construction sector, evidenced by a significant dip in output during 2020, the first half of 2021 has seen a gradual rise towards pre-pandemic levels.

Significantly, the value of underlying project starts (during the three months to May 2021) rose by 20%, and was 70% higher than when the UK was in the midst of the first national lockdown a year ago.

After this sharp initial upturn, a steadier progressive strengthening in project starts is anticipated over the forecast period. However, the recovery will not be evenly spread, with some regions and sectors performing better than others, reflecting a changing UK economic and social landscape.

Some of the key predictions are:

Some of the key predictions are:

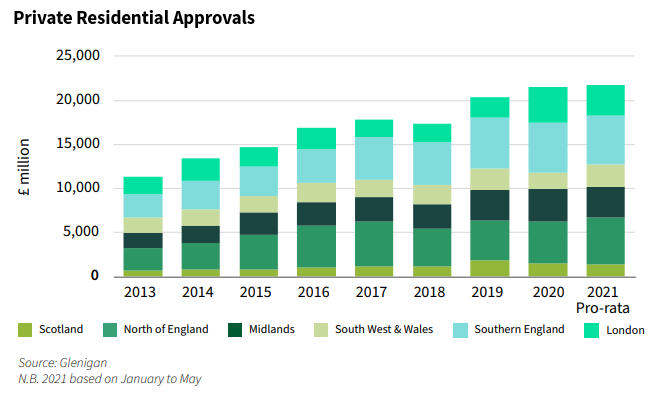

Private Housing Moderates

Despite Private Housing showing a 70% rise against 2020 in the first five months of this year, the market is expected to cool over the coming months as the temporary reduction in stamp duty is partially withdrawn from July before ending in September.

Higher unemployment and economic uncertainty are subsequently expected to restrain property transactions and house price inflation during 2022 and 2023.

We expect this to temper the rise in new activity, with project starts rising by 11% next year and 4% in 2023.

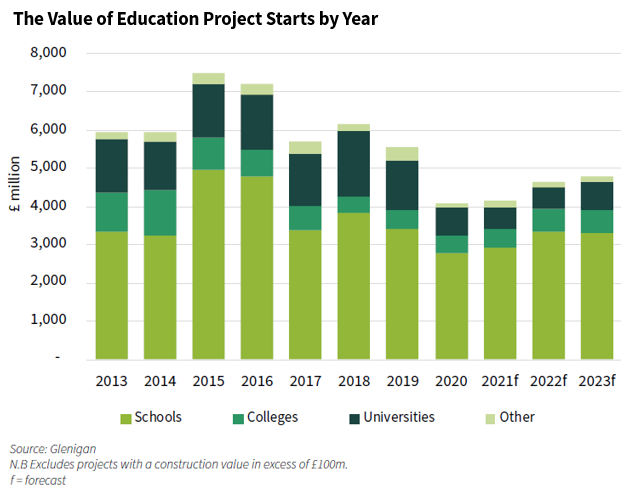

Public Sector Starts Up

Public Sector building has seen positive indicators of recovery, with social housing, health, schools and infrastructure project starts up on 2020.

Positively, school project starts are forecast to rise 5% in 2021 and 14% in 2022, driving a recovery in sector activity as local authorities tackle a shortage of secondary school places. Work to deliver further education facilities is also forecast to rebound over the next two years due to increased government investment. The value of project starts is forecast to climb 8% in 2021 and 22% in 2022.

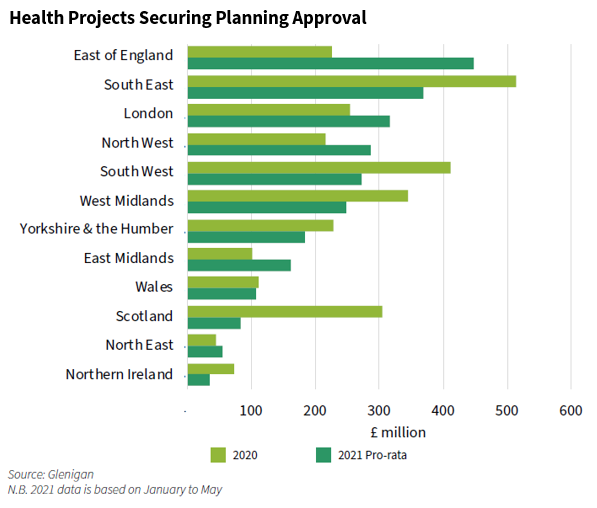

The outlook for the health sector is also brightening, with promised increases in NHS capital funding expected to lift project starts over the forecast period. Starts are expected to consolidate after last year’s growth before rising by 14% in 2022 and 6% in 2023 as NHS trusts develop and implement their investment programmes.

The outlook for the health sector is also brightening, with promised increases in NHS capital funding expected to lift project starts over the forecast period. Starts are expected to consolidate after last year’s growth before rising by 14% in 2022 and 6% in 2023 as NHS trusts develop and implement their investment programmes.

While civil engineering project starts, along with other sectors, were disrupted and delayed by the 2020 lockdown, the sector is set to recover strongly over the forecast period, with underlying civils starts rising by 21% in 2021, falling marginally by 4% in 2022, rising again by 7% in 2023.

While civil engineering project starts, along with other sectors, were disrupted and delayed by the 2020 lockdown, the sector is set to recover strongly over the forecast period, with underlying civils starts rising by 21% in 2021, falling marginally by 4% in 2022, rising again by 7% in 2023.

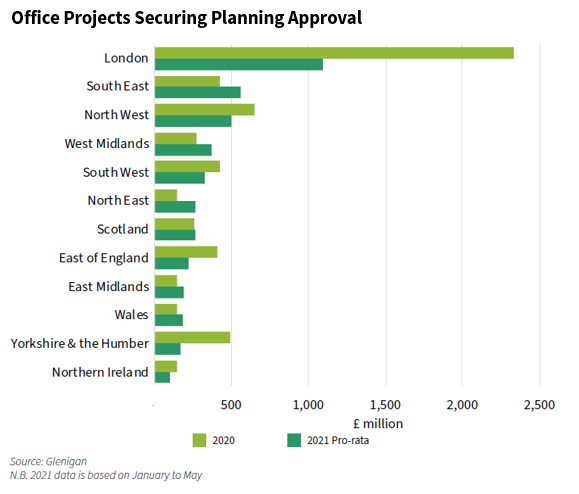

Office Revival

Office starts are forecast to largely recover this year from the sharp decline experienced as a result of the pandemic, but are forecast to remain flat for the rest of the forecast period. A rise in refurbishment projects are expected to boost project-starts in 2021 as tenants and landlords adapt premises to accommodate changing working practices.

Across the sector, underlying starts fell 32% in 2020 but started 2021 strongly, with a 48% increase during the five months to May, against the previous year.

Positively, the underlying development pipeline is strong and remained especially high throughout the pandemic. However, weaker economic conditions and potential structural changes in occupiers’ accommodation requirements are expected to prompt the delay or reappraisal of a number of projects currently in the development pipeline.

Overall, Glenigan anticipates the value of office project starts will largely recover from the fall experienced last year, before falling 3% in 2022 and increasing 1% in 2023.

Overall, Glenigan anticipates the value of office project starts will largely recover from the fall experienced last year, before falling 3% in 2022 and increasing 1% in 2023.

Commenting on the Forecast, Economic Director, Allan Wilen says, “There are definitely reasons to be cheerful and the Forecast provides a good indication that the construction industry is returning to pre-COVID levels of activity. However, the sector faces a number of challenges ahead. Particularly, the current shortage of construction materials highlights the potential impact of supply-side constraints on the pace of the recovery over the next two years.”

He concludes, “Contractors will need to be agile in a post-COVID landscape, evolving with emerging opportunities, for example, an increasing numbers of retrofit projects over new build in the commercial sector. They will also need to mitigate a number of external risks, reinforce supply chains, as well as adapting to the changing regulatory framework and digital transformation. Indicators suggest we’re now entering a disruptive era in construction, but equally, an exciting one.”