To understand how UK wholesalers and distributors have faced profitability challenges during a period of significant turbulence, OGL Software surveyed decision-makers at SMEs about their concerns and priorities, the current state of technology adoption and how they have fared when transforming their businesses. Offering a perspective broader than just the merchant sector, OGL’s Chief Operating Officer Sharon Moreno takes us through the results.

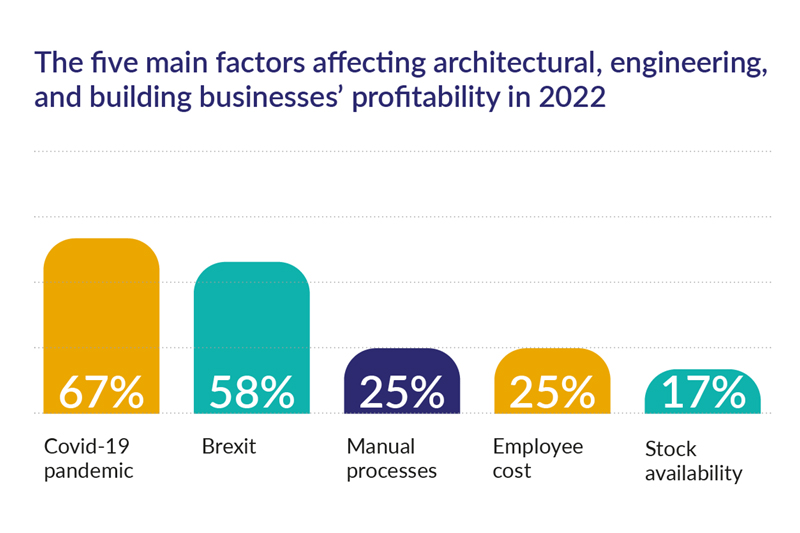

Covid, Brexit, the continued reliance on manual processes and supply chain issues are revealed to be the greatest factors affecting profitability for architectural, engineering and building sector businesses in 2022.

A new survey commissioned by OGL Software — entitled Profitability in UK Wholesale Businesses — focused on companies that stock and supplying tools such as handheld laser distance meters, architect scales, power tools, ladders to trolleys, and provide equipment including welding machines, workwear and safety equipment, to providers and commercial businesses across the architectural, engineering and building sectors.

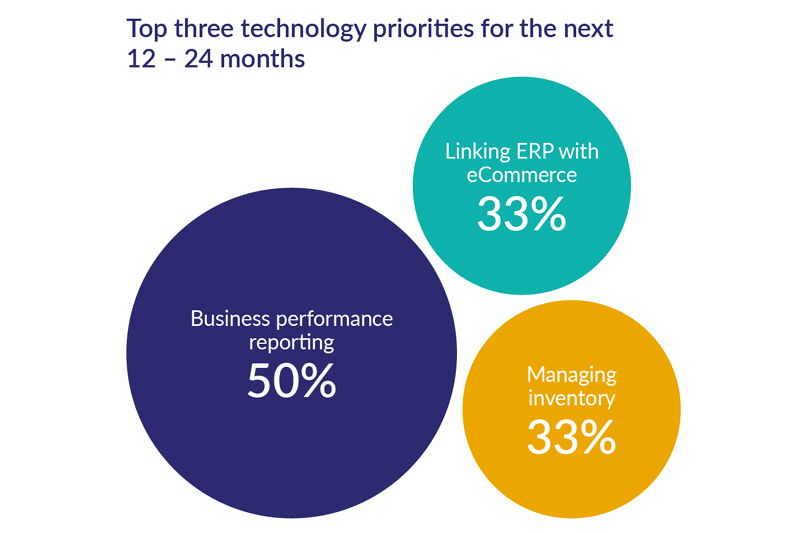

The market size of the architectural industry is £6.5 billion in revenue in 2022, for example, with the UK construction sector contributing more than £110 billion per annum and nearly 7% of GDP. The engineering and building sectors are one of the UK’s broadest with 5.5 million people working in those industries, accounting for 18% of all UK employment. With the rapid increase in the need for housing, there is continued demand for architectural, engineering and building services, made more prominent by the return to work after 2020’s extended lockdown period. The pandemic coupled with Brexit hit supply chains hard, with many businesses pivoting to online sales. This is reflected in the top technology priorities for the next 12–24 months as business performance reporting (50%), linking ERP with ecommerce (33%) and managing inventory (33%) revealed as among the most important by survey respondents.

The pandemic coupled with Brexit hit supply chains hard, with many businesses pivoting to online sales. This is reflected in the top technology priorities for the next 12–24 months as business performance reporting (50%), linking ERP with ecommerce (33%) and managing inventory (33%) revealed as among the most important by survey respondents.

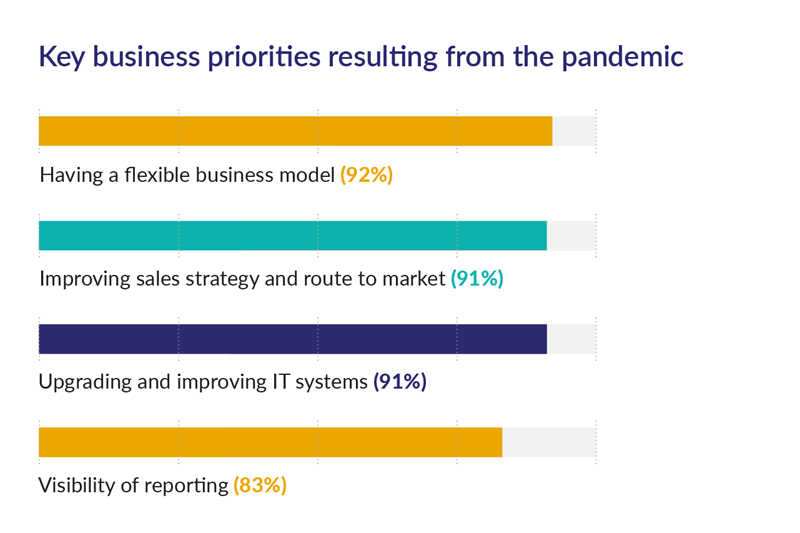

To manage the aftereffects of the coronavirus, business priorities focused on having a more flexible business model (92%), improving sales strategy and route to market (91%), upgrading and improving IT systems (91%) and visibility of reporting (83%).

“A single view of a business, especially of inventory levels, and integrated technologies will lead to better profitability, increased productivity and accurate data for planning.”

The pandemic has led to supply chain challenges, with some businesses stockpiling products and parts to ensure supply. Manual processes are still plaguing businesses, leaving them behind the curve with regards to digital transformation.

Architectural, Engineering and Building businesses all noted that using technology to automate their business processes (92% for each sector) was more key for their businesses over and above technology being vital to those companies. But, that confidence in automation technology really showcases use of technology in all forms, including automaton, is helping business processes, which in turn enables those companies to remain competitive.

Indeed, technology is at the heart of efforts to increase profitability as we enter another potentially uncertain economic period. 91% of respondents agreed that automating business processes helps their companies stay competitive, up from 70% (engineering) / 88% (architectural and building) pre-pandemic.

A key finding of the research was the wide spread of technologies used — and the disparate nature of systems that are not necessarily “talking to each other” to provide a full view of operations. On this point, architectural, engineering and building businesses use a range of software systems to function — more than 95% of respondents use one or more software application to run their business, from inventory / stock control to accounting software and CRM (customer relationship management).

Indicative of some of the issues also facing builders’ merchants, Sphinx Industrial Supplies provides welding-specific products and accessories for industrial use and the company’s Finance Director, Sophie Donnelly, commented that one of the major factors affecting profitability was ensuring that there was a centralised system in place to digitise all business processes. This was something that Sphinx did, transforming its business by switching out manual processes to ERP software, which has been beneficial in providing visibility and accuracy of stock, while assisting with sales and orders online.

Sophie explained how the integration of that technology has helped the company streamline everything, stating: “We wanted to expand without employing more people and the system helps massively to manage all our sales channels because we can easily see and control all our stock in one place. It’s the little things [the system does] that work for us which we don’t even think of now, like printing an order confirmation or picking list, that the previous system just couldn’t do.

“We use the system in everything we do. Online sales revenue increased by 300%. One of the biggest compliments we get is ‘that was so quick’ when receiving orders. If a local business wants an item that’s in stock, we can pick it and get it on the van in the hour.” As the pandemic accelerated digital transformation, cloud computing continues to be a driver for change, with 83% of respondents agreeing that hosting applications and data in the cloud have improved efficiencies and productivity (or would if cloud were implemented).

As the pandemic accelerated digital transformation, cloud computing continues to be a driver for change, with 83% of respondents agreeing that hosting applications and data in the cloud have improved efficiencies and productivity (or would if cloud were implemented).

Critically ERP systems are a key technology with 92% agreeing that ERP systems give greater availability and control of stock. ERP refers to a suite of integrated software that businesses use to manage day-to-day business activities, such as sales order management, stock control, finance, CRM and more.

Positively, there is a greater degree of acceptance of cloud technology and understanding that ERP systems are not just for larger companies. Manual processes are still a hindrance as are disparate systems, both of which lead to inefficiencies. A single view of a business, especially of inventory levels, and integrated technologies will lead to better profitability, increased productivity and accurate data for planning.

In conclusion, Architectural, engineering and building firms need to streamline their businesses like never before to ensure that they efficiently and quickly meet demand.

OGL Software is a leading UK ERP software company, first established in 1976. Its software is designed specifically for merchants, distributors and wholesalers of all kinds, and counts its total number of users in the thousands across several sectors.

A version of this article appeared in the January edition of PBM. Click or tap the link to read the full digital issue via our website.