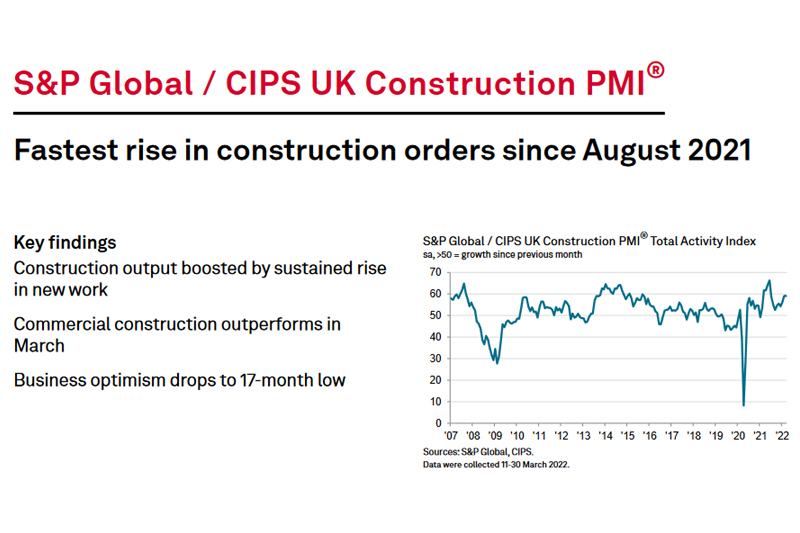

The S&P Global / CIPS UK Construction PMI March data pointed to a continued rise in UK construction output, helped by the fastest increase in new work for seven months.

That said, escalating inflationary pressures and concerns about the economic impact of the war in Ukraine contributed to a sharp drop in business optimism. And overall, the degree of confidence about the growth outlook was the weakest since October 2020.

The headline S&P Global / CIPS UK Construction Purchasing Managers’ Index – which measures month-on-month changes in total industry activity – registered 59.1 in March, unchanged from February and well above the 50.0 mark that separates expansion from contraction. The latest reading signalled the joint-fastest rate of output growth since June 2021.

Commercial work was the best-performing segment in March (index at 60.8), with projects restarting amid the roll back of pandemic restrictions. This part of the construction sector has seen output growth accelerate for three months in a row and the latest upturn was the strongest since June 2021. In contrast, the recoveries in civil engineering (index at 56.3) and residential work (54.9) lost momentum in March. The latter saw the slowest expansion of the three broad categories monitored by the survey.

Total new orders expanded at a robust and accelerated pace in March, with the latest rise the strongest since August 2021. Construction companies typically cited improving tender opportunities and resilient customer demand, despite some reports that economic uncertainty and rising costs had limited new business growth.

Rising workloads contributed to a considerable rise in staffing numbers during March. That said, the pace of job creation eased to its weakest so far this year amid ongoing difficulties filling vacancies.

Mirroring the trend for new orders, latest data signalled a sharper increase in purchasing activity across the construction sector. Input buying rose at the steepest pace since July 2021, driven by a combination of stronger demand and efforts to build stocks where possible.

Capacity constraints, a lack of haulage availability and ongoing logistics difficulties led to another sharp downturn in supplier performance. Around 33% of the survey panel reported longer lead times for construction products and materials, while only 1% saw an improvement. However, delays remained less widespread than the peak seen last summer.

Imbalanced supply and demand, alongside escalating energy, fuel and commodity prices, resulted in a rapid rise in average cost burdens in March. The overall rate of input price inflation accelerated sharply since February and was the highest for six months.

Concerns about the war in Ukraine, forecasts of severe cost inflation and a less favourable global economic outlook all weighed on constructors’ confidence in March. Around 48% of the survey panel expect a rise in business activity during the year ahead, while only 15% predict a decline. However, the balance of positive sentiment was the weakest seen since October 2020.

Commenting, Tim Moore, Economics Director at S&P Global, which compiles the survey said:

“Commercial projects helped keep construction growth at its highest level since last summer as clients boosted spending in response to the roll back of pandemic restrictions. Civil engineering also fared well in March as work on major infrastructure contracts underpinned growth. Residential work found itself in the slow lane, however, as some firms noted that greater caution crept into spending decisions.

“The construction recovery looks set to continue in the near-term as order books improved at the fastest pace for seven months in March. Input buying and job creation in the sector also remained indicative of strong underlying momentum.

“Escalating fuel, energy and commodity prices led to the fastest rise in costs for six months. Intense inflationary pressures appear to have unnerved some construction companies. Business optimism slipped to its lowest since October 2020 on concerns that clients will cut back spending in response to rising prices and heightened economic uncertainty.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, added:

“A heartening result in March overall where new order levels were the highest since August last year, but not all the sub-sectors offered an equal contribution to output this month. Commercial projects were the most abundant with the strongest rise in almost a year, but residential building became the laggard of the pack as affordability concerns were a factor in holding back progress particularly in new housing and refurbishment work.

“The crippling rise in inflation ramped up again as transport and raw materials went up in price. Longer wait times for deliveries were reported by a third of supply chain managers. Construction companies are braced for more disruption on the horizon as a result of the Ukraine conflict. The rise in purchasing demand fed into higher costs for materials already in short supply as energy hikes also impacted on business costs.

“With these severe challenges, it is no surprise that business optimism for the months ahead has been affected and fell to levels last seen in October 2020. The sector is facing a number of roadblocks as levels of job creation were also held back with the ongoing skills shortage and lack of builders.”

Related news

UK Construction PMI for February 2022

UK Construction PMI for January 2022

UK Construction PMI for December 2021

UK Construction PMI for November 2021

UK Construction PMI for October 2021

UK Construction PMI for September 2021

UK Construction PMI for August 2021

UK Construction PMI for July 2021

UK Construction PMI for June 2021

UK Construction PMI for May 2021

UK Construction PMI for April 2021