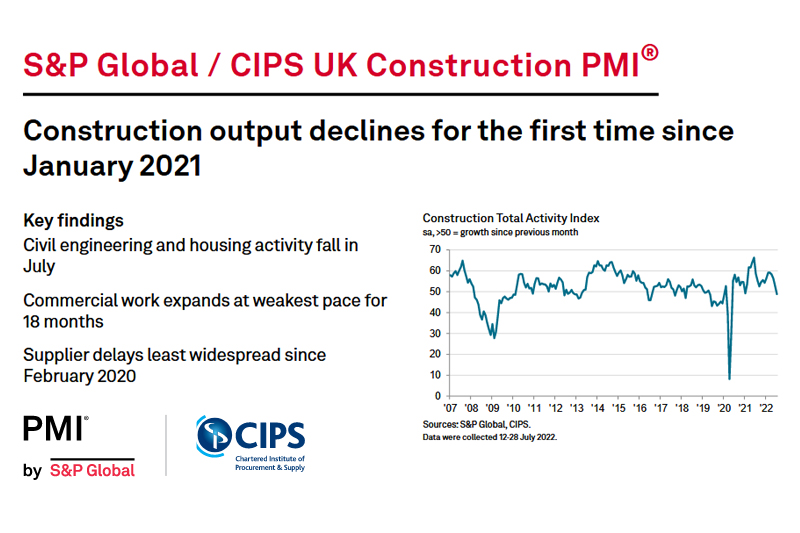

The latest S&P Global / CIPS UK Construction PMI data for July 2022 reveal that construction output has declined “for the first time since January 2021”.

July data pointed to a reduction in UK construction output for the first time in one-and-a-half years. Lower volumes of residential work and civil engineering activity more than offset a sustained expansion in the commercial segment.

A strong rate of jobs growth nonetheless continued as construction companies sought to boost capacity and meet increased order intakes. Meanwhile, improvements in the availability of some materials meant that supplier delays were the least widespread since February 2020.

The headline seasonally adjusted S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – posted 48.9 in July, down from 52.6 in June and below the 50.0 no-change threshold for the first time since January 2021. Although only marginal, the rate of decline was the fastest since May 2020.

Civil engineering was the worst-performing segment in July (index at 40.1), with business activity falling to the greatest extent since October 2020. House building declined for the second month running, but the rate of contraction was only slight (index at 49.4). Commercial work bucked the downturn seen elsewhere (52.3 in July), although growth was the weakest for 18 months. Survey respondents commented on headwinds to client demand from rising inflation, fragile consumer confidence and higher interest rates.

July data indicated an overall rise in new orders for the twenty-sixth consecutive month. That said, the latest upturn in new business was notably weaker than seen on average in the first half of 2022. As a result, some construction companies cited a lack of new projects to replace completed contracts.

Employment numbers expanded at a robust and accelerated pace in July. There were again many reports of difficulties filling vacancies and strong wage pressures.

Purchase price inflation meanwhile eased considerably (index at 78.1, down from 85.8 in June), with the latest rise in cost burdens the least marked since March 2021. Construction firms noted upward pressure on business expenses from higher energy, fuel and transport costs, but this was partly offset by some easing in commodity prices (especially for metals and timber).

Around 22% of the survey panel reported longer lead times from suppliers in July, while 7% signalled an improvement. Although still pointing to an overall downturn in vendor performance, the latest survey indicated that supplier delays were the least widespread since February 2020. Anecdotal evidence suggested that imported items remained the biggest area of concern, especially those from China and mainland Europe.

A gradual turnaround in supply conditions and hopes of softer price pressures ahead meant that construction firms tempered their stock building efforts in July. As a result, purchasing activity expanded at the weakest pace since January 2021. Where higher levels of input buying were reported, this mostly reflected new project starts and hopes of rising business activity in the months ahead.

Business optimism remained subdued across the construction sector in July, with growth expectations well below those seen in the opening months of 2022. That said, the degree of positive sentiment picked up slightly from June’s 23-month low. Around 42% of the survey panel anticipate a rise in output during the year ahead, while only 15% forecast a decline. Recession concerns, the cost of living crisis and lower levels of consumer confidence were the most commonly cited factors affecting business expectations in July.

Tim Moore, Economics Director at S&P Global Market Intelligence (which compiles the survey), said:

“July data illustrated that cost of living pressures, higher interest rates and increasing recession risks for the UK economy are taking a toll on construction activity. Total industry output fell for the first time since the start of 2021 as civil engineering joined house building in contraction territory. Only the commercial segment registered growth in July, supported by strong pipelines of work from the reopening of hospitality, leisure and offices.

“More positively, input cost inflation has retreated from the peak seen this spring as lower commodity prices and supply improvements gradually filter through to buyers of construction products and materials. The latest round of purchase price inflation was the least marked for 16 months, despite sustained pressure from escalating energy costs and staff wages, while supplier delays were the least widespread since the pandemic began.

“Expectations for output growth in the next 12 months are far less exuberant than those seen over the past two years, amid concerns that elevated inflation and higher borrowing costs will constrain demand. Nonetheless, the degree of construction sector optimism picked up slightly since June, which ended a five-month period of falling confidence.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said:

“After several months of difficult conditions for builders, these challenges have now resulted in a contraction in construction with the biggest fall in activity since May 2020.

“This disappointing result was felt across all the sectors, including housing which had demonstrated more resilience over the last couple of years, but fell for the second month in a row in July. However, it was civil engineering that fell the hardest and furthest. With fewer new orders in the offing, it may be some time before we see a rebound in this sector bearing in mind the time lag of infrastructure projects.

“Builders optimism remained at the lowest levels seen for two years. Job creation was healthy to complete work in hand but the danger remains that should the UK economy turn unfavourable, this will affect job hiring and the development of key skills. A feather-like fall in prices may ease some of the pain as access to raw materials also improved, but prices at historically high levels will continue to hamper activity in 2023.”

Related News

UK Construction PMI for June 2022

UK Construction PMI for May 2022

UK Construction PMI for April 2022

UK Construction PMI for March 2022

UK Construction PMI for February 2022

UK Construction PMI for January 2022

UK Construction PMI for December 2021

UK Construction PMI for November 2021

UK Construction PMI for October 2021

UK Construction PMI for September 2021

UK Construction PMI for August 2021

UK Construction PMI for July 2021

UK Construction PMI for June 2021

UK Construction PMI for May 2021

UK Construction PMI for April 2021