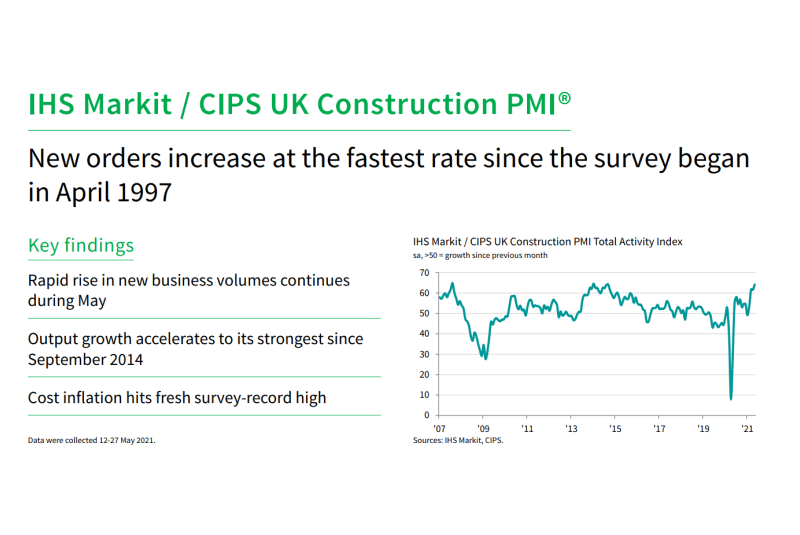

The latest UK Construction Purchasing Managers Index from IHS Markit / CIPS shows that construction activity is increasing at the fastest rate since the survey began in April 1997 — however, there are growing concerns about supply issues and price rises.

May PMI data indicated that the UK construction sector remained on a strong recovery path, with output growth reaching its strongest since September 2014. Moreover, new order volumes increased at the fastest pace since the survey began just over 24 years ago.

However, input cost inflation was also at a survey-record high during May, reflecting a surge in demand for construction materials and severe supply shortages. At 64.2 in May, up from 61.6 in April, the seasonally adjusted IHS Markit / CIPS UK Construction PMI Total Activity Index registered above the 50.0 no-change value for the fourth consecutive month and signalled the strongest rate of output growth for just under seven years.

House building (index at 66.3) was the best-performing category of construction activity in May, followed by commercial work (64.4). Civil engineering activity (index at 61.3) also increased sharply during May, and indeed across the construction sector, around 47% of the survey panel reported higher volumes of new work while only 11% signalled a reduction.

Accordingly, the rate of job creation was the fastest since July 2014 with sub-contractor usage again increasing at a survey-record pace.

The latest data indicated a steep upturn in purchasing activity across the construction sector. Some firms noted that input buying had been boosted by efforts to build inventories in response to supply shortages, whilst suppliers’ delivery times lengthened sharply in May with “the downturn in vendor performance” the second-steepest since the survey began (exceeded only by that seen in April 2020).

Stretched supply chains and steep rises in raw material prices were said to have contributed to “a rapid increase in average cost burdens” with the overall rate of input price inflation “the highest in just over 24 years of data collection”.

Cost and supply issues notwithstanding, construction companies “remain highly upbeat about their growth prospects for the next 12 months” with around 61% of the survey panel predicting a rise in business activity and positive sentiment mostly attributed to “resurgent customer demand alongside optimism about the UK economic outlook following the successful vaccine roll out”.

Outlining a word of caution, Tim Moore, Economics Director at IHS Markit which compiles the survey, said: “There were widespread reports citing shortages of construction materials and wait times from suppliers lengthened considerably in comparison to those seen during April. Imbalanced supply and demand led to survey-record increases in both purchasing prices and rates charged by sub-contractors.”

Brian Berry, Chief Executive of the Federation of Master Builders, added: “Rising material prices are continuing to limit the ability of local builders to build back better from the pandemic. It’s incredibly worrying to hear that the overall rate of input price inflation was the highest on record.

“This is consistent with FMB State of Trade data that shows 93% of builders reported material price increases in Q1 of this year. Against the backdrop of high levels of inquiries for building work, it’s imperative that smaller businesses have the same access to materials as the larger firms during these difficult times.”

For more information, go to: https://professionalbuildersmerchant.co.uk/news/ihs-markit-cips-construction-pmi-for-may-2021/