NBS and Glenigan have revealed the findings of their ‘Construction Manufacturers’ Marketing Report’, which surveyed 166 building product manufacturers to assess the state of marketing in the industry.

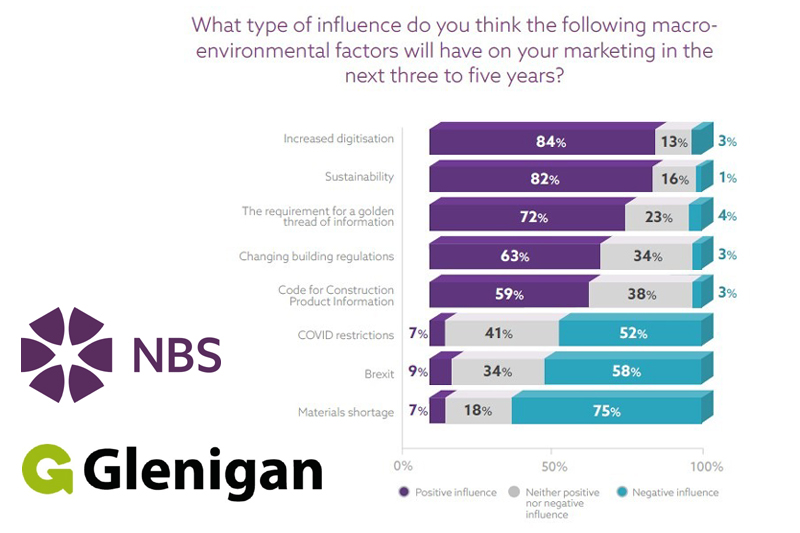

As cited in the report, marketers for construction manufacturers are facing a fast-changing world and, overall, the big macro change drivers are seen as positive. More than four out of five respondents view sustainability and increased digitalisation as forces for good. The drive for the ‘Golden Thread’ of information, changing building regulations and the Code for Construction Product Information (CCPI) are all also viewed as constructive developments.

However, COVID, Brexit and supply shortages are considered detrimental, posing a marketing challenge.

Despite one in three respondents saying that managing product information was a barrier to effective marketing, just 23% stated they use product information management (PIM) systems. 63% use PDFs and over half (51%) rely on Excel.

When seen in context against other responses, the lack of PIM use is extremely low given that almost three quarters (72%) see golden thread adoption as a positive move, and six in ten view the CCPI and changing building regulations favourably. Furthermore, the relatively low uptake of digital tools around product data management is seen by the report’s authors as “perhaps surprising” as it is against a backdrop of forthcoming building safety regulation changes and the CCPI, which – while voluntary – will likely push towards the digital provision of product information becoming a standard expectation.

To further explore why this is concerning, it’s widely recognised using PDFs presents a risk, as they quickly become out-of-date. Once shared they cannot easily be replaced, leading to those specifying or using the product referring to “redundant information”. While PIM systems enable manufacturers to update their product information in multiple places at once, other ways to manage product information include specifier-targeted product libraries and databases which can integrate into manufacturer websites.

Show us the money

Marketing budgets have remained static for half of construction product manufacturers (52%), and this was particularly evident in companies with the highest turnover. The percentage of those with a turnover of over £50 million whose marketing budget has stayed about the same increases to 67%.

Positively, for one in three construction product manufacturers (29%), their marketing budgets have increased in recent years, even with COVID and other uncertainties affecting the industry.

Marketing budgets for construction product manufacturers average at around 2.3% of turnover – whilst they are higher for larger organisations, those with turnovers of over £50 million spend “proportionally far less than expected”. The Gartner CMO marketing spend survey from 2019-2020 says the average investment for all industries in marketing is 11% of turnover, with technology firms investing 11.4% and the average for all types of manufacturing is 12.7%, so as a sector construction product manufacturers invest less than their manufacturing peers.

Barriers to marketing

Professionals report a number of challenges including resourcing (55%) and demonstrating ROI (43%), with over one in three marketers (35%) highlighting difficulties in reaching their target audiences. External factors are also having an impact, such as supply shortages and Brexit which are having affecting revenue and therefore budgets.

Target audience

The most common construction manufacturer audiences are specifiers and designers (such as architects), followed by construction contractors, distributors (e.g builders’ merchants), housebuilders, trade professionals (such as plumbers) and, lastly, consumers.

Demonstrating success

While return on investment (ROI) is important to sector marketers, just under half (43%) said that it was difficult to prove effectiveness. The study looked at what metrics were actually being used to assess success. The key stats used by nine out of ten was website traffic, which also has the advantage of being able to show spikes driven by other campaign activity. Collateral downloads (70%) and leads generated (75%) were also popular metrics which are also easy to obtain.

Around six in ten (58%) used specification numbers as a success metric. Being included in a specification can be hard to track following generic marketing where manufacturers may not know they have been specified. However, while some data may still be missing due to GDPR constraints, construction orientated channels, such as product databases, can provide some of this information. For example, in many cases NBS can tell manufacturers have been added to a specification.

More sophisticated metrics, well-used in other sectors, such as the customer acquisition cost and lifetime value were used minimally (15% and 14% respectively).

Channels

More than 53% of construction product marketing is now digital, however there’s still a place for traditional (non-digital) channels/tactics. Around 18% of activity is allocated to construction specific channels, such as product information libraries and project leads services.

Looking at specific marketing channels, owned ones are most popular – such as website, organic social, email and brochures. Slightly less popular are SEO/PPC, content marketing, PR, printed brochures and catalogues and digital display.

Print ads, direct mail, and events were the least used, but this low usage may be partly influenced by COVID, as readers were located at home rather than at offices or headquarters where publications were still being sent. It’s worth flagging that physical events were put on pause during the lockdowns and this will have impacted on spend. A logical supposition is that event spend will increase in 2022 as the world opens up once more.

Robin Cordy, Marketing Director at NBS, said: “The construction product sector marketing is changing fast, and it’s refreshing to see marketers generally optimistic about the future. However, the data supports that there’s endemic under investment in this critical business function.

“Most manufacturers say they want to digitise their marketing, and they know they need to digitise their product data, but this doesn’t seem to be supported from an investment point of view. More resources would improve the accuracy and quality of product marketing content and attract more specifiers. This will be a virtuous circle with better marketing leading to improved compliance and higher sales.

“There’s a significant opportunity around digital product information for construction marketers. Right now, an over reliance on outdated means of managing product data is adding potential risk to manufacturers’ businesses. However, forthcoming regulation and the CCPI will no doubt drive the appetite for digital product information and ways to improve how product data can be managed, along with construction-specific marketing channels.”

Ian Bellamy, Head of Marketing at Glenigan, added: “Marketers are having to react to complex, shifting market conditions, changing how they target and communicate with their audiences, with digital channels becoming much more important as marketers look for maximum reach from their budgets. And while marketers expect challenges around materials shortages and the Brexit transition, it’s great to see a heavy focus on sustainability over the next few years.”

To find out more, a free download of the NBS & Glenigan Construction Manufacturers’ Marketing Report is available here.

NBS is a leading construction industry specification and product information platform. Glenigan provides UK construction project data, market analysis and company intelligence.