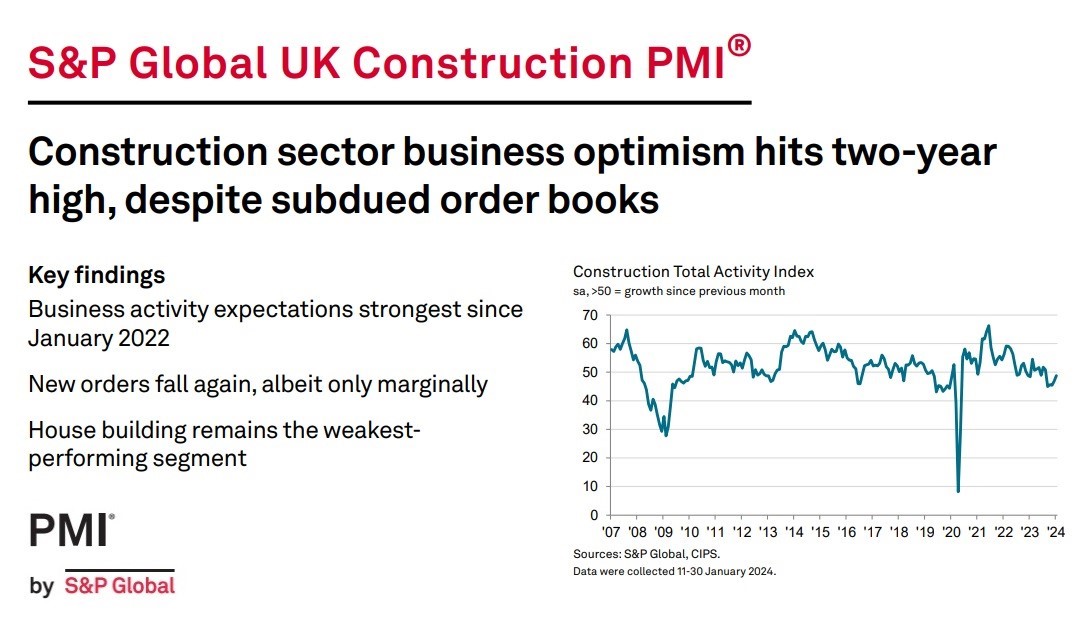

UK construction companies “indicated a strong improvement in business activity expectations” in the S&P Global UK Construction PMI report for January 2024, with optimism reaching its highest level for two years.

This positive feedback came despite an ongoing decline in current output levels and a marginal fall in incoming new work. Survey respondents (with data collected from Jan 11-30) often cited hopes of a turnaround in client demand due to looser financial conditions and more favourable underlying economic prospects.

The headline S&P Global UK Construction Purchasing Managers’ Index™ (PMI) – a seasonally adjusted index tracking changes in total industry activity – registered 48.8 in January, up from 46.8 in December and the highest reading since August 2023. That said, the index remained below the crucial 50.0 no-change threshold for the fifth month running and signalled a moderate decline in total industry activity.

Civil engineering was the best-performing segment in January (index at 49.8), with output levels close to stabilisation. Commercial activity also showed some resilience, with the respective index pointing to only a marginal rate of decline (49.1).

Meanwhile, house building continued to fall sharply at the start of 2024 (index at 44.2). Survey respondents noted subdued demand conditions and a lack of work to replace completed projects. The rate of contraction for residential activity nonetheless eased to the least marked since March 2023.

January data indicated a reduction in total new work for the sixth consecutive month, but the pace of decline was only marginal and the weakest seen over this period. Companies reporting a fall in new business generally cited delayed decision-making among clients and subdued market conditions, especially in the house building segment.

Despite subdued order books, latest data signalled a sharp upturn in business activity expectations. Around 51% of the survey panel forecast a rise in business activity during the year ahead, while only 12% predict a decline. This pointed to the highest level of business optimism since January 2022. Lower borrowing costs and higher consumer confidence were cited as factors likely to boost construction activity over the course of 2024.

Construction companies remained cautious about staff hiring in January. Total employment numbers fell fractionally, while sub-contractor usage was broadly unchanged since the previous month. Rates charged by sub-contractors increased at the fastest pace since September 2023, despite a robust and accelerated improvement in availability.

Demand for construction inputs softened for the fifth consecutive month in January, with survey respondents commenting on weak demand and ongoing efforts to minimise inventory holdings. Meanwhile, suppliers’ lead times shortened again as an improved balance between demand and supply helped to reduce delivery delays.

January data indicated a renewed increase in purchasing prices across the construction sector, following three months of falling costs. The latest survey signalled a solid rise in input costs that was the fastest since May 2023. Some firms commented on higher prices paid for imported items,

especially those that had incurred additional shipping costs.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“UK construction companies seem increasingly optimistic that the worst could be behind them soon as recession risks fade and interest rate cuts appear close on the horizon. The prospect of looser financial conditions and an improving economic backdrop meant that business activity expectations strengthened to the highest for two years in January. Moreover, there were again signs that customer demand is close to turning a corner as total new orders fell to the smallest extent for six months.

“Relatively subdued pipelines of new work nonetheless resulted in lower levels of construction output for a fifth successive month in January. House building remained by far the weakest-performing category, despite the rate of decline easing to its slowest since March 2023.

“Meanwhile, higher prices paid for imported items contributed to a rise in overall cost burdens for the first time since last September. However, there were still signs of space capacity across the construction supply chain as vendor delivery times shortened again at the start of 2024 and sub-contractor availability increased at a robust pace.”

Purchasing Managers’ Index (PMI)

Related News

S&P Global UK Construction PMI December 2023 data

S&P Global / CIPS UK Construction PMI November 2023 data

S&P Global / CIPS UK Construction PMI September 2023 data

S&P Global / CIPS UK Construction PMI July 2023 data

S&P Global / CIPS UK Construction PMI June 2023 data

S&P Global / CIPS UK Construction PMI May 2023 data

S&P Global / CIPS UK Construction PMI April 2023 data

S&P Global / CIPS UK Construction PMI March 2023 data

S&P Global / CIPS UK Construction PMI February 2023 data