Business activity in the UK construction sector increased for the twelfth consecutive month in January and growth picked up since December, according to the latest PMI data compiled by IHS Markit and CIPS.

There were also said to be encouraging signs for the near-term outlook as new orders rose at the fastest pace since August 2021 and input buying was the strongest for six months. Supplier lead times continued to lengthen in January as staff shortages and a lack of haulage availability hindered deliveries.

However, the peak phase of supply chain difficulties appears to have passed as the latest downturn in vendor performance was the smallest since September 2020.

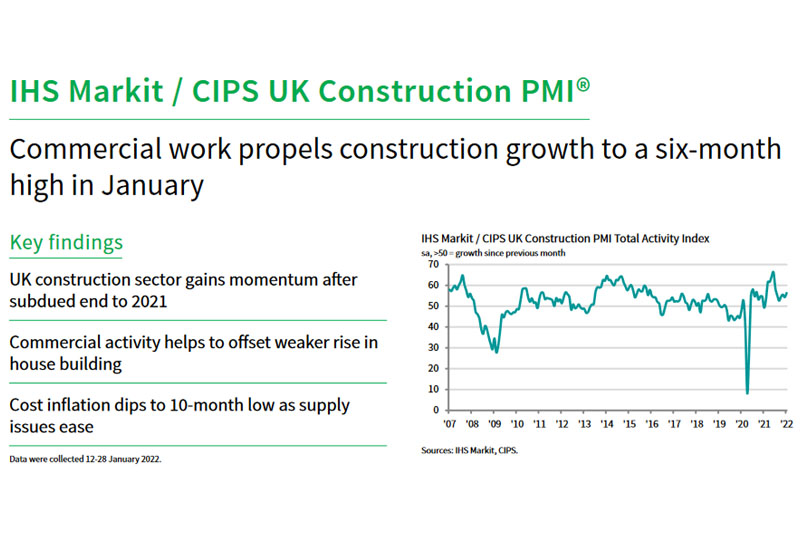

At 56.3 in January, up from 54.3 in December, the headline seasonally adjusted IHS Markit/CIPS UK Construction PMI Total Activity Index registered above the crucial 50.0 no-change mark for the twelfth month in a row. Moreover, the latest reading signalled the strongest rate of output expansion since July 2021.

Commercial work was by far the best-performing category (57.6), with growth accelerating to a six-month high amid a boost to client demand from recovering UK economic conditions. Survey respondents often noted that optimism about the roll back of pandemic restrictions had led to greater spending on commercial construction projects. Civil engineering returned to growth in January (53.2), although the rebound was softer than seen in other parts of the construction sector.

House building activity meanwhile increased at the slowest pace for four months (54.3).

January data illustrated a robust and accelerated rise in new work received by construction companies. The rate of growth was the fastest since August 2021, which survey respondents often attributed to rising confidence among clients. Strong pipelines of new work encouraged additional staff hiring in January. Indeed, the latest data pointed to the best month for job creation since last October.

Input buying picked up at the start of 2022, reflecting new project starts and stock building efforts. Despite another rise in demand for construction products and materials, the latest survey pointed to a turnaround in supply pressures as construction firms recorded the least widespread delays for almost one-and-a-half years.

However, rapid rises in raw material prices, energy costs and transportation bills continued push up business expenses in the construction sector. The overall rate of inflation nonetheless eased to its lowest for 10 months in January.

Finally, the latest survey indicated that construction companies remained highly upbeat about the business outlook. More than half of the survey panel (53%) forecast a rise in output during the year ahead, while only 5% predict a decline. Optimism was the strongest since May 2021 and largely reflected increasing tender opportunities and expectations of a swift recovery for the UK economy in 2022.

Tim Moore, Director at IHS Markit, which compiles the survey said:

“UK construction companies started the year on a strong footing as business activity picked up speed and new orders expanded to the greatest extent since last August. The composition of growth has become more tilted towards commercial projects as house building lost momentum and civil engineering remained subdued.

“Commercial construction activity benefited from fewer concerns about the Omicron variant and strong business optimism about recovery prospects over the course of 2022.

“Residential work increased at one of the slowest rates since spring 2020, which is an early sign that cost of living concerns and rising interest rates could start to dampen the post-lockdown surge in spending.

“Higher energy, transport and raw material bills led to across the board increases in input prices during January, but fewer supply issues helped ease the overall rate of cost inflation to its lowest since March 2021.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said:

“Builders enjoyed their best month since July, bouncing back from December’s doldrums as opportunities unfurled in terms of new orders, job creation and optimism offering a strong start to 2022.

“Pipelines of commercial work snapped back into action as businesses were more confident in their investment decisions and the sector came out on top with the strongest gap in output growth compared to the residential sector in almost six years. Housebuilders became January’s laggards raising concerns that higher interest rates and consumer inflation could feed into a further slowdown in the coming months as affordability rates are weakened.

“There was some light at the end of the tunnel where supply chains showed signs of improvement and the best delivery times since September 2020. However, the rapid upturn in activity is putting more pressure on suppliers still in recovery while there are shortages in skilled labour and a lack of reliable transportation adding to their woes. 34% of supply chain managers said their materials were taking longer to arrive and as a result purchasing activity escalated in an effort to beat price hikes and shortages.”

Related news

UK Construction PMI for December 2021

UK Construction PMI for November 2021

UK Construction PMI for October 2021

UK Construction PMI for September 2021

UK Construction PMI for August 2021

UK Construction PMI for July 2021

UK Construction PMI for June 2021

UK Construction PMI for May 2021

UK Construction PMI for April 2021