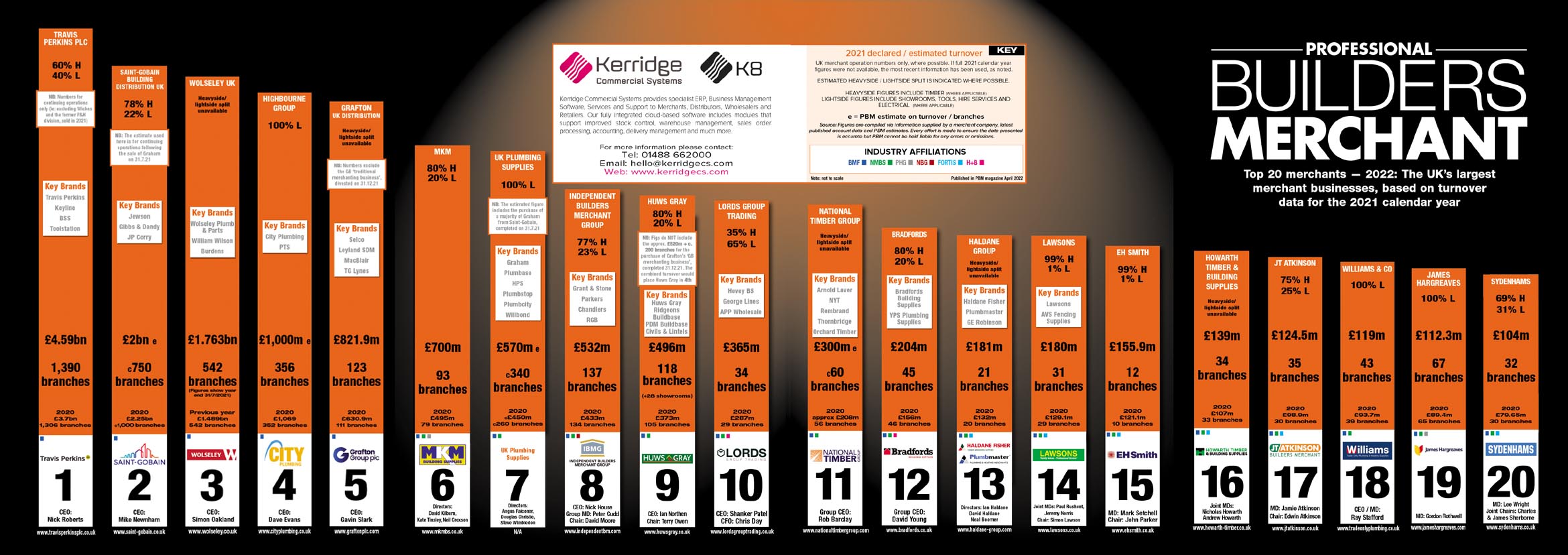

2022 Top 20: As published in our April 2022 edition, PBM outlines the background to the performance of the UK merchant sector’s largest businesses during 2021.

A dramatic recovery from the worst ravages of the pandemic is starkly highlighted by the universal increase in turnover (and profit margins) presented by the sector’s largest merchant firms, as sustained customer demand kept the tills ringing despite the ongoing challenges of Covid, supply chain issues and material price rises.

We’ll add the standard caveat that turnover does not necessarily equate to profit, whilst the biggest headline news remains the seismic shake-up caused by an array of mergers and acquisitions over the last twelve months. Indeed, the ‘realignment’ of the market has continued in the early months of 2022 (and therefore outside of our reporting period) with the confirmation, for example, of Saint-Gobain Building Distribution UK’s sale of its remaining specialist plumbing & heating businesses Neville Lumb, DHS, Bassetts and Ideal Bathrooms to Wolseley UK.

Looking back to the 2021 performances of our market leaders, Travis Perkins plc continues to lead the way…

1: Travis Perkins plc

2021 turnover = £4.59bn (2020 = £3.7bn)

1,390 branches (1,306 in 2020)

Offering adjusted figures for its continuing operations only following the demerger of Wickes and the sale of its Plumbing & Heating business last year (in April and May respectively), the Group — primarily under its Travis Perkins and Toolstation brands — reported “a year of significant strategic and operational progress, building a strong platform for future growth”.

Recording like-for-like revenue growth of 25.4% (14.4% ahead of 2019 for continuing operations), the “strong revenue performance” was said to be driven by an “enhanced customer proposition and robust recovery in key market segments” with an “excellent performance in Merchanting resulting from volume growth, improved operational focus and a streamlined cost base”.

Adjusted operating profit of £353m was reported by the Group, 19% ahead of 2019 (continuing businesses only).

Click here to view the Travis Perkins plc 2021 year-end report.

2: Saint-Gobain Building Distribution UK

2021 turnover = £2bn estimated (2020 = £2.25bn)

c.750 branches (c.1,000 in 2020)

Following the divestment of the group’s 130 Graham outlets last summer (2020 turnover: approx. €260 million), Saint-Gobain continued its plans to exit the specialist plumbing & heating distribution sector with the news it was selling Neville Lumb, DHS, Bassetts and Ideal Bathrooms to Wolseley UK.

The disposals are part of Saint-Gobain’s continued portfolio optimisation strategy to enhance the Group’s “growth and profitability profile in line with the ‘Grow & Impact’ plan objectives”.

3: Wolseley UK

2021 turnover = £1.763bn (2020 = £1.489bn)

542 branches (542 in 2020)

NB: Figures show year end 31.7.21 from the company’s annual report

Following the completion of the sale from Ferguson plc to private equity firm Clayton, Dubilier & Rice, completed in January 2021, the Group highlighted the importance of increased digitisation, noting that it “continues to invest in the latest technology solutions to make a more efficient business and to save time and resources for customers. An omni-channel approach allows customers the choice of how they want to do business; through traditional bricks and mortar, for consultations and to interact with products, or through the latest e-business platforms for advice and access to the product range 24/7.”

In addition to the business acquisitions detailed above, Wolseley also took over approximately 30 branches of Graham from SGBD.

4: Highbourne Group

2021 turnover = £1,000m estimated (2020 = £1,069m)

356 branches (352 in 2020)

The new owners of the former Travis Perkins Plumbing & Heating division opened four new branches in 2021 in addition to converting five PTS branches into City Plumbing depots. The business also reports increased website sales, further enhancement of its pioneering app and launched new customer delivery models to improve service.

For the year ahead, the Group has plans to open a total of 25 new branches in 2022.

5: Grafton Group plc

2021 turnover = £821.9m (2020 = £630.9m)

123 branches (111 in 2020)

Presenting figures for its continuing operations, Grafton has described a “transformational year for the business” with the “excellent results” showing a strong performance across all of its businesses. The sale of its Traditional Merchanting Business in Great Britain for £520 million “provides further investment capacity for growth” whilst the results showed a record adjusted operating profit of £271.2 million and a record Group adjusted operating profit margin of 12.9% (both before property profit).

Its successful Selco business opened three new branches in 2021, increasing the estate to 72, and Grafton has “identified significant opportunities to further grow the business” with a target of 100 branches by 2026.

Click here to view more information on Grafton’s year-end report.

6: MKM

2021 = £700m (2020 = £495m)

93 branches (79)

New branches for MKM in 2021 included Wallingford, Newark, Birmingham North, Barnsley, Inverness, Penrith, Derby, Ashford, Canterbury, Peterhead and Sunderland, whilst a further 15-20 additional locations are said to be planned for 2022. The company reports its strategy “will be to maintain and grow market share within its geographical areas, with a focus on key product sectors and increasing customer numbers”.

7: UK Plumbing Supplies

2021 = £570m estimated (2020 = £450m)

c. 340 branches (c.260)

UK Plumbing Supplies acquired the majority of Saint-Gobain Building Distribution’s Graham the Plumbers’ Merchant branches (approximately 73 depots, as well as the website) in a sale completed on the 31st July 2021.

8: Independent Builders Merchants Group (IBMG)

2021 = £532m (2020 = £433m)

137 branches (134)

CRS, Build it, Total Plumbing Supplies, RGB and Devondale Electrical were all added to the Group under the Grant and Stone banner in early 2021 whilst, during the summer, Grant and Stone merged with Parkers, Chandlers, Fairalls and Stamco to create an enlarged Independent Builders Merchant Group “spanning Kent to Cornwall”.

October then saw a further strengthening of the Group, with the addition of Sussex Plumbing Supplies, DW Burns and Perrys Builders Merchants.

CEO Nick House commented: “We are delighted 2022 has started as strongly as 2021 finished off, seeing trading ahead of the prior year and the completion of the acquisition of Dougfield Plumbers Supplies. We have an exciting pipeline of further M&A opportunities for the coming year and plan to open 20 further Greenfield sites in 2022. We will, though, continue to do all of this whilst maintaining our fiercely independent ethos across all our great brands.”

9: Huws Gray

2021 = £496m (2020 = £373m)

118 branches (105)

The figures quoted above do NOT include the approx. £520m + c. 200 branches for the purchase of Grafton’s ‘GB merchanting business’ — Buildbase, PDM Buildbase in Scotland, Civils and Lintels, NDI, The Timber Group, Bathroom Distribution Group and Lloyd Worrall — which completed on 31st December 2021.

Taken together, the combined turnover would propel a significantly enlarged Huws Gray Group to fourth position.

10: Lords Group Trading plc

2021 = £365m (2020 = £287m)

34 branches (29)

New branches in 2021 included the acquisitions of Condell, MAP Building & Civils Supplies and Nu-Line (Malton Road) in addition to a new Lords branch on Kenton Road. The Group says it “remains committed to sustainable growth through a combination of organic and acquisitive expansion… through new locations, product range extension and digital investment”.

It adds: “Customer and colleague engagement remains the Group’s primary performance metrics. Our successful oversubscribed IPO in July ’21 has allowed most colleagues to become shareholders in LGT Plc”.

11: National Timber Group

2021 = £300m estimated (2020 = £208m)

c. 60 branches (56)

Hymor Timber and Orchard Timber Products joined National Timber Group in 2021 whilst in May, the business launched its award-winning ‘Timberworld’ eCommerce solution within a rapid 16 week turnaround from signing the contract.

Writing in the firm’s staff bulletin in December, CFO Richard Myatt noted: “After a record breaking Q2 for NTG, we have seen the second half of 2021 continue in a similar vein with exceptional trading results throughout the summer months and on into early autumn.”

12: Bradfords Building Supplies

2021 = £204m (2020 = £156m)

45 branches (46)

In 2022, Bradfords says it is “planning record levels of investment in our existing estate to drive efficiency and an improved customer experience / service”. Greater sustainability remains a key objective, with the company reporting: “This will include investment in electrification of our fork lift truck fleet, renewable heating solutions for our branches, LED lighting across the estate, transitioning company cars to plug-in hybrid and full EV by 2025 and the removal of plastic carrier bags from our shops.”

13: Haldane Group

2021 = £181m (2020 = £132m)

21 branches (20)

In October 2021, the Haldane Group acquired timber specialist Prowood — an importer, sawmiller and distributor of high quality softwoods and hardwoods. For 2022, it will “continue to focus on (the) customer experience across all our brands such as greater use of ecommerce, improved branch layouts and focus on customer service processes. Ongoing digitisation of the business and investment in people remain core objectives to help realise this.”

14: Lawsons

2021 = £180m (2020 = £129.1m)

31 branches (29)

New branches included the acquisition of Hertfordshire Timber & Building Supplies and a new greenfield site in Sidcup. Going forward, “Lawsons will continue to grow the group through strategic acquisitions and the opening of greenfield branches to support our plans geographically.”

15: EH Smith

2021 = £155.9m (2020 = £121.1m)

12 branches (10)

A clear statement from EH Smith read: “We remain focused on being a ‘proper merchant’ — expanding core products and services, understanding our customers, and striving to exceed their expectations.”

However, it is perhaps interesting to note that a ‘proper merchant’ these days is many things, as evidenced by the company’s activities in 2021 which included opening an “industry-leading” architectural design centre in Clerkenwell, Central London and a new K&B showroom in Henley-in-Arden.

16: Howarth Timber & Building Supplies

2021 = £139m (2020 = £107m)

34 branches (33)

17: JT Atkinson

2021 = £124.5m (2020 = £98.9m)

35 branches (30)

In December, JT Atkinson acquired the businesses of B&TS (Ilkley, Otley and Yeadon) and Harrogate Timber.

18: Williams & Co

2021 = £119m (2020 = £93.7m)

43 branches (39)

New branches were opened in Christchurch, Swindon, High Wycombe, Luton whilst Williams has plans for six new branches in 2022 in addition to the further development of its website (which was launched in 2020).

19: James Hargreaves

2021 = £112.3m (2020 = £89.4m)

67 branches (65)

James Hargreaves added to its network with new branches in Stevenage and Peterborough, whilst a further depot has been launched so far in 2022 (Melton Mowbray) with additional sites planned for Telford and Bristol.

A number of refurbishments are planned for the firm’s estate, whilst the company will also be launching new digital platforms and investing in its main warehousing facility in Burnley.

20: Sydenhams

2021 = £104m (2020 = £79.65m)

32 branches (30)

2021 saw Sydenhams add a newly-built branch in Tidworth, Wiltshire along with the acquisition of Staverton Building Supplies near Cheltenham. For 2022, Sydenhams will “continue to look to deliver excellent service, grow the business and product offering and seek acquisition opportunities around our main regions of operation.”

In addition, the company has been “working on further modernising the business recently with a new Iris Cascade payroll & HR system, EDI electronic invoice matching and developing the website and e-commerce offering.”

Whilst any assessment of the merchant sector has to focus currently on the mergers, acquisitions and general ‘realignment’ of the very largest businesses, it is well worth reasserting that a sizeable number of businesses are ‘jostling for position’ just below our ‘Top 20’ threshold.

The likes of LBS and Elliotts expanded their branch networks in 2021 and have further plans outlined for 2022, whilst businesses like James Burrell and Builder Depot remain very close to the Top 20 benchmark.

Meanwhile, the rapid expansion of self-proclaimed “online builders’ merchant” CMO Stores is indicative of one of the key changes to the market, recording a 47% increase in total sales to £77m for the year ended 31 December 2021.

Industry affiliations

BMF (20) — All

NMBS (15) — All except TP, SGBD, Wolseley UK, Highbourne Group, Grafton Group

Fortis (6) — Haldane Group, Lawsons, EH Smith, Howarth Timber & Building Supplies, JT Atkinson, Sydenhams

NBG (1) — Independent Builders Merchants Group (IBMG)

H+B (2) — Lords, Bradfords Building Supplies

PHG (2) — MKM, James Hargreaves

Source: Figures are compiled via forecasted information supplied by each company, latest published account data and PBM estimates. Every effort is made to ensure the data presented is accurate but PBM cannot be held liable for any errors or omissions.

Click here for a more detailed version of the Top 20 League table image.

Related news

UK merchant sector Top 20 — 2020 calendar year

UK merchant sector Top 20 – 2019 calendar year

UK merchant sector Top 20 – 2018 calendar year

UK merchant sector Top 20 – 2017 calendar year

UK merchant sector Top 20 – 2016 calendar year