The latest S&P Global / CIPS UK Construction PMI data for May “signalled another growth slowdown in the construction sector amid a considerable loss of momentum for the residential category”.

The latest rise in housing activity was reportedly the weakest since the recovery began two years ago with survey respondents suggesting the subdued consumer confidence and worries about the economic outlook had constrained demand. Higher borrowing costs and intense inflationary pressures were also cited as factors likely to hold back growth over the next 12 months. Furthermore, the latest survey data indicated that business activity expectations at construction companies “were the least upbeat since August 2020”.

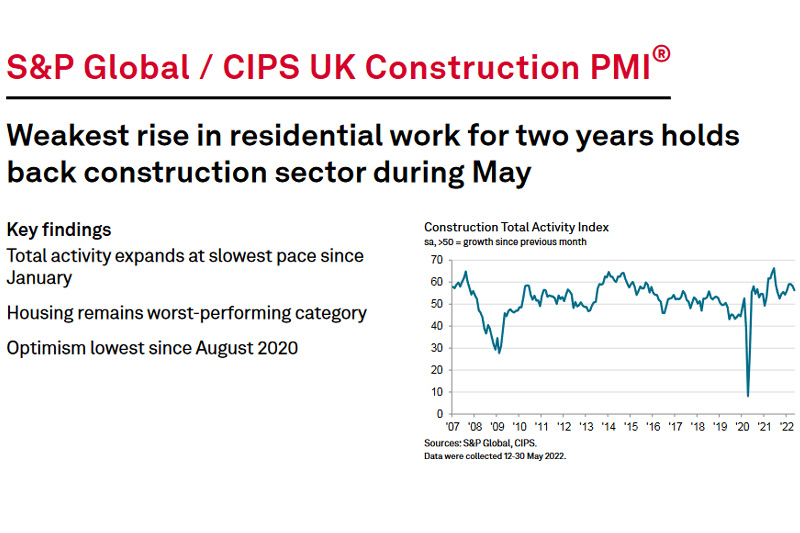

The headline S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month

changes in total industry activity – registered 56.4 in May, down from 58.2 in April and the lowest reading for four months. Weaker trends in the house building sub-sector were “the main brake on growth”, with this index falling to 50.7 from 53.8 in April. Moreover, the latest reading signalled the worst performance for residential work since May 2020.

Commercial building was the fastest-growing segment in May (index at 59.8), with the speed of expansion easing only slightly since April. Construction companies noted strong demand for commercial work, despite a degree of hesitancy due to the uncertain economic outlook.

Meanwhile, civil engineering activity increased for the fifth month running and at a robust pace (index at 55.5) amid a sustained boost from major infrastructure projects.

Total new orders expanded again in May, which marked two years of continuous sales growth in the construction sector.

That said, the latest increase in new work was the slowest since December 2021.

Job creation accelerated slightly in May and was the strongest for four months. Survey respondents typically cited efforts to boost capacity and meet rising customer demand. There were again widespread reports citing recruitment difficulties due to shortages of suitably skilled candidates.

May data highlighted strong demand for construction products and materials, as signalled by a steep and accelerated rise in total purchasing volumes. Efforts to replenish stocks and pre-purchase ahead of price rises also contributed to higher purchasing activity in May, according to survey respondents.

There were positive signals for supplier performance in May, as delays were the least widespread since February 2020. Some firms noted an improvement in the availability of construction items, despite ongoing challenges including logistics bottlenecks, Brexit trade frictions and supplier staff shortages.

Rapid cost inflation persisted in May, with the vast majority of survey respondents (73%) reporting a rise in purchasing prices. This was linked to rising fuel, energy and raw material costs. That said, the overall rate of inflation eased to a three-month low.

The number of construction firms predicting an increase in business activity during the year ahead (46%) continued to exceed those expecting a decline (19%) by some margin. However, the resulting index measuring overall growth expectations across the construction sector signalled the weakest degree of optimism since August 2020.

Construction companies suggested that lower consumer confidence, rising borrowing costs and heightened economic uncertainty were all likely to act as headwinds to client demand in the next 12 months.

Tim Moore, Economics Director at S&P Global Market Intelligence (which compiles the survey), said:

“May data signalled a solid overall rise in UK construction output as resilience across the commercial and civil engineering segments helped to offset weakness in house building. Residential construction activity was close to stagnation in May, which represented its worst performance for two years amid signs of softer demand and a headwind from low consumer confidence.

“New order volumes expanded at the slowest pace since the end of 2021, which added to signs that heightened economic uncertainty has started to impact client spending. Concerns about the business outlook were signalled by a fall in construction sector growth projections to the lowest for more than one-and-a-half years in May. Around 19% of construction firms predict an outright decline in business activity during the year ahead, up from just 5% at the start of 2022.

“On a more positive note, supplier delays subsided in May, with the latest downturn in performance the least marked since February 2020. Meanwhile, rapid price pressures persisted due to rising energy, fuel and staff costs, but the overall rate of inflation eased to a three-month low in May.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said:

“Though still offering a comfortable margin above the no change mark, the construction sector saw growth ease to a four-month low with the usual suspects taking the heat out of the recovery – elevated inflation, future uncertainty and supply-chain disruption.

“Supply chain managers scaled up purchasing levels to beat expected price increases in the months ahead as inflation rates remained powerfully strong even with the slight easing in prices. There was also robust job hiring in May so businesses could secure the best talent from a dwindling pool of skilled candidates to build capacity for the remainder of the year.

“Subdued client confidence affected new order levels with the slowest rise in pipelines of new work since December 2021. The housing sector in particular showed further signs of fragility with the worst performance since May 2020 and moving closer to the danger zone of negative territory. Affordability concerns will be weighing on the mind of potential house buyers grappling with escalating costs for everyday items, resulting in a postponement of big purchases until the UK economy shows more resilience.

“The lack of positive sentiment was also reflected in construction companies’ confidence over the next 12 months, with optimism dropping to the weakest since August 2020 even though this was the best performing sector out of the three.”

In response to the PMI construction data, the Federation of Master Builders (FMB) argued that with residential construction performing at it’s worst rate since the pandemic began, local building firms are continuing to suffer at the hands of price inflation, falling consumer optimism and skills shortages.

FMB CEO Brian Berry said:

“With output and optimism hitting lows we last saw at the start of the pandemic, it’s a worrying time for small building firms. Hardworking local builders have been beset by challenges and at a time when they rightly hoped for recovery, things look set to get worse, with inflation on the rise alongside a likely decline in consumer demand for building services as the cost of living crisis bites.

“If the market continues to stagnate, many of these local building firms will face difficulty remaining solvent. The Government must set out a credible plan for keeping the small building firms afloat. The upcoming planning reforms must make it easier for small housing developers, and reverse their decades of decline. The Government should also bring forward a long-term National Retrofit Strategy to decarbonise the nation’s homes, which would create a stable workstream for local builders whilst also moving the UK closer to net zero.”

Related News

UK Construction PMI for April 2022

UK Construction PMI for March 2022

UK Construction PMI for February 2022

UK Construction PMI for January 2022

UK Construction PMI for December 2021

UK Construction PMI for November 2021

UK Construction PMI for October 2021

UK Construction PMI for September 2021

UK Construction PMI for August 2021

UK Construction PMI for July 2021

UK Construction PMI for June 2021

UK Construction PMI for May 2021

UK Construction PMI for April 2021