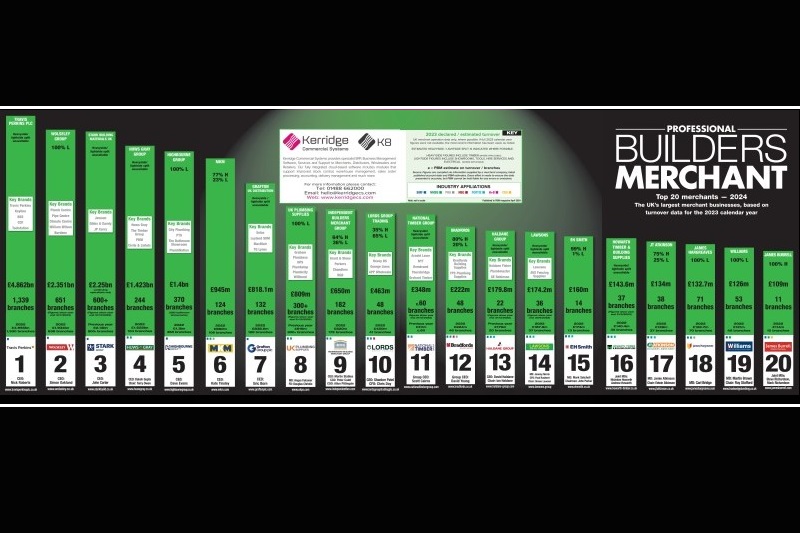

2024 Top 20: As published in our April 2024 edition, PBM looks behind the numbers to consider the performance of the UK merchant sector’s largest businesses during 2023.

It has undoubtedly been a challenging year for the merchant sector and the wider construction industry. A declining housebuilding market and a stuttering RMI segment contributed to falling revenues for a number of our respondents — in the ‘Top 20’ and beyond — whilst material price inflation added further pressures to the bottom line.

Efficiency savings, often involving reductions in headcount, were not uncommon — though many merchants also continued to expand their branch networks and / or introduce new services.

In broad terms, it was a somewhat static picture as the exact same businesses make up this year’s league table, with only a handful even moving positions in our listing. Equally, there were no seismic mergers and acquisitions, breaking a pattern which had seen some substantial shifts in the ownership and composition of the UK’s biggest merchants in recent years.

Looking to our latest countdown itself, Travis Perkins plc remains well clear at the summit although the market leader has been far from immune to the current market challenges…

*** NB: Click here for an enlarged version of the Top 20 graphic ***

1: Travis Perkins plc

2023 turnover = £4.862bn (2022 = £4.995bn)

1,339 branches (1,330 in 2022)

As detailed in the company’s 2023 Annual Report, the organisation says it “invested to protect and build market positions with market share gains in both Toolstation and Travis Perkins General Merchant” during 2023 and in looking to whether the challenges ahead, it is “transforming the operating model to build a stronger business… through the simplification of Group structures, lowering supply chain costs and harnessing benefits from new technology.”

CEO Nick Roberts (who is now set to leave the business) added: “While the timing of recovery in our end markets is uncertain, the long-term growth drivers of our industry remain robust. The proactive steps we are taking to rebuild profitability and strengthen our balance sheet will create a more resilient business and, together with our strong customer relationships and differentiated offer, will see the Group well positioned to emerge stronger when markets recover.”

Click here to see the Travis Perkins plc 2023 Annual Report.

2: Wolseley UK

2023 turnover = £1.934bn (2022 = £1.763bn)

638 branches (542 in 2022)

NB: Figures show year end 31.7.23

The Wolseley UK year end report notes that total revenue grew by £417 million in 2023, with approximately one third of the growth organic and two thirds coming from businesses owned for less than 12 months. During the year, the Group acquired C.P. Hart & Sons which is engaged in the supply of luxury bathroom products and therefore provides access to a new customer segment.

A key area of focus as detailed in the report was the continued development of its “processes to identify, assess and develop talent.” This is said to include succession planning for key roles whilst training and development programmes have been “established to develop the skills and behaviours of employees at all levels” ranging from apprenticeship schemes for new and existing talent to coaching for senior leaders.

A Director of Innovation has also been appointed to “support the design and delivery of the net zero transition strategy, including working with external policy-making bodies.”

Click here to see the full Wolseley UK financial report.

3: STARK Building Materials UK

Latest recorded turnover = £2.25bn (Previous year = £2.13bn)

600+ branches

NB: Figures show year end 31.12.22

A recent update from the parent STARK Group noted that the establishment of STARK Building Materials UK Ltd (following the acquisition early last year of Jewson along with Saint-Gobain Building Distribution’s other UK merchant brands) has helped the wider business to deliver record-high net sales in 2022/23 including 17.7% net sales growth.

Group CFO Sisse Fjelsted Rasmussen said: “The UK business contributed with net sales of EUR 1.2bn and EBITDA of just EUR 31m in the year’s results for 5 months of the financial year.

“We acquired our UK business because we believe we can run it better. The company has underperformed for several years. We’re now changing that.

“Today, we have a business in the Nordics that is very strong (while) our German-Austrian business improved commercially and financially since we acquired it in 2019. Our plan is to let our new British management team transfer our knowledge and concepts from the Nordics and Germany to the UK market. It’s a big task, but our British team has created a good momentum.”

4: Huws Gray Group

2023 turnover = £1.423bn (2022 = £1.622bn)

244 branches

A further year on from the acquisition and integration of the former Grafton Group ‘Traditional Merchanting’ brands such as Buildbase, and the Huws Gray Group now has a new CEO at the helm.

In December 2023, the company announced that after 14 years with the business, Ian Northen steped down as CEO to spend more time with his family. Following a comprehensive search, Daksh Gupta took up the reins on 1 February 2024.

Speaking at the time of the announcement, Founder and Chairman Terry Owen said: “We are delighted to welcome Daksh as our new Chief Executive. The Board and I look forward to working with him to realise the potential of the Group as a winning business which delivers long term value for all its stakeholders.

“I would also like to take this opportunity on behalf of the Board to thank Ian for the significant role he has played in the Huws Gray story, the Board wishes him the very best for the future.”

5: Highbourne Group

2023 turnover = £1.4bn (2022 = £1.3bn)

370 branches including 290 bathroom showrooms (365 in 2022)

CEO Dave Evans commented: “Over the last 12 months we’ve continued to invest in our people, customer experience and digital innovation to build the business and support the UK’s Net Zero goals.”

Examples include the launch of its first ever City Plumbing Renewables Centre in Farnborough where, thanks to a partnership with GTEC Training, installers can become certified in the installation of heat pumps and solar PV.

In the digital field, customer-focused apps for the housebuilding and social housing market were launched whilst 2023 was also the first full year of online plumbing and bathroom business Plumbworld being a part of Highbourne Group, “broadening the Group from a b2b offering, to both b2b (trade) and b2c (retail).”

A significant focus was also placed on colleague engagement and recruitment goals, including moves to support diversity and enhance its teams.

For 2024, the firm has already opened a further City Plumbing Renewables Centre in Basildon and appointed a new Commercial Director in Dominic Sarkar, and new MD of The Underfloor Heating Store in Mim Mogul.

Dave added: “The next 12 months are a critical moment for energy efficiency in the UK and as a business we are poised to support installers in the shift to lower temperature heating systems with training, tools, resources and expertise.”

6: MKM

2023 turnover = £945m (2022 = £860m)

124 branches (106 in 2022)

In 2023, new branches were added in Sleaford, Nottingham, Carlisle, Stafford, Wigan, Wakefield, Eastleigh, Chichester, Barrow, Newcastle, London Colney, Thame and Boston whilst the John Nicholls sites in Banbury, Bicester, Long Hanborough, Kidlington and Rugby were acquired.

Going forward, MKM has plans to continue with its new branch opening programme “with 15-20 additional branches planned for 2024 (and) the potential also for further acquisitions.”

In March, MKM opened its 125th branch with a new depot in Colchester.

7: Grafton UK Distribution

2023 turnover = £818.1m (2022 = £838.6m)

132 branches (128 in 2022)

Focusing on the Group’s UK merchant operations (demarked as its UK Distribution segment and incorporating Selco, Leyland SDM, MacBlair and TG Lynes), its 2023 Annual Report noted how “cost-of-living pressures driven by high inflation and interest rate rises led to reduced spending by households on home improvements and weakened demand for new homes as affordability became stretched. Volumes in the distribution businesses were therefore lower in these weaker markets.

“Building materials price inflation gradually declined before turning to deflation in the closing months of the year. There were sharp falls in steel and timber prices from record highs, partly reversing the post pandemic spike. Lower timber prices resulted in reduced revenue and gross profit in the Distribution businesses in Ireland and the UK.”

In recent months, Selco has announced new partnerships with HSS Hire, Magnet kitchens and Chiltern Brick & Tile to expand its range of in-branch services.

Click here to read the full Grafton Group plc 2023 year end report

8: UK Plumbing Supplies

Latest recorded turnover = £809m (Previous year = £616m)

300+ branches

NB: figures show year end 31.12.22

9: Independent Builders Merchant Group

2023 turnover = £650m (2022 = £620m)

182 branches (172 in 2022)

IBMG completed a number of strategic acquisitions during the year including the builders’ merchant operations of Kent Blaxill, along with the acquisition in June of Roofing Gear. Roofing Gear expanded IBMG’s specialist roofing division by a further three branches in Yeovil, Dorchester and Poole, while the acquisition of Sussex’s MS Roofing Supplies’ added a further five roofing depots across East and West Sussex. This was followed by the opening of new MS Roofing branches across Sussex in 2023.

Alongside this, IBMG announced its first foray into private-label products with the launch of its ProRange product line. The first product to launch under the brand is underfloor heating (UFH).

Ian Kenny, Group Marketing director, said: “We’ve been at the coalface of product supplies for decades so we know what the trade wants and we know what makes a product ‘great’, so launching our own-brand range was a logical step for us.”

Going forward, IBMG says it “will continue to identity good fit acquisitions as well as look to grow its existing brands across all divisions.” It will also be adding to its private label ProRange line over the coming year “with the intention to provide a comprehensive product range to installers.”

10: Lords Group Trading plc

2023 turnover = £463m (2022 = £450m)

48 branches (41 in 2022)

In 2023, Lords completed the acquisitions of Chiltern Timber (1 site) and Alloway Builders Merchants (5 sites) with one organic opening Mr Central Heating Edinburgh.

Recognising that “the first half of 2024 is likely to be challenging,” the Group notes that it will continue to invest in “its 3 Ps of people, plant and premises.” Refurbishments are planned for a number of its sites, whilst “new technology investments” are planned across both its Merchanting and P&H division alongside new sites for Mr Central Heating and George Lines.

A statement adds: “We expect consolidation opportunities to continue to be available but will be exercising discipline in our approach to acquisitions.”

11: National Timber Group

Latest recorded turnover turnover = £348m (Previous year = £311m)

c.60 branches

NB: figures show year end 31.12.22

In December 2023, National Timber Group announced the appointment of Scott Cairns as its new Group Chief Executive. Well known to many across the timber industry in a career spanning almost 40 years, Scott spent much of his career with the Donaldson Group where he was Group Chief Executive until 2020 and, more recently, a non-executive member of its board.

In 26 years with that firm, initially leading the timber and merchanting businesses, Scott led a number of companies to become market leaders within their categories. During his tenure as Group CEO, the Donaldson Group doubled its annual turnover to £230m.

12: Bradfords

2023 turnover = £222m (2022 = £224m)

48 branches (46 in 2022)

In 2023, Bradfords acquired the trade and assets of Smart Build Supplies in Torquay in April and also opened a new branch in Launceston in June.

13: Haldane Group

Latest recorded turnover = £179.8m (Previous year = £179m)

22 branches (20 in prior year)

NB: figures show year end 31.12.22

14: Lawsons

2023 turnover = £174.2m (2022 = £187.9m)

36 branches (37 in 2022)

Of its plans for 2024, Lawsons reported it was set for “a period of consolidation and integration of acquisitions.”

15: EH Smith

2023 turnover = £160m (2022 = £174m)

14 branches (13 in 2022)

EH Smith opened a new branch in Coventry in 2023 comprising of a merchant operation and a K&B showroom.

Following the success of the firm’s London Design Centre in Clerkenwell, EH Smith is creating a new building materials innovation centre in the heart of Birmingham. Due to open late 2024, the centre “will showcase a wide range of construction materials and incorporate large practical demonstration spaces.”

16: Howarth Timber & Building Supplies

2023 turnover = £143.6m (2022 = £140.4m)

37 branches (35 in 2022)

NB: figures show year end 31.3.23

17: JT Atkinson

2023 turnover = £134m (2022 = £129m)

38 branches (37 in 2022)

18: James Hargreaves

2023 turnover = £132.7m (2022 = £122.7m)

71 branches (70 in 2022)

A new branch opened in Portishead (Bristol) whilst the business is set for further expansion in 2024 with three new branches already in progress and more set to follow. An additional large distribution warehouse has also been purchased next door to the company Head Office in Burnley.

19: Williams

2023 turnover = £126m (2022 = £121m)

53 branches (49 in 2022)

New branches were opened in West Drayton, Gloucester, Sevenoaks and Bedford.

20: James Burrell

2023 turnover = £109m (2022 = £114m)

11 branches (10 in 2022)

Whilst this presentation of the merchant sector focuses on the performance of the largest businesses, it is worth reasserting that a considerable number of firms – such as Builder Depot, M Markovitz, Sydenhams, Covers, Joesph Parr Group and LBS – are delivering figures very close to our ‘Top 20’ threshold.

Furthermore, and perhaps for additional context, the ongoing expansion of self-proclaimed “online builders’ merchant” CMO Group plc is indicative of one of the key changes to the market and recorded a turnover of £71.5m in 2023 (£83.1m in 2022).

Industry affiliations / buying group membership:

BMF (20) — All

NMBS (15) — All except TP, Wolseley UK, STARK Building Materials UK, Highbourne Group, Grafton Group

Fortis (5) — Haldane Group, Lawsons, EH Smith, Howarth Timber & Building Supplies, JT Atkinson

H+B (2) — Lords, Building Supplies (exc. plumbing & heating – see below)

PHG (3) — MKM, Bradfords, James Hargreaves

CBA (1) — James Burrell

Source: Figures are compiled via forecasted information supplied by each company, latest published account data and PBM estimates. Every effort is made to ensure the data presented is accurate but PBM cannot be held liable for any errors or omissions.

Related news

UK merchant sector Top 20 – 2022 calendar year

UK merchant sector Top 20 – 2021 calendar year

UK merchant sector Top 20 — 2020 calendar year

UK merchant sector Top 20 – 2019 calendar year

UK merchant sector Top 20 – 2018 calendar year

UK merchant sector Top 20 – 2017 calendar year

UK merchant sector Top 20 – 2016 calendar year