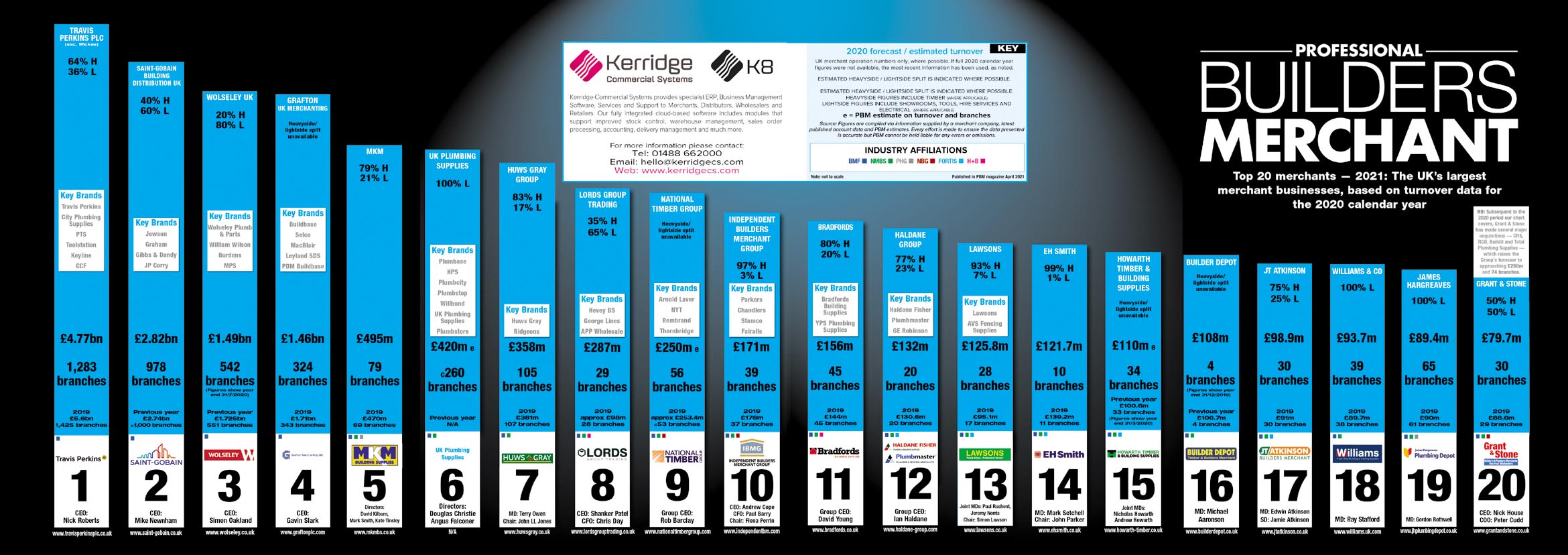

2021 Top 20 merchants: As published in our April 2021 edition, PBM presents the annual ‘league table’ countdown of the UK merchant sector’s largest businesses throughout 2020 (based on turnover figures) and details the activities behind the numbers.

It is no surprise to say the Covid-19 pandemic had a seismic impact on the performance of the UK’s largest merchant organisations, yet our countdown also shows the full range of activity as seen in any normal year — mergers, new depots, branch closures and new business activities.

Furthermore, 2021 has already seen some significant transformative action within the sector. Huws Gray, Lords Group Trading and the National Timber Group have all made acquisitions outside of our 2020 full year data period, whilst the series of major acquisitions made by Grant & Stone will propel the business some way up our countdown next time around.

Selco and MKM are amongst those to have opened new branches, whilst Wolseley UK’s demerger from Ferguson plc was completed via private equity investment from Clayton, Dubilier & Rice in January.

Looking back to 2020, Travis Perkins plc continues to take its place at the head of our list…

1: Travis Perkins plc (excluding Wickes ‘Retail Division’)

2020 turnover = £4.77bn (2019 = £5.6bn)

1,283 branches (1,425 in 2019)

Our figures exclude Wickes to allow for a closer ‘like-for-like’ comparison (across the chart, direct comparisons are increasingly difficult given the broad constituent areas in which our Top 20 operate…), and the Group has reported “resilient trading amidst significant uncertainty” highlighting the “robust recovery” experienced during the second half of the year, driven by strong RMI demand.

Click here for more comment from our story on the Travis Perkins plc 2020 year end report.

2: Saint-Gobain Building Distribution

£2.82bn (£2.74bn)

978 branches (c. 1,000 branches)

NB: Figures shows 2019 / 2018 details

3: Wolseley UK

£1.49bn (£1.725bn)

542 branches (551 branches)

NB: Figures show year end 31.7.21 from the Ferguson plc year end report (Wolseley UK’s demerger from Ferguson was confirmed in early 2021)

Wolseley UK reclaims third following a year in which it “took steps to refocus the business on a clear customer proposition, separating out the Building Services businesses and branches (Wolseley Pipe and Wolseley Climate) and Plumbing and Heating (Wolseley Plumb & Parts) to ensure that customers have access to a service and expertise that aligns to their needs”.

4: Grafton Group plc

£1.46bn (£1.71bn)

324 branches (343 branches)

CEO Gavin Slark acknowledged the impact of the crisis but reflected on the strong recovery in the second half of the year, outlining that the measures taken by the Group would have a lasting effect on its future performance. He said: “Grafton today is a stronger, more resilient, more digitally and sustainability savvy business than it was before the outset of the Covid-19 pandemic… underpinned by an improved customer proposition across all of our businesses.”

Click here for more comment from our story on the Grafton Group plc 2020 year end report.

5: MKM

£495m (£470m)

79 branches (69 branches)

With ten locations added to its network in 2020, MKM outlined its plans to continue its new branch opening programme with 15-20 additional sites earmarked for 2021, with the “potential also for further acquisitions”.

6: UK Plumbing Supplies

£420m estimated (2019: n/a)

260 branches

Taking sixth position, UK Plumbing Supplies is the first ‘new’ name on our countdown, having officially transitioned from Plumbing & Heating Investments Limited on 6th January 2020.

7: Huws Gray Group

£358m (£381m)

105 branches (107 branches)

Huws Gray notes that “online sales more than tripled in 2020 as a direct impact of Covid-19” whilst the company also made a number of acquisitions to its network in 2020 including Milford Building Supplies in October 2020. The acquisition trail continues, with the purchase of Builders Suppliers (West Coast) finalised in February 2021 and adding a further four branches to its network.

8: Lords Group Trading

£287m (£98m)

29 branches (28 branches)

Having only just missed out on last year’s Top 20, Lords Group Trading makes a significant jump up the rankings as a result of its acquisition (in December 2019) of APP Wholesale. In March 2021, the Group’s Hevey Building Supplies brand announced the acquisition of MAP Building & Civil Engineering Supplies, continuing the growth plan for the family-owned Group, which is “aiming to become a top five supplier of building materials in the next five years.”

9: National Timber Group

£250m estimated (£253.4m)

56 branches (53 branches)

In ninth, the National Timber Group is another to have already expanded its operations in 2021 with its Arnold Laver arm acquiring Hymor Timber. In 2020, Arnold Laver joined NBG with its fellow brands such as North Yorkshire Timber, Thornbridge Sawmills and Rembrand Timber coming on board as associate members.

10: Independent Builders Merchants Group

£171m (£178m)

39 branches (37 branches)

Concluding the Top 10, the Independent Builders Merchants Group said that 2020 was very much about consolidating and integrating its newly expanded businesses following a “busy year of acquisitions in 2019” however, the firm did grow its roofing business with dedicated new branches in Guildford, Leatherhead and Rye.

Doubtless echoing the sentiments of many, it added: “We look ahead to 2021 with a sense of optimism for strong customer demand and further growth opportunities, along with significant developments in our ecommerce capabilities across the Group.”

11: Bradfords

£156m (£144m)

45 branches (45 branches)

Bradfords celebrated an incredible 250th anniversary in 2020 and scooped no less than three national awards at the Construction Marketing Awards for its ‘We’ve Got Your Back’ campaign, launched to support the essential work being carried out by its trade customers across the region during the pandemic.

The firm kicked off 2021 with the opening of a new branch in Glastonbury, which includes one of the first Sustainable Home Centre showrooms in the UK, whilst it was also one of the first merchant businesses to sign up for the Construction Talent Retention Scheme.

12: Haldane Group

£132m (£130.6m)

20 branches (20 branches)

Now formally known as the Haldane Group (having previously been Haldane Shiells), Haldane Fisher NI Managing Director David Haldane said: “In 2020 the Haldane Group worked on a number of initiatives including an Ecommerce Website/Online Portal that we believe, in 2021, will make it easier for our customers to do business across all of our brands as we strive to be more focused to our customers’ changing needs.”

13: Lawsons

£125.8m (£95.1m)

28 branches (17 branches)

The acquisitions of AVS Fencing and Bell & Davis were made in February and October 2020 respectively, whilst a new AVS branch is to open in Ashford. The Crawley branch of Lawsons is to be expanded whilst a new branch in Sidcup is set to open in spring.

Further potential acquisitions are said to be ‘pending’ whilst trading over the last year is reported as being “successful” and has seen a “huge increase in e-Commerce sales, particularly in the spring and summer months of 2020 due to lockdown”.

14: EH Smith

£121.7m (£139.2m)

10 branches (11 branches)

“We continue to concentrate on increasing sales volumes and margins, expanding core products and services, and maintaining a tight control over costs.”

15: Howarth Timber & Building Supplies

£110m (£100.6m — figures show year end 31.3.20)

34 branches (33 branches)

16: Builder Depot

£108m (£106.7m)

4 branches (4 branches)

NB: Figures show year end 31.12.19

17: JT Atkinson

£98.9m (£91m)

30 branches (30 branches)

18: Williams & Co

£93.7m (£89.7m)

39 branches (38 branches)

During 2020, Williams opened a new branch in Poole along with a new Regional Fulfilment Centre. For 2021, the company is looking at opening an additional five new branches along with a second distribution centre and a new ecommerce website.

19: James Hargreaves

£89.4m (£90m)

65 branches (61 branches)

New branches were opened in Coventry, Birkenhead, Chester, Burton-on-Trent and Derby in 2020, whilst James Hargreaves also undertook a large investment in IT and telecommunications — a new ERP system was launched in March with a new telephony system rolled out across the business in November.

The firm says its branch development strategy will continue throughout 2021 with one new depot opened already in Peterborough (taking the total to 66) and two more “in the pipeline for the first half of the year”. An ongoing programme of existing branch refurbishments continues, with Oldham and Rochdale next on the list.

A product data enrichment programme and the launch of new digital platforms also figure in the company’s plans.

Grant & Stone

£79.7m (£88.6m)

30 branches (29 branches)

At the end of September 2020, Grant & Stone acquired 3 Counties Timber & Building Supplies and 3 Counties Plant & Tool Hire, with the two trading locations taken over additional to the 30 branches mentioned above, as up until 31st December 2020 these locations still traded separately in the two 3 Counties companies.

In 2021, Grant & Stone acquired CRS Building Supplies (January) and has recently announced the further acquisitions of RGB Building Supplies, Buildit and Total Plumbing Supplies. These major additions see the Group’s turnover increase to approaching £250m and now trading from 74 branches.

The likes of Sydenhams, LBS, James Burrell and Elliotts were all challenging immediately below the line and will undoubtedly be in the mix for a place on our countdown next year, not least as trading conditions remain unpredictable due to the ongoing Covid-19 situation.

For example, Sydenhams (2020 turnover: £79.65m) acquired Cheltenham-based Staverton Building Supplies in January 2021 whilst in 2020, LBS (£71m) opened its flagship branch in Barry and grew its Total Plumbing branch network with further new sites in Aberystwyth and Carmarthen. New sites have already been purchased in early 2021.

A final point is to say that we are extremely grateful for the support of the sector in compiling this industry barometer. We hope you find it interesting.

Industry affiliations

BMF (20) — All

NMBS (16) — All except TP, SGBD, Wolseley UK & Grafton Group

Fortis (5) — Haldane Group, Lawsons, EH Smith, Howarth Timber & Building Supplies, JT Atkinson

NBG (3) — National Timber Group, Independent Builders Merchant Group, Grant & Stone

H+B (2) — Lords, Bradfords Building Supplies

PHG (2) — MKM, James Hargreaves

Source: Figures are compiled via forecasted information supplied by each company, latest published account data and PBM estimates. Every effort is made to ensure the data presented is accurate but PBM cannot be held liable for any errors or omissions.

UK merchant sector Top 20 – 2019 calendar year

UK merchant sector Top 20 – 2018 calendar year

UK merchant sector Top 20 – 2017 calendar year

UK merchant sector Top 20 – 2016 calendar year