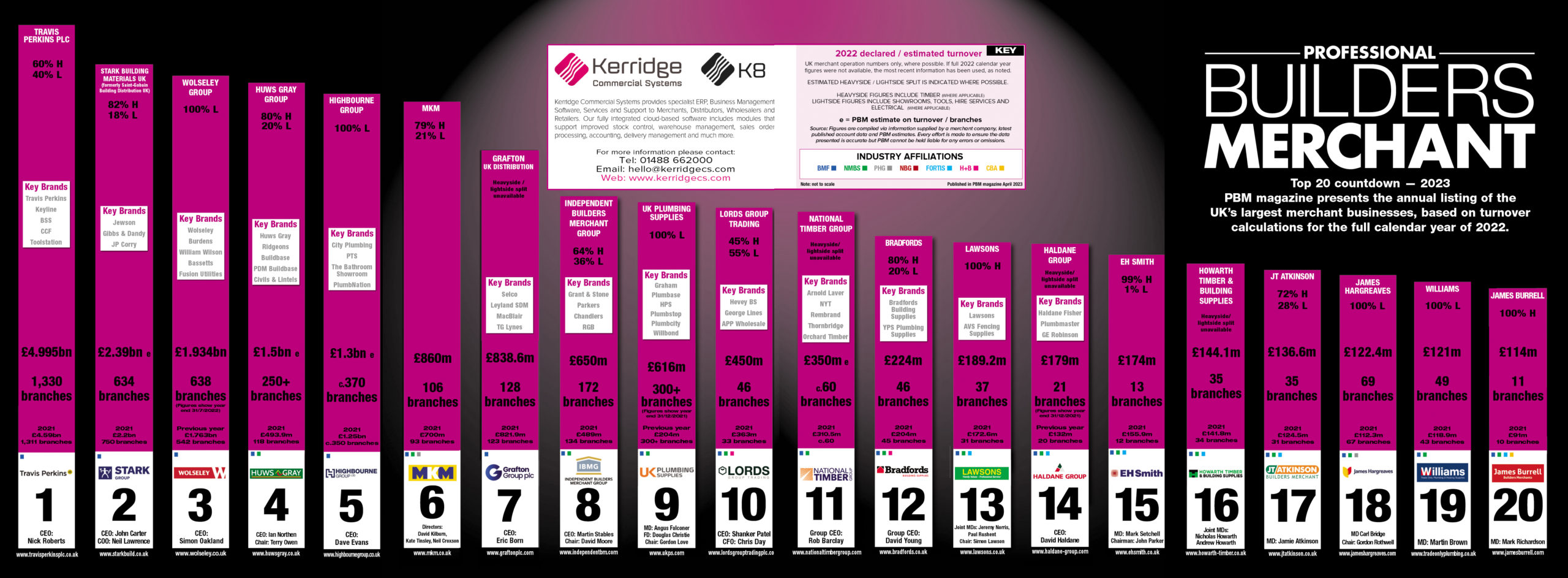

2023 Top 20: As published in our April 2023 edition, PBM outlines the background to the performance of the UK merchant sector’s largest businesses during 2022.

As we emerged from the turmoil of the pandemic, anticipation of a period of stability at the start of the 2022 once more gave way to reality. An emerging cost of living crisis was heightened by the tragic events in Ukraine, and then further compounded by political turbulence at home, to ensure that the last 12 months have been defined by rising inflation, diminished consumer confidence and increased business costs.

Whilst the performance of the merchant sector has once again been bullish, the industry’s largest players have not been unaffected by the upheaval, navigating testing market conditions whilst also investing in business improvement and also attempting to confront the longer term issues impacting upon both the supply chain and construction more broadly.

When it comes to this year’s countdown, we’ll add the standard caveat that turnover does not necessarily equate to profit, however looking back to the 2022 performances of our market leaders, Travis Perkins plc continues to lead the way…

1: Travis Perkins plc

2022 turnover = £4.995bn (2021 = £4.59bn)

1,330 branches (1,311 in 2021)

In the year end review, CEO Nick Roberts reflected on the “weaker trading environment”, yet the business continued to invest in ‘value-added services’ for customers — including hire, its Benchmarx kitchens offering and credit provision for SME developers — along with boosting its ecommerce provision, addressing sustainability issues (for example, through its electric forklift truck initiative) and expanding its apprenticeship programme.

Furthermore, investment continues in its strategic growth programme for further new “destination branches” and the ongoing roll out of new Toolstation outlets.

Click here to see full details of the Travis Perkins plc 2022 year-end report.

2: STARK Building Materials UK

2022 turnover = £2.39bn estimated (2021 = £2.2bn)

634 branches (750 in 2021)

First announced on 12 December 2022 with the parties expecting a closing date later this year, the acquisition of Saint-Gobain Building Distribution UK by STARK Group – a leading retailer and distributor of heavy building materials across Europe – has now been recently completed “following an accelerated process.”

Group CEO Søren P. Olesen said: “We look very much forward to welcoming nearly 9,000 colleagues and many new tradespeople to our customer list in the UK. The UK is an attractive market with solid population growth, one of Europe’s oldest housing stocks, and a huge potential for energy renovations.

“We are facing a challenging transition year, but we have acquired a company that we can make thrive and grow. The more than 600 branches and distribution centres are in good locations across the entire UK. We will invest in the business, the customers, the employees, and the distribution. We have acquired a company with whom we can continue our growth journey.”

STARK Group in the UK will be known as STARK Building Materials UK, and is being headed up by former TP head honcho John Carter. Following the divestment Saint-Gobain no longer has any distribution businesses in the UK.

Click here for more on STARK Building Materials UK.

3: Wolseley UK

2022 turnover = £1.934bn (2021 = £1.763bn)

638 branches (542 in 2021)

NB: Figures show year end 31.7.22

In 2022, Wolseley UK acquired seven businesses to “provide a combination of complementary products to the Group’s Infrastructure businesses… and additional access to large customers within the UK plumbing and heating market.”

In its annual report, the business stated: “Revenue for the year ended 31 July 2022 was £1,934 million, £171 million ahead of 2021 with £92 million of the growth coming from businesses acquired in the year. During 2022 the RMI and new construction markets were impacted by both product shortages and price inflation at levels not experienced in the UK for many years.

“Product shortages were particularly acute in one of Wolseley’s core product ranges, boilers, which reduced the size of the market in the 2022.”

Click here to see the full Wolseley UK financial report.

4: Huws Gray

2022 turnover = £1.5bn estimated (2021 = £493.9m)

250+ branches (118 in 2021)

Huws Gray has made a sizeable jump from ninth last time around to fourth place this year. Whilst we are only able to provide a broad estimate of its enlarged turnover, the integration of the former Grafton Group ‘Traditional Merchanting’ brands such as Buildbase significantly expands its scale and geographic reach.

5: Highbourne Group

2022 turnover = £1.3bn estimated (2021 = £1.25bn)

c.370 branches (c.350 in 2021)

In fifth position, Highbourne Group states it is “celebrating a year of significant growth” which included the opening of 21 new City Plumbing branches to boost its network to 370 outlets. Significantly, the business says it is “dedicated to providing a service to all areas of the trade in one place,” with the 2022 expansion seeing the addition of electrical trade counters in every new branch in addition to ‘The Bathroom Showroom’ facilities, whilst the majority are also home to a dedicated ‘Energy Efficiency’ provision.

Enhanced online ordering systems have also been central to a philosophy of ensuring “that tradespeople can more easily access the products and know-how they need; however, wherever and whenever they need it.”

6: MKM

2022 turnover = £860m (2021 = £700m)

106 branches (93 in 2021)

Including the acquisition of Woodrow Timber and its three branches (in Ayr, Airdrie and Dunfermline) MKM opened 13 new outlets in 2022 and outlined its intent to add “15-20 additional branches in 2023, with the potential also for further acquisitions.”

7: Grafton UK Distribution

2022 turnover = £838.6m (2021 = £821.9m)

128 branches (123 in 2021)

Following the sale of its Traditional Merchant Business, a more streamlined Grafton UK Distribution secured seventh place with longstanding CEO Gavin Slark also succeeded by Eric Born in November. Expansion at Selco saw new depots in Exeter and Cheltenham to increase the estate to 74 branches with a further outlet set to open in Peterborough this month.

However, and indicative of the ongoing economic uncertainty, an earlier plan to reach a target of 100 branches by 2026 has been reassessed to “envisage a store estate of approximately 80-90 stores over the medium term.”

Click here to read the full Grafton Group plc year end report

8: Independent Builders Merchant Group

2022 turnover = £650m (2021 = £489m)

172 branches (134 in 2021)

The growth of the Independent Builders Merchant Group continued with several acquisitions including Merkko, Cornish Fixings and Wantage Builders Merchants. It also opened 17 new branches of existing brands, expanding IBMG’s presence across all five of its divisions – general builders merchants; plumbing, heating & bathrooms; electrical wholesale; roofing & timber. Alongside this IBMG entered the tool hire sector to meet local customer demand.

CEO Martin Stables said: “The backbone of IBMG is that each of the merchant brands that we own is given the freedom to choose how to thrive and we provide the support framework to achieve it. We do not alter ‘the DNA’ of the merchant brands within the Group, we simply add our IBMG ‘magic’ to it.”

IBMG has “robust growth plans for 2023 and beyond” including further acquisitions, opening more new branches, on-going organic growth through increased product and service offerings as well as efficiency improvements.

9: UK Plumbing Supplies

2021 turnover = £616m (2020 = £204m)

300+ branches (-)

NB: figures show year end 31.12.21

10: Lords Group Trading plc

2022 turnover = £450m (2021 = £363m)

46 branches (33 in 2021)

During 2022, Lords acquired Advance Roofing Supplies, AW Lumb, HRP Trade, Direct Heating and Buildbase Sudbury whilst it also opened two new locations – George Lines in Horsham and Mr Central Heating in West Bromwich (Sept’22).

Looking forward, it says it will continue the delivery of its growth strategy by investing in the ‘Lords three Ps’ of People, Plant and Premises and by offering a superior service to our customers, whilst it “remains on track” to deliver its £500m revenue target by 2024 through further organic growth and acquisitions.

11: National Timber Group

2022 turnover = £350m estimated (2021 = £310.5m)

c.60 branches (c.60 in 2021)

12: Bradfords

2022 turnover = £224m (2021 = £204m)

46 branches (45 in 2021)

Bradfords opened a standalone P&H branch in Exmouth and reports that a new branch will be opening in Launceston this summer.

13: Lawsons

2022 turnover = £189.2m (2021 = £172.6m)

37 branches (31 in 2021)

The group made the acquisitions of Oxford Fencing Supplies, The Landscape Centre, Witham Timber, Basingstoke Building Supplies and Knights Fencing across 2022.

14: Haldane Group

2021 turnover = £179m (2020 = £132m)

21 branches (20 in 2021)

NB: figures show year end 31.12.21

15: EH Smith

2022 turnover = £174m (2021 = £155.9m)

13 branches (12 in 2021)

2022 was described as a special year for the EH Smith group as the business marked its centenary. A plethora of customer, supplier and staff events took place to mark the occasion, with charity fundraising a key element of the celebrations with over 50 different initiatives for staff to get involved in. In particular, an ambitious target was set to raise £100k in its 100th year however the company eventually achieved more than double that target with £223,000 raised for Teenage Cancer Trust.

The acquisition of Builders Supply Stores in Coventry was announced last summer with the firm “officially integrated” as an EH Smith branch in January.

16: Howarth Timber & Building Supplies

2022 turnover = £144.1m (2021 = £141.8m)

35 branches (34 in 2021)

17: JT Atkinson

2022 turnover = £136.6m (2021 = £124.5m)

35 branches (31 in 2021)

JT Atkinson acquired both B&TS builders merchant and Harrogate Timber in 2022.

18: James Hargreaves

2022 turnover = £122.4m (2021 = £112.3m)

69 branches (67 in 2021)

New branches opened in Telford and Melton Mowbray last year, whilst 2023 sees the plumbing & heating merchant celebrate its centenary. In addition, the business has recently announced a series of ‘progressive changes’ at Boardroom level including the promotion of former Purchasing Director Carl Bridge to Managing Director, succeeding Gordon Rothwell whose family has owned the company since 1968. Mr Rothwell has decided to retire as MD, but will continue as company Chairman.

Across 2023, a new branch is planned in Portishead along with refurbishments in Nelson, Carlisle and Blackburn with the latter two outlets to incorporate new bathroom showrooms.

A major focus on low carbon technologies will see an expansion to its existing team of specialists in addition to a new Low Carbon Heating Specialist Centre and Daikin Sustainable Home Centre in Burnley (including a bespoke training facility) whilst a second Daikin Centre is planned at its Cheadle Heath branch. Specialist Low Carbon Training Courses will also be launched to cover Daikin, Panasonic, LG and Ideal Heating.

New digital platforms are also in the pipeline whilst there will be “continued investment” in its main warehousing facility (and IT infrastructure) in Burnley.

19: Williams

2022 turnover = £121m (2021 = £118.9m)

49 branches (43 in 2021)

New branches were opened in Cambridge, Minworth, Coventry, Oxford, Smethwick and Cheltenham. For 2023, Williams said it will “continue to expand our branch network, bringing our market leading service to more of mainland UK.”

20: James Burrell

2022 turnover = £114m (2021 = £91m)

11 branches (10 in 2021)

£4.5 million has been invested into the recently opened Billingham depot, reportedly the biggest outlet in James Burrell’s 146-year history. Looking forward, the business is making an investment of over £500k at its head office branch.

Any assessment of the merchant sector has to focus currently on the mergers, acquisitions and general ‘realignment’ of the very largest businesses, however it is worth reasserting that a sizeable number of businesses – such as Builder Depot, Sydenhams, Covers, JT Dove, LBS and Elliotts – are delivering figures very close to our ‘Top 20’ threshold.

Furthermore, and perhaps for additional context, the ongoing expansion of self-proclaimed “online builders’ merchant” CMO Group plc is indicative of one of the key changes to the market and recorded a turnover of £83.1m in 2022 (up from £76.3m in 2021).

Industry affiliations

BMF (20) — All

NMBS (15) — All except TP, STARK Building Materials UK, Wolseley UK, Highbourne Group, Grafton Group

Fortis (5) — Lawsons, Haldane Group, EH Smith, Howarth Timber & Building Supplies, JT Atkinson

H+B (2) — Lords, Bradfords Building Supplies

PHG (2) — MKM, James Hargreaves

CBA (1) — James Burrell

Source: Figures are compiled via forecasted information supplied by each company, latest published account data and PBM estimates. Every effort is made to ensure the data presented is accurate but PBM cannot be held liable for any errors or omissions.

Related news

UK merchant sector Top 20 – 2021 calendar year

UK merchant sector Top 20 — 2020 calendar year

UK merchant sector Top 20 – 2019 calendar year

UK merchant sector Top 20 – 2018 calendar year

UK merchant sector Top 20 – 2017 calendar year

UK merchant sector Top 20 – 2016 calendar year