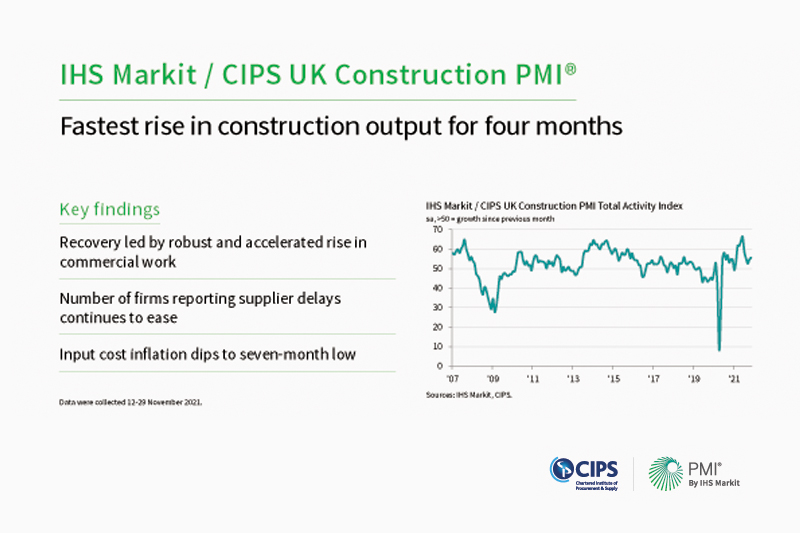

The latest IHS Markit / CIPS Construction PMI data, for November 2021, indicates that UK construction companies saw a sharp increase in business activity during the month.

Led by the fastest upturn in commercial work since July as clients continued to boost spending in response to the reopening of the UK economy, the report – with data collected 12-29 November 2021 – also shows that there were signs that the worst phase of supplier delays may have passed with the portion of survey respondents citing longer delivery times falling to 47% in November (compared with a peak of 77% in June).

And whilst rapid input price inflation persisted and haulage driver shortages added to cost pressures, the latest overall rise in operating expenses was the least marked for seven months.

At 55.5 in November, up from 54.6 in October, the headline seasonally adjusted IHS Markit/CIPS UK Construction PMI Total Activity Index signalled a robust and accelerated expansion of overall construction activity. The index has now posted above the 50.0 no-change value for ten consecutive months and the latest reading pointed to the strongest rate of expansion since July.

A steeper rise in commercial construction (index at 56.5) helped offset a sight showdown in house building growth

(54.7, down from 55.4). Civil engineering was the weakest performing area in November (53.9), although the latest rise in activity was the largest since August.

Another solid increase in new business volumes helped to boost construction output during November, with this index hitting a three-month high. Survey respondents mostly noted that improving client demand had led to increased numbers of new enquiries, although some firms suggested that supply constraints had a negative impact on confidence.

Construction firms sought to increase their business capacity in November, as signalled by another steep rise in staffing numbers. That said, the overall speed of job creation eased to an eight-month low. Sub-contractor usage also increased at a slower pace in November. The latest survey also indicated that sub-contractor availability decreased to the least marked extent since May.

November data pointed to another robust rise in demand for construction products and materials. Higher levels of input buying reflected a combination of increased workloads and efforts to build inventories due to supplier delays.

The index measuring overall supplier performance reached it highest level since April, but remained well inside negative territory.

Around 47% of the survey panel reported longer lead times in November, while only 4% reported an improvement.

Port delays and a severe lack of transport availability due to haulage driver shortages continued to hold back supplier

performance, although firms noted an improvement in the availability of specific items (especially timber).

Around 72% of the survey panel reported an increase in purchase prices in November, while only 3% reported a decline. That said, the resulting index signalled the least marked rate of cost inflation since April.

Rapid price pressures and supply shortages were a factor dampening business optimism in November. Latest data signalled the weakest output growth projections for four months.

Tim Moore, Director at IHS Markit, which compiles the survey, said:

“November data highlighted a welcome combination of faster output growth and softer price inflation across the

UK construction sector. Commercial building led the way as recovering economic conditions ushered in new projects, which helped compensate for the recent slowdown in house building. Major infrastructure work also boosted construction activity in November, as signalled by the fastest growth in the civil engineering category since

August.Input price inflation remains extremely strong by any measure, but it has started to trend downwards after

hitting multi-decade peaks this summer. The latest rise in purchasing costs was the slowest since April, helped by a gradual turnaround in supply chain disruption and a slight slowdown in input buying. Port congestion and severe shortages of haulage capacity were again the most commonly cited reasons for longer lead times for construction products and materials.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said:

“UK construction enjoyed a rebound in November with the fastest level of output growth for four months as supply

chain managers increased their purchasing activity to meet a strong pipeline of new building projects. Commercial orders were the strongest, picking up the slack from the subdued housing and civil engineering sectors and demonstrating that business confidence in the UK economy was improving.Adding to this positivity was signs of recovery in supply chain performance with just 47% of construction firms

reporting longer waiting times, which is the smallest number for eight months. Even with this glimmer of hope that the pressure on deliveries was easing, purchasing remained at higher level to counteract disruptions from ongoing driver shortages and port delays as supply chain managers bought more than their immediate need.Job hiring growth was still maintained in November but was the weakest since March. Builder optimism was somewhat flat as the costs of building still remained high and firms struggled to stay competitive.”

Related news

UK Construction PMI for October 2021

UK Construction PMI for September 2021

UK Construction PMI for August 2021

UK Construction PMI for July 2021

UK Construction PMI for June 2021

UK Construction PMI for May 2021

UK Construction PMI for April 2021