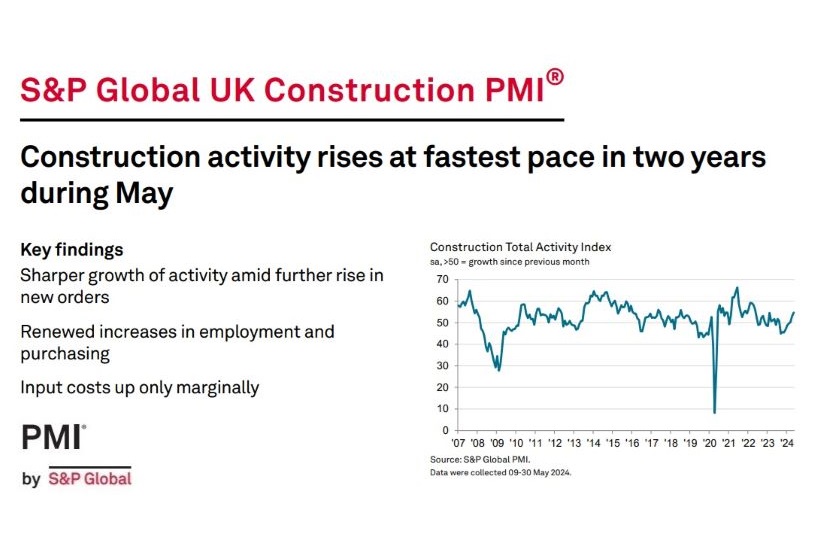

Growth in the UK construction sector gained momentum during May, with activity and new business increasing at sharper rates than in April according to the latest UK Construction PMI report from S&P Global.

Rising workloads prompted renewed expansions in purchasing activity and employment, while business confidence also strengthened. Supply-chain conditions continued to improve amid reports of good stock availability at vendors. This contributed to the pace of input cost inflation slowing to a marginal pace.

The headline S&P Global UK Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted index tracking changes in total industry activity – posted above the 50.0 no-change mark for the third month running in May to signal a sustained expansion in activity midway through the second quarter of the year. Moreover, the index rose to 54.7 from 53.0 in April, pointing to a marked increase in activity that was the fastest for two years.

For the first time since May 2022, all three monitored categories saw activity increase during the month as Housing activity returned to growth. The expansion in activity on residential projects was only marginal, however. The sharpest increase in activity was seen in the Commercial category where the rate of growth accelerated to a two-year high. Meanwhile, Civil Engineering activity rose at a solid, but slightly softer pace.

According to respondents, the latest increase in total construction activity reflected sustained growth of new orders. New business rose for the fourth consecutive month, and at a solid pace that was the fastest for a year as demand conditions improved. In particular, firms linked higher new orders to the winning of new contracts and the commencement of previously delayed projects.

With new order growth sustained midway through the second quarter, construction firms increased employment for the first time in five months. Although only modest, the pace of

job creation was the sharpest since last September.

A renewed increase in purchasing activity was also registered in May, again linked to improving workloads. The rise in input buying ended an eight-month sequence of decline.

Where companies purchased inputs, they once again experienced an improvement in vendor performance amid reports that stock holdings at suppliers were healthy. Furthermore, lead times shortened to the greatest extent in seven months.

With supply-chain conditions improving, companies noted only a marginal increase in input costs during May, with the rate of inflation the softest in the current five-month sequence of rising input prices.

Construction firms also signalled a marked improvement in the availability of sub-contractors in May, despite the largest expansion in their usage since April 2022. The rates charged by sub-contractors increased solidly, albeit at a pace that was weaker than the series average.

Further increases in new orders, in some cases linked to planned marketing campaigns, are set to support continued growth of construction activity over the next 12 months. Companies also hoped for an improvement in economic conditions and reduction in interest rates. Business confidence increased to a three-month high in May.

Andrew Harker, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“The UK construction sector looks to be building good momentum as we approach the middle of 2024, highlighted by activity increasing at the fastest pace in two years during May. Particularly pleasing was the broad-based nature of the rise in activity as work on housing projects increased for the first time in more than a year-and-a-half.

“Firms are gearing up for further growth in the months ahead, posting renewed expansions in both employment and purchasing activity as workloads increase.

“Moreover, the supply-chain environment continued to improve in May. Companies were able to secure inputs much more quickly than in April and at prices that were only slightly higher than in the previous month on average. These factors should help constructors in their efforts to ramp up operations in line with greater new order inflows.”

Purchasing Managers’ Index (PMI)

Related News

S&P Global UK Construction PMI April 2024 data

S&P Global UK Construction PMI March 2024 data

S&P Global UK Construction PMI February 2024 data

S&P Global UK Construction PMI January 2024 data

S&P Global UK Construction PMI December 2023 data

S&P Global / CIPS UK Construction PMI November 2023 data

S&P Global / CIPS UK Construction PMI September 2023 data

S&P Global / CIPS UK Construction PMI July 2023 data