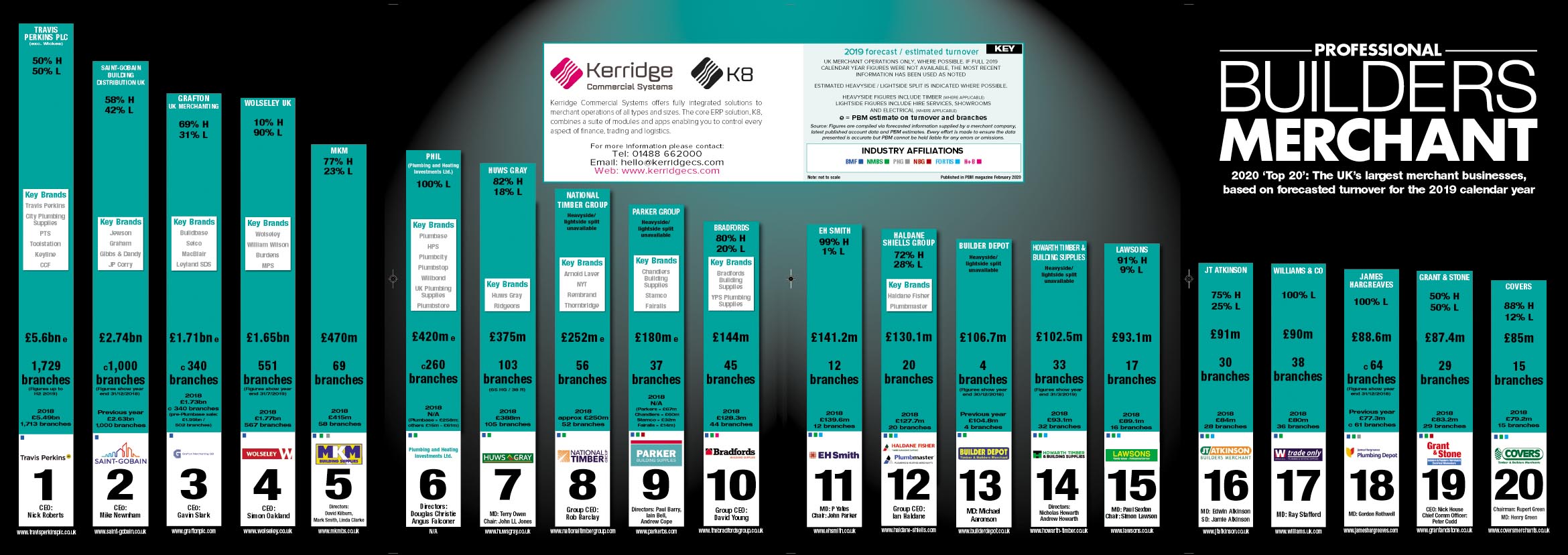

Top 20 merchants 2020: As published in our February 2020 edition, PBM presents the annual ‘league table’ countdown of the UK merchant sector’s largest businesses throughout 2019 (based on turnover figures) and details the activities behind the numbers.

In a year of sustained political and economic uncertainty, many of our ‘Top 20’ can be seen to have performed above any reasonable expectation. Inward investment has been strong, with a number of our respondents adding new branches or facilitating improvements and efficiencies to their business operations.

Of course, private equity investment has to be the real headline grabber, with funding from Cairngorm Capital Partners — now underpinning Grant & Stone and the newly-named Independent Builders Merchant Group (incorporating Parker Building Supplies, Chandlers, Stamco and Fairalls) — following on from Huws Gray’s acquisition of Ridgeons shown on last year’s league table. As new NBG partners, we have also added Arnold Laver and its fellow National Timber Group members to our listing for the first time — another business fuelled by finance from Cairngorm.

In terms of our Top 20 countdown itself however, Travis Perkins plc continues to lead the way…

1: Travis Perkins plc (excluding Retail division of Wickes + Tile Giant)

2019 turnover = £5.613bn (2018 = £5.491bn)

1,759 branches (1,709 in 2018)

Now with a new leadership team, plans to divest its Plumbing & Heating merchant division have been put on hold, but the drive to concentrate on its core strengths remains — Wickes (which is excluded from our figures) is expected to be sold in the second quarter of the year, whilst the business has recently announced the sale of its Primaflow F&P wholesale division.

For the first time, the numbers presented here incorporate ToolStation alongside its core Merchanting brands (including those in its ongoing Plumbing & Heating division).

UPDATE: Travis Perkins plc 2019 full year results

2: Saint-Gobain Building Distribution

£2.74bn (£2.63bn)

c. 1,000 branches (c. 1,000)

3: Grafton (excluding Plumbase following sale to PHIL)

£1.71bn (£1.73bn)

c. 340 branches (c. 340)

Grafton reports that the Plumbase sale to Plumbing & Heating Investments Limited (PHIL) “is in line with the Group’s strategy of orientating towards higher returning businesses with good long-term growth prospects.”

UPDATE: Grafton Group 2019 full year results

4: Wolseley UK

£1.65bn (£1.77bn)

551 branches (567)

Wolseley UK’s demerger from Ferguson is said to be “well underway”. Simon Oakland was appointed as Interim CEO at the start of the year to steer the process and the parent company expects to complete the transaction in 2020 with an update coming during the first quarter of 2020.

NB: Figures show year end 31/7/2019

Ferguson plc 2019 annual report

5: MKM

£470m (£415m)

69 branches (58)

MKM added 11 new branches to its ever-growing network and tells us it has plans to “further ramp up” its expansion programme, with 15-20 new depots planned for 2020.

The firm celebrates its 25th anniversary in 2020 and has already added a new branch to its network this year.

6: Plumbing & Heating Investments Limited (PHIL)

£420m estimated (2018: n/a)

c 260 branches (2018: n/a)

Whilst we can only rely on outline figures this year for Plumbing and Heating Investments Limited (effectively considering the most recent data for the newly-acquired Plumbase along with its core divisions such as HPS, Plumbcity, Plumbstop and Willbond), we can expect to hear much more over the coming months.

7: Huws Gray (+ Ridgeons)

£375m (£388m)

103 branches: 65 Huws Gray + 38 Ridgeons (2018 branches: 105)

Huws Gray says its main focus going forward “will be on the final integration of Ridgeons branches” and completing an ongoing branch refurbishment programme. Looking ahead to the second half of 2020, it reports that it will “continue with the acquisition trail, buying independent builders’ merchants in strategic geographical locations”.

8: National Timber Group

£252m estimated (approx £250m)

56 branches (52)

As a BMF member and now an NBG partner, it was impossible not to include Arnold Laver and its National Timber Group counterparts for the first time. We recognise that the quoted figures are both estimates and do include a degree of timber manufacturing / processing operations, but feel that the inclusion of the expanding timber specialist — funded by investment through Cairngorm Capital Partners — allows our chart to be a more effective industry benchmark.

9: Independent Builders Merchant Group (Parker Building Supplies, Chandlers Building Supplies, Stamco, Fairalls)

£180m estimated (2018: n/a)

37 branches (2018: n/a)

Boosted by the merger of Chandlers Building Supplies and an expanded Parker Building Supplies in October 2019, the Independent Builders’ Merchant Group (the name of the holding company behind the individual brands) surges into the Top 20. As readers will be well aware, Parkers was acquired by Cairngorm in March 2018 and added Stamco and Fairalls in June and July respectively last year. With minimal branch overlap between the businesses, this ‘new player’ in the sector effectively becomes the largest independent merchant group in the South East of England and we wouldn’t be surprised to see more developments over the coming year.

10: Bradfords

£144m (£128.3m)

45 (44)

Rounding off the Top 10 in some style, we are delighted to report an incredible milestone for Bradfords Building Supplies which celebrates its 250th anniversary in 2020!

11: EH Smith

£141.2m (£139.6m)

12 branches (12)

Company comment: “We continue to concentrate on increasing sales volumes and margins, expanding core products and services, and maintaining a tight control over costs.”

12: Haldane Shiells Group

£130.1m (£127.7m)

20 (20)

Company comment: “As we enter 2020, the Haldane Shiells Group is working on a number of initiatives that we believe will make it easier for our customers to do business across all of our brands as we strive to be more focused to our customers’ needs.”

13: Builder Depot

£106.7m (£104.8m)

4 (4)

NB: Figures show year end 30/12/2018

14: Howarth Timber & Building Supplies

£102.5m (£93.1m)

33 branches (32)

The business is marking its 180th anniversary in 2020.

NB: Figures show year end 31/3/2019

15: Lawsons

£93.1m (£89.1m)

17 branches (16)

Lawsons South East opened April 2019 whilst the business has started 2020 with the acquisition of AVS Fencing & Landscaping Supplies.

16: JT Atkinson

£91m (£84m)

30 (28)

Two new branches were added in 2019 in Stokesley and Scarborough.

17: Williams & Co

£90m (£80m)

38 branches (36)

In 2019, new branches in Harlow and Bristol were added to the Williams & Co network along with a new regional fulfilment centre in Bristol. The business tells us that it introduced through the night distribution, enabling it to achieve overnight logistics so that its customers can now pick up their orders from 7am in the morning.

It also gained a listing in the Sunday Times Best 100 Companies to work for.

Looking ahead, Williams & Co says it will “continue to invest in delivering industry leading customer service and an ever-improving value proposition for our customers.”

18: James Hargreaves

£88.6m (£77.3m)

c. 64 branches (c 61)

NB: Figures show year end 31/12/2018

19 Grant & Stone

£87.4m (£83.2m)

29 branches (29)

Acquired by Cairngorm Capital in Nov 2019, Grant & Stone says that, moving forward, it will “look to take advantage of growth opportunities as they arise, whether that be through new branch openings or acquisitions, whilst maintaining and developing our well-deserved reputation for superior service.”

20 Covers

£85m (£79.2m)

15 branches (15)

Completing our Top 20, Covers recently moved its Southampton branch to a larger new site.

The likes of Lords and Sydenhams in particular, along with Elliotts, James Burrell and RGB were all challenging below the line and will undoubtedly be in the mix for a place on our countdown next year.

A final point is to say that we are extremely grateful for the support of the sector in compiling this industry barometer. We hope you find it interesting.

Industry affiliations

BMF (20) — All

NMBS (16) — All except TP, SGBD, Grafton Group & Wolseley UK

Fortis (6) — EH Smith, Haldane Shiells, Howarth Timber & Building Supplies, Lawsons, JT Atkinson, Covers

NBG (2) — Independent Builders Merchant Group (Parker BS, Chandlers BS, Fairalls, Stamco), Grant & Stone

H+B (1) — Bradfords Building Supplies

PHG (2) — MKM, James Hargreaves

Source: Figures are compiled via forecasted information supplied by each company, latest published account data and PBM estimates. Every effort is made to ensure the data presented is accurate but PBM cannot be held liable for any errors or omissions.

UK merchant sector Top 20 – 2018 calendar year