The latest S&P Global UK Construction PMI report revealed that “UK construction companies indicated a renewed increase in total industry activity during March, thereby ending a six-month period of decline.”

Survey respondents often commented on a turnaround in sales pipelines and greater new business enquiries linked to the improving economic outlook and more stable financial conditions.

Adding to signs of a recovery in construction sector performance, new orders expanded at the fastest pace since May 2023. However, construction companies remained cautious about staff hiring, with employment numbers falling for the third month running in March.

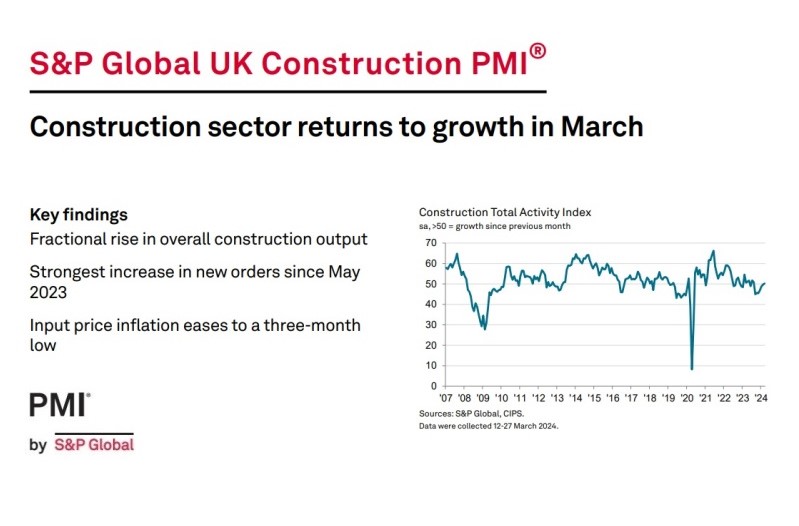

The headline S&P Global UK Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted index tracking changes in total industry activity – rose from 49.7 in February to 50.2 in March. Any reading above 50.0 indicates an overall expansion of construction output. Although

signalling only a fractional rise in business activity, the index was at its highest level since August 2023.

Civil engineering was the best-performing segment in March, as output levels increased at a marginal pace. Panel members cited increased work on infrastructure projects and resilient demand in the energy sector.

House building and commercial construction activity were both broadly unchanged in March. The stabilisation in residential work represented the best performance for this category since November 2022.

March data pointed to a moderate increase in new work received by construction companies. The rate of expansion accelerated since February and was the strongest for ten months. Anecdotal evidence pointed to a general rise in new project starts and greater tender opportunities across the

construction sector so far in 2024.

In contrast to the positive trends for output and new orders, latest data signalled another reduction in staffing numbers. That said, the rate of job shedding was only marginal and eased since the previous month. At the same time, sub-contractor usage was stable in March. The latest

survey indicated a strong improvement in sub-contractor availability. Rates charged by sub-contractors increased at the fastest pace since August 2023.

Purchasing costs rose for the third month running in March. However, the rate of inflation was only marginal and the weakest seen over this period. Survey respondents noted increasing transport costs, but others suggested that strong competition among suppliers had constrained the overall rate of input price inflation.

Suppliers’ delivery times shortened for the thirteenth consecutive month in March, albeit to only a moderate extent. Anecdotal evidence suggested that improving materials availability and subdued demand had contributed to improving vendor performance.

Construction companies remain upbeat about their prospects for business activity in the next 12 months. Around 49% of the survey panel anticipate a rise in output levels, while only 11% predict a decline.

That said, the degree of optimism eased since February and was the lowest in 2024 to date. Survey respondents typically commented on stronger order books and hopes that broader market conditions will continue to improve, especially in relation to house building projects. Meanwhile, political uncertainty, squeezed margins and financial pressures were cited as factors weighing on optimism.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“UK construction output returned to growth in March as a renewed expansion of civil engineering work was supported by more stable conditions in the housing and commercial building segments. The marginal overall rise in total construction activity ended a six-month period of contraction.

“The near-term outlook for construction workloads appears increasingly favourable as order books improved again in March and to the greatest extent for just under one year. Construction companies generally commented on a broad-based rebound in tender opportunities, helped by easing borrowing costs and signs that UK economic conditions have started to recover in the first quarter of 2024.

“Staff hiring was a weak spot for the construction sector in March amid lingering concerns about margin pressures and continued risk aversion among major clients. Construction firms often reported delays with replacing departing staff, which led to a decrease in total employment numbers for the third month in a row.

“Supply chain pressures eased across the construction sector as subdued purchasing activity helped to alleviate strains on capacity. Improved supply conditions also led to a slowdown in the rate of cost inflation, which slipped to a three-month low in March.”

Purchasing Managers’ Index (PMI)

Related News

S&P Global UK Construction PMI February 2024 data

S&P Global UK Construction PMI January 2024 data

S&P Global UK Construction PMI December 2023 data

S&P Global / CIPS UK Construction PMI November 2023 data

S&P Global / CIPS UK Construction PMI September 2023 data

S&P Global / CIPS UK Construction PMI July 2023 data

S&P Global / CIPS UK Construction PMI June 2023 data

S&P Global / CIPS UK Construction PMI May 2023 data